No, we are not talking about our favorite Marvel comic superhero, friendly neighborhood Spider-Man! But we are borrowing the Peter Parker principle to place emphasis on the fact that if you have the power to control a foreign corporation, then it comes with a greater responsibility when filing Form 5471, Information Return of U.S. Persons With Respect To Certain Foreign Corporations ("Form 5471"). This article will focus on the application of the attribution rules for purposes of determining who is a Category 4 Filer (a term of art) who is deemed to be in control for purposes of Form 5471.

LET'S BACK UP BEFORE MOVING FORWARD

A Controlled Foreign Corporation ("C.F.C.") is a foreign entity treated as a corporation for U.S. tax purposes that is owned by one or more "U.S. Shareholders" that collectively own (directly, indirectly, or constructively) more than 50% of the total combined voting power of all classes of stock or more than 50% of the total value of the stock of the foreign corporation. A U.S. Shareholder is a U.S. person who (directly, indirectly, or constructively) owns shares representing at least 10% of (i) the total combined voting power of all classes of stock entitled to vote or (ii) the total value of all issued and outstanding stock of a foreign corporation.

If a foreign corporation meets the definition of a C.F.C., each U.S. Shareholder of the corporation is subject to U.S. Federal income tax on his pro-rata share in the income of the corporation attributed to shares owned directly or indirectly (but not constructively). This means that while constructively owned stock is considered as actually owned for purposes of determining whether a U.S. person is a U.S. Shareholder and whether a foreign corporation is a C.F.C., the constructively owned stock is ignored for the purposes of income inclusion. Constructive ownership for these purposes is provided for in Code §958(b), with reference to the attribution rules of Code §318, subject to certain modifications.

If certain conditions are met, a U.S. person who directly, indirectly, or constructively own shares in a foreign corporation is required to file Form 5471 to provide the I.R.S. with information relating to the foreign corporation and its financial results. Form 5471 is attached to the filer's U.S. Federal income tax return and is due by the due date (including extensions) for the income tax return. The obligation to file Form 5471 may exist even if the foreign corporation is not a C.F.C.

There are total of five Form 5471 filing categories, however the focus of this article is the Category 4 Filer only. As will be discussed below, due to the application of the attribution rules for these purposes, which differs from its application for purposes of determining the U.S. person's status as a U.S. Shareholder, a U.S. person may not be a U.S. Shareholder for purposes of determining whether a foreign corporation is a C.F.C. but may still meet the definition of a Category 4 Filer and be subject to the full responsibilities that come with that status.

FORM 5471 CATEGORY 4 FILER

The reporting requirement of a Category 4 Filer is found in Code §6038 and Treas. Reg. §1.6038-2 ("Category 4 Filer Regulations"). A Category 4 Filer includes a U.S. person who has control of a foreign corporation during the annual accounting period of the foreign corporation.1 A person is in control of a corporation if such person owns stock possessing more than 50% of the total combined voting power of all classes of stock entitled to vote, or more than 50% of the total value of shares of all classes of stock, of a corporation.2 Additionally, a person in control of a corporation which, in turn, owns more than 50% of the combined voting power, or of the value, of all classes of stock of another corporation is also treated as being in control of such other corporation.3

For purposes of determining a person's control of a corporation, the Category 4 Filer Regulations make reference to Code §318(a) which provide for the application of the attribution rules, subject to certain modifications.4 Those modifications are not identical to the modifications in Code §958(b) which provides for constructive ownership for purposes of determining the status of a U.S. person as a U.S. Shareholder.

Family Attribution Rules under Code §318(a) for a Form 5471 Category 4 Filer

The direct or indirect ownership interest of a family member of a U.S. person is attributed to the U.S. person for purposes of determining whether he or she controls a foreign corporation.5 The family members of an individual include the following:

- The spouse of the individual.

- The children, grandchildren, and parents of the individual.6

No rule prevents attribution of shares of stock from a non-resident, non-citizen individual. Hence, for purposes of determining whether a U.S. person has control, ownership is attributed for shares held by a non-resident-noncitizen family member.7 However, there is no attribution among siblings and no attribution from grandparents, i.e., stock owned by a grandparent will not be deemed owned by a grandchild. But stock owned by a grandchild will be deemed owned by a grandparent. Additionally, stock attributed to a family member will not be treated as actually owned for purposes of reattribution to another.8

Example 1

A family comprises of a foreign husband (H) and a U.S. citizen wife (W). The couple has a son, S, and daughter, D, both of whom are also U.S. citizens. The family owns foreign corporation, FC, in which H owns 75%, W owns 15% and each of S and D own 5%. The voting rights and value of each shareholder is in proportion to their ownership interest in FC. Can W, S, and D be treated as having control over FC such that each of them must file Form 5471 on an annual basis?

