Hotel Lawyer: Is the hotel industry on the verge of salvation, or precipice of despair?

We are less than a week from Thanksgiving and a lot of new data has been released in the past few days, with important implications for the hotel industry and the economy. Some highlights discussed below are:

- An American Hotel & Lodging Association survey taken November 10-13, 2020, provides a grim short-term forecast for the hotel industry, saying 71% report they can last only 6 months more, and 34% can last only 1 to 3 more months.

- A City National Bank (CNB) report provides a November 18 update that new COVID vaccines now claim 90% or higher effectiveness; they might become available in December and be widely available by spring 2021.

- The same CNB report projects short-term pain (rising COVID cases, deaths and hospitalizations) a decrease in consumer activity, and contraction for the economy (driven by COVID) – but projects a strong economic recovery starting with the second half of 2021.

- CNB Report warns that its projected recovery in for the economy and markets is "unconditionally dependent on [the COVID] vaccine ending the pandemic."

The AHLA Survey

The American Hotel & Lodging Association (AHLA) issued a press release on November 19, 2020 with the results of a survey taken November 10-13, 2020 with 1,200 respondents. The survey indicates widespread hotel closures and failures unless there is significant federal economic relief to survive the devastating loss of travel and tourism.

- 71% of hotels report they will only be able to last 6 more months at current projected business, and 34% say they can last only 1 to 3 months longer.

- 82% of hotel owners say they cannot obtain additional debt relief from their lenders beyond the end of the year.

- 59% of hotels says they are in danger of foreclosure by their lenders due to COVID-19.

- 52% say they will close without additional federal assistance, and 98% would apply for and use another round of Payroll Protection Program (PPP) loans.

When will travel come back?

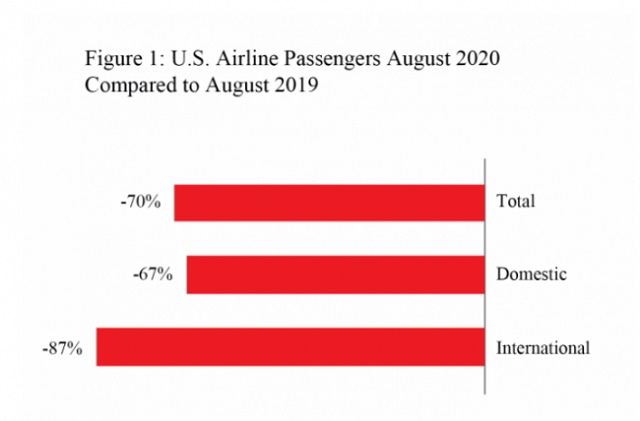

The Bureau of Transportation Statistics reported that US airline passenger traffic in August 2020 is down by 70% from a year earlier. In other words, the US is running at less than a third the number of passengers compared to a year ago. And, this was the smallest decrease since March.

As shown in the graphic, while overall air travel is down by 70%, domestic is down by 67% and international by 87%.

Matters do not look much better for the near term, according to a new national study by the AHLA. Some of the highlights from that study on American travel plans say:

- 72% of Americans are unlikely to travel for Thanksgiving

- 69% of Americans are unlikely to travel for Christmas.

- 65% of Americans are unlikely to travel for Spring Break.

- 8% have taken an overnight business trip since March.

- 8% expect to travel for business within the next 6 months.

The study also sets out the direct impact on hotel business:

- 44% say their next hotel stay for vacation or leisure will be a year or more from now.

- 44% nationwide hotel occupancy for the week ending October 31.

- 36% urban market hotel occupancy for the week ending October 31.

Short-term COVID pain versus long-term vaccine

In its November 18, 2020 report and briefing, City National Bank's (CNB) economic experts see the macro US economic prospects as dominated by COVID-19 and effectiveness of the vaccines.

While forecasting continuing erosion in US and international economic growth well into 2021, the CNB report sees the latest announcements by Pfizer/BioNTech and Moderna as possible turning points in the COVID crisis – both health-wise and economically.

The report shows current surges of COVID cases, deaths and hospitalizations reaching new peaks in November, and expects targeted restrictions on indoor businesses and activities such as bars and restaurants. They do not expect a return to nationwide lockdowns in the US at this point.

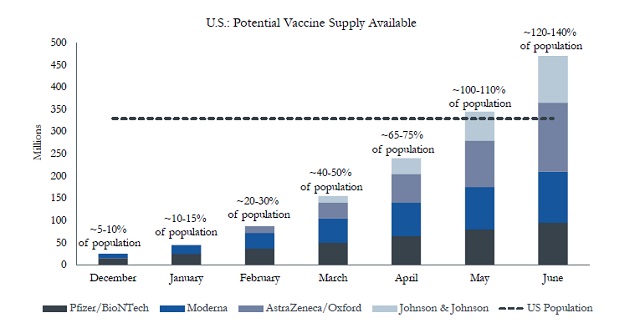

But all hopes of recovery in the second half of 2021 are really hinged upon the present optimistic final approval, manufacturing and distribution of effective vaccines, which are predicted to be available for high-risk groups starting in December. They may become widely available in the spring, with sufficient doses for virtually the entire US population around May 2021.

In fact, the CNB report says projected recovery in the economy and markets is "unconditionally dependent on vaccine ending the pandemic."

And here is the CNB report projected time table for vaccine availability:

Based upon the scenario described, CNB sees consumer spending and confidence recovering as the vaccine spurs an opening and expansion of the economy, with stock values potentially exceeding their all-time highs by the end of 2021.

What does this all mean for the hotel industry?

To state the obvious, it looks like the experts have effectively written off a recovery before the second half of 2021, at the earliest. If a troubled hotel has been desperately holding out for relief by the end of the year, much less Summer 2021, it will have to come from Congress, lenders, rescue capital – or a miracle. And even that recovery is based on a very tight schedule for COVID vaccine deployment without any glitches.

Every hotel's situation must be evaluated independently based on its circumstances. We have some clients that are actually doing pretty well right now – particularly in extended stay and drive-to resort locations. The prospects for large urban hotels that depend on group business are dimmer with a much longer journey to find the end of the tunnel.

The AHLA survey numbers confirm the industry sense that a substantial number of hotels are in imminent danger of closing and being foreclosed. Roughly a third are almost on life support now and will only survive 1 to 3 months. More than half are in serious trouble and may not make it until a hoped-for recovery starts in the second half of 2021.

Everyone needs to analyze what happens under these scenarios. What else can your hotel do to drive business? Have you tried to cut a deal with state or local authorities for the homeless or Covid patients? What can be done with the hotel brand and management?

How realistic is additional federal relief, and when will it come, if at all? What is in borrowers' and lenders' best interests given the prospects and uncertainties for each hotel? Isn't this the time for distressed hotels to arrange a backup plan with capital and resources to weather what may be 3-5 years to full recovery?

The hotel industry is on the verge or the precipice of something significant. Will you be prepared either way?

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.