Executive Summary

Telemedicine and digital health technology continues to gain acceptance among patients and health care professionals alike, and more organizations are implementing and expanding robust virtual care programs to supplement their traditional in-person offerings. Our first national telemedicine and digital health survey was published seven years ago, with this report being our team's fourth publicly available survey on telemedicine. Our prior reports found one of the most significant barriers to adoption was limited or unclear reimbursement for telehealth and digital health services.

Enter the COVID-19 pandemic, which compelled state and federal policymakers to remove restrictions and expand reimbursement for telehealth and virtual care at a rate previously unseen. The new changes followed the previously established pathway of coverage, but the pace at which they were made was stunning. Medicare introduced nearly 100 telehealth service codes covered on a temporary basis until the federal public health emergency declaration expires, including payment for telephone-only consults. States and commercial health plans followed suit. Although some of the reimbursement expansions are temporary and slated to end when the public health emergency expires, many have already become permanently codified into state law.

Foley & Lardner's 2021 50-State Survey of Telehealth Commercial Insurance Laws provides a detailed landscape of the state telehealth commercial insurance coverage and payment laws. The report is useful to health care providers (both traditional and emerging), lawmakers, entrepreneurs, telemedicine companies, and other industry stakeholders as a guide of telehealth insurance laws and regulations across all 50 states and the District of Columbia.

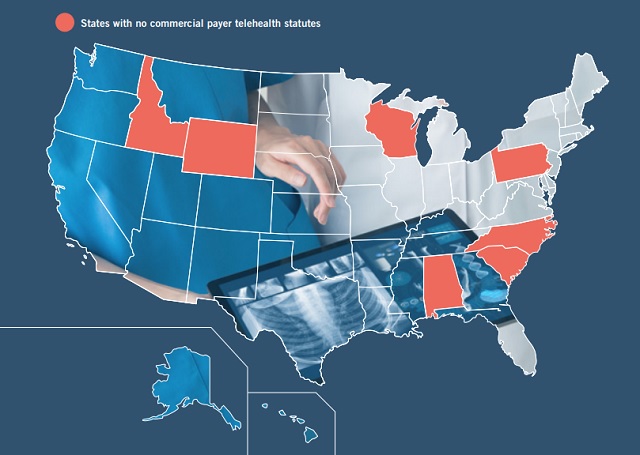

In the time since our 2019 report, the legal landscape for telehealth reimbursement has significantly improved. Currently, 43 states and DC maintain some sort of telehealth commercial payer statute, with West Virginia joining the list in 2020. Yet, the quality and efficacy of these laws varies significantly from state to state. For example, three states have telehealth coverage laws on the books that do not actually mandate health plans to cover services delivered via telehealth (Florida, Illinois, and Michigan).

And while telehealth coverage has widely expanded, the same cannot be said for reimbursement/payment parity. Currently, 22 states maintain laws expressly addressing reimbursement of telehealth services (an increase from 16 states in 2019), and 14 of those offer true "payment parity" (an increase from 10 in 2019), meaning that providers outside those 14 states may find they receive lower payment for telehealth-based services compared to in-person services (i.e., same service code, but different reimbursement rates). States with payment parity laws are Arkansas, California, Delaware, Georgia, Hawaii, Kentucky, Minnesota, Missouri, New Mexico, Texas, Utah, Vermont, Virginia, and Washington. In addition, the new Massachusetts law offers true payment parity, but only for behavioral health services. Massachusetts also temporarily extended payment parity for: (i) primary care and chronic disease management services via telehealth over the next two years, and (ii) all other health care services, which have been temporarily mandated by a gubernatorial Executive Order, for 90 days beyond the end of the COVID-19 state of emergency.

Other limitations on telehealth commercial insurance reimbursement continue to exist in some states, but the trend is towards equitable treatment for telehealth. For example, only one state (Tennessee) still maintains some restrictions on the patient's originating site. And 30 states have cost shifting protections, which prohibit a plan from charging a patient a deductible, co-insurance, and/or co-payment for a telehealth consultation that exceeds what the insurer would charge for the same service if it were provided during an in-person consultation.

Coverage of asynchronous telehealth and remote patient monitoring also has grown. Patients and providers continue to push for more virtual care services, and health plans are beginning to offer meaningful coverage of these modalities. More than half of the states (27 states) mandate coverage for store-and-forward/asynchronous telehealth. And 17 states require commercial health plans to cover remote patient monitoring services. These laws benefit patients by increasing access and availability to health care services, and catalyze the growth of telehealth technologies throughout the country.

We are pleased to share this 50-state survey of state telehealth commercial payer statutes. This survey contains pinpoint citations to the governing statutes or rules, but includes only commercial health insurance laws and does not include Medicaid fee-for-service rules or Medicaid managed care organization laws and rules, which also vary on a state-by-state basis.

CURRENTLY, 43 STATES AND DC MAINTAIN SOME SORT OF TELEHEALTH COMMERCIAL PAYER STATUTE, WITH WEST VIRGINIA JOINING THE LIST IN 2020

The heat maps that follow provide a summary of the following:

- Does the State Have a Telehealth Commercial Payer Statute? Whether or not the state has a law addressing commercial health plan coverage of telehealth services

- Does the Law Have a Coverage Provision? Does the state's law expressly discuss coverage parity, meaning the law requires a commercial insurer to cover a health care service delivered via telehealth if the insurer would cover the same service if it were provided during an in-person consultation? (Variances exist among the laws and not every state has strong coverage parity, so please be sure to read the actual statutory language.)

- Does the Law Have a Reimbursement Provision? Does the state law expressly include language addressing payment and reimbursement rates for telehealth services? For some states, this means the commercial insurer must pay the provider for a health care service delivered via telehealth at the same reimbursement rate the insurer would pay that same provider for the same service if it were delivered in-person. For other states, the reimbursement language sets a ceiling, floor, or gives instruction on how the parties must negotiate rates for telehealth services. (Variances exist among the laws and not every state has strong payment parity, so please be sure to read the actual statutory language.)

- Unrestricted Originating Site? Does the state impose restrictions on the patient's originating site? Some states still require the patient to be located in a particular clinical setting at the time of the telehealth consultation.

- Member Cost-Shifting Protections? Does the state have a cost-shifting protection, meaning does the state law prohibit a commercial insurer from charging a patient a deductible, co-insurance, and/or co-payment for a telehealth consultation that exceeds what the insurer would charge for the same service if it were provided during an in-person consultation?

- Provision for Narrow/Exclusive/In-Network Provider Limits? Does the state telehealth law have language addressing whether or not a health plan may limit coverage and/or reimbursement for telehealth services to only those providers that are within the plan's narrow telehealth network, exclusive network contracting, or payment provisions for in-network vs. out-of-network providers? (Variances exist among the laws, so please be sure to read the actual statutory language.)

- Remote Patient Monitoring (RPM)? Does the state require coverage of RPM services?

- Store-and-Forward (S&F) Telehealth? Does the state require coverage of store-and-forward/asynchronous telehealth services?

To read the full article click here

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.