Analysis

- For W:

-

- W directly owns shares representing 15% of the ownership in FC.

- Due to family attribution between a mother and her children, W will be deemed to own the direct interest of her children, resulting in W being treated as owning 25% of FC.

- Additionally, due to family attribution between a husband and wife, W will also be deemed to own the direct interest owned by H, notwithstanding his non-resident status. This is because unlike the modification in Code §958(b)(1) with respect to U.S. Shareholder, the family attribution rules under the Category 4 Regulations do not prohibit attribution from a non-resident family member.

- Therefore, W is treated as owning 100% interest in FC and therefore is said to control FC. As a result, she is a Category 4 Filer and must file Form 5471 with respect to FC on an annual basis.

- For S and D:

-

- S and D will also be treated as having control over FC since each will be treated as owning 95% interest in FC. This is because more than one family member can be attributed the same stock. Therefore, each of S and D will be attributed the ownership interest of their parents (75% from their father; 15% from their mother; and their own 5%).

- Attribution is not allowed among siblings, therefore, neither will be deemed as owning the 5% owned by the other.

- Therefore, both S and D are treated as Category 4 Filers and must file Form 5471 with respect to FC on an annual basis.9

Wondering, if FC is a C.F.C.? For purposes of determining C.F.C. status, family attribution does not apply in the case of a non-resident shareholder. Nevertheless, more than 50% of FC will be deemed U.S. owned as follows: W is deemed to own 25% (15% directly plus 5% from each of her children, S and D; but not her non-resident husband's 75%), S and D will be deemed to own 20% each (5% directly plus 15% from their mother). As a result, all three U.S. family members are deemed U.S. Shareholders and collectively, they are deemed to own 65% of FC. As a result, W, S and D may have income inclusion with respect to FC's earnings, in proportion to their actual ownership in FC.

Observe, however, that if W owned 9% and H owned 81%, while all U.S. family members would still be treated as having control for purposes of Category 4 Filer, FC would not be a C.F.C. and no one would face income inclusion. This is because W would be treated as owning 19% (9% directly plus 5% from each child) and each of S and D would be treated as owning 14% (5% directly plus 9% from their mother). As a result, all would have been treated as U.S. Shareholders whose ownership count towards C.F.C. status, but together, their ownership would have been 47%, lower than the required threshold. Additionally, while the filing obligation would theoretically apply, an exception discussed below would have eliminated such obligation.

EXCEPTIONS TO FILING FORM 5471 AS CATEGORY 4 FILER

A U.S. person who is a Category 4 Filer for Form 5471 reporting purposes may be exempt from the reporting obligation under the following alternate circumstances:

- First Exception: If two or more persons are required to file a Form 5471 with respect to the same foreign corporation for the same period, they may jointly file one Form 5471 and attach it to the tax return of any one of the persons required to file.10 This is known as the Multiple Filer Exception.

- Second Exception: A person who does not directly own stock of the corporation, but is required to file a Form 5471 solely by reason of attribution of stock from a U.S. person, is excused from filing if the direct owner of the stock from whom the stock was attributed furnishes the required information.11

- Third Exception: A U.S. person who does not own a direct or indirect interest in the foreign corporation; and is required to furnish information solely by reason of attribution of stock ownership from a non-resident alien(s) as a result of the attribution rules of Code §318(a) is exempt from filing a Form 5471.12

Under the Multiple Filer Exception, the person who does not attach Form 5471 to his or her income tax return must submit with the return a statement indicating that the reporting obligation is being satisfied by another and identify the person who fulfils the reporting obligation and the place where his return is filed.13 The person who files Form 5471 must identify the persons who are included on his or her return. Under the second and third exceptions, no statement is required to be included with the tax return of the person claiming the exception.

Example 2

The facts are the same as in the Example 1. Since W, S, and D are all required to file Form 5471 for FC for the same period, any one of them may file Form 5471 on behalf of the other two and absolve them of their reporting obligation. The person filing Form 5471 (assume W, the mother) must complete Item F, Person(s) on Whose Behalf This Information Return Is Filed, on Page 1 of Form 5471 to report S and D's full name, address, and their U.S. Tax Identification Number (generally, their S.S.N.). At the same time, S and D must submit with their Form 1040, U.S. Individual Income Tax Return, a statement indicating that their Form 5471 reporting obligation is being satisfied by their mother, W, and including her S.S.N. and the I.R.S. service center where her tax return is filed.

Example 3

Ms. Texas is a single mother of Florida and Georgia. All of them are U.S. citizens. Ms. Texas and Florida own a European travel company, Going Places Inc. 60% / 40%, respectively. Does Georgia have a Form 5471 filing obligation?

Analysis

- Georgia does not own any direct or indirect interest in Going Places Inc.

- However, the 60% ownership interest of her mother, Ms. Texas will be attributed to her under the family attribution rules.

- The attribution rules do not apply attribution between siblings and therefore, Florida's 40% interest will not be attributed to Georgia.

- As a constructive owner of 60%, Georgia is treated as having control over Going Places.

- Georgia may claim exemption from reporting under the Multiple Filer exception if Texas agrees to identify her on her Form 5471 and Georgia submits a statement indicating that her reporting obligation has been met by Texas.

- Alternatively, since Georgia does not directly own any stock of Going Places, Inc., but is required to file a Form 5471 solely by reason of the attribution of stock ownership from her U.S. mother, Ms. Texas, she can claim exemption from filing Form 5471 under the second exception. The second exception is likely better than the Multiple Filer Exception since neither Georgia is required to attach any statement with her U.S. personal income tax return nor is Ms. Texas required to furnish any information about Georgia on her Form 5471.

Example 4

D is the daughter of a wealthy Australian couple. The parents equally own multiple conglomerates all around the world. D arrived in the U.S. on an F-1 visa on Jan 1, 2018, to pursue a master's degree. She is expected to complete the course by December 31, 2020, after which she intends to obtain an H-1b visa (work visa) and work for a U.S. employer on a full-time basis. D asks about her U.S. tax reporting obligations once she becomes a U.S. resident under the substantial presence test, in particular, with respect to non-U.S. entities owned by her parents.

Analysis

- D does not own any direct or indirect interest in any of the family owned foreign corporations.

- The 50% ownership of each of the parents will be attributed to D under the family attribution rules, as applicable for purposes of the Category 4 Filer Regulations, despite the fact her parents are non-residents.

- As a result, D will be treated as owning 100% of the voting rights and value of the foreign corporations and therefore will be treated as having control of each such corporation.

- However, under the third exception mentioned above, D will be exempt from filing Forms 5471 with respect to such foreign corporations. This is because she does not own any direct or indirect interest in any foreign corporation and would be required to furnish Form 5471 solely by reason of attribution of stock ownership from non-resident aliens.

If D owned a 10% direct interest in one of the foreign corporations in which her parents also own equal direct interest of 45% each, no exception would apply and she would have to file Form 5471 with respect to such foreign corporation. This is because no other person is required to furnish the same information, the attribution is not from a U.S. person who fulfils the reporting requirement, and she owns a direct interest.

DETERMINING CONTROL WHEN OWNERSHIP IS SPLIT BETWEEN USUFRUCT AND BARE OWNERSHIP

Splitting ownership into usufruct and bare ownership is a common estate planning technique in several civil law countries. It typically involves an older generation making a gift of bare ownership in an income generating asset to members of a younger generation. The person making the gift retains the usufruct interest. A usufruct interest gives its holder the right to the enjoyment of the underlying asset and the right to the income generated by the underlying asset. With respect to the stock of a company, the usufruct holder, typically, also has the voting rights. A bare ownership, on the other hand, essentially indicates that the stock is held in the name of the holder of bare ownership that gives him the right to transfer the stock, but not to receive dividends.

When viewed from a U.S. tax point of view, this planning technique may give rise to reporting obligations as a Category 4 Filer for Form 5471 purposes for the bare legal owner and / or the usufruct interest holder, depending on the different facts.

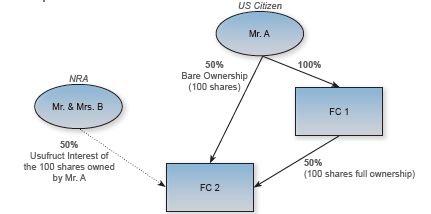

Example 5

FC 2, a foreign corporation, has one class of stock and 200 outstanding shares. Mr. A, a U.S. citizen, owns the bare legal title of 100 shares of the stock. Mr. A's parents, Mr. and Mrs. B are non-residents noncitizens. Mr. and Mrs. B hold the usufruct interest with respect to the 100 stock of FC 2 owned by their son, A. The usufruct interest gives them the right to receive dividends and right to vote. A is the sole shareholder of another foreign corporation, FC 1, which in turn owns the remaining 100 shares of FC 2 (both the bare ownership and usufruct). Is Mr. A required to file Form 5471 with respect to FC 2?

Analysis

- Mr. A owns the bare legal title to 100 shares of stock of FC 2. It means that the stock certificates with respect to the 100 shares indicate Mr. A as the legal shareholder.

- Mr. and Mrs. B have usufruct interest with respect to the 100 shares of stock owned by Mr. A. In other words, Mr. and Mrs. B, both, own 50% of the voting rights and value of FC 2.

- The usufruct interest of Mr. and Mrs. B will be attributed to Mr. A under the family attribution rules of the Category 4 Filer regulations.

- As a result, Mr. A will be treated as owning 50% of the voting rights and value of FC 2.

- Additionally, Mr. A also fully owns 100% of FC 1, which in turn, owns the remaining 100 shares of stock of FC 2 (or 50% ownership interest).

- As a result, by attribution from FC 1, Mr. A will be treated as owning a proportionate interest in the stock of FC 2. In other words, Mr. A will be treated as indirectly owning 50% ownership interest (100% x 50%) in FC 2.14

- Consequently, Mr. A is treated as owning 100% of FC 2 for purposes of determining control of FC 2 as a Category 4 Filer.

Observe that for purposes of determining whether FC 2 is a C.F.C., the 50% voting rights and value owned by Mr. and Mrs. B as a result of their usufruct ownership will not be attributed to Mr. A because the family attribution rules are "turned off" for non-residents under Code §958(b). Therefore, while FC 2 is not a C.F.C., Mr. A must file Form 5471 as a Category 4 Filer.

PENALTIES FOR FAILURE TO TIMELY FILE FORM 5471

A failure to timely file Form 5471 by a Category 4 Filer is subject to a $10,000 penalty for each annual accounting period of each foreign corporation.15 An additional $10,000 penalty, limited to $50,000, (per foreign corporation) may be imposed if the form is not filed within 90 days after a notification of noncompliance by the I.R.S. for each 30-day period, or fraction thereof, after the 90-day period has expired.16 Further, a failure to timely file Form 5471 results in a reduction of the foreign tax credits by 10% which are further reduced if noncompliance continues after a notification by the I.R.S.17 More importantly, the statute of limitation on the assessment of a tax return does not begin to run if Form 5471 is not filed, as a result, the tax return remains open for audit indefinitely. A failure my also attract criminal penalties.18

CONCLUSION

Thousands of foreign nationals come to the U.S. every year. The reasons may be umpteen: higher education, better employment opportunities, business venture, etc. Depending on many factors, these individuals may become U.S. residents sooner or later. Due to the significant penalties applicable for noncompliance, when this epic event occurs, and ideally, before, it is imperative to carefully examine foreign structures and determine U.S. tax consequences that may result, including when the effect is "merely" that of compliance.

Footnotes

1 Code §6038(a)(1)(D)(ii).

2 Code §6038(e)(2).

3 Treas. Reg. §1.6038-2(b).

4 Treas. Reg. §1.6038-2(c).

5 Code §6038(e)(2); Treas. Reg. §1.6038-2(c).

6 Code §318(a)(1).

7 In contrast, as modified under Code §958(b)(1), for purposes of determining the status of a U.S. person as a U.S. Shareholder, the family attribution rule of Code §318 is only applied for stock owned by a family member who is a U.S. person.

8 Code §318(a)(5)(B).

9 Notwithstanding the obligation to file, the Multiple Filer Exception discussed below may alleviate this obligation.

10 Treas. Reg. § 1.6038-2(j)(1).

11 Treas. Reg. § 1.6038-2(j)(2).

12 Treas. Reg. § 1.6038-2(l).

13 Treas. Reg. § 1.6038-2(j)(3).

14 Treas. Reg. §1.6038-2(c)(3) read with Code §318(a)(2)(C) provides that if a person owns 10% or more in the value of the stock of a corporation, that person shall be deemed to own the stock owned by that corporation in proportion to the person's interest in that corporation.

15 Treas. Reg. §1.6038-2(k)(1)(i).

16 Treas. Reg. §1.6038-2(k)(1)(ii).

17 Treas. Reg. §1.6038-2(k)(2).

18 Treas. Reg. §1.6038-2(k)(4).

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.