This blog post will cover several noteworthy, recently-introduced pieces of New York tax legislation. While these bills are set to expire today at the end of the current legislative session, these bills may be reintroduced when the new legislative session begins in January 2021. If ultimately passed, these new pieces of legislation could have a significant impact on New York taxpayers, so we plan to keep these bills on our radar and track their progression through the legislative process when the new session begins.

- S44B – Proposing

a New Pied-à-terre Tax

As discussed in our prior blog posts, the idea of charging a pied-à-terre tax has once again been introduced. Borrowing from the French and literally meaning "foot on ground," a pied-à-terre refers to a small apartment, house, or room kept for occasional use. In essence, it is a small second home that is not the purchaser's primary residence. This bill would impose an additional tax on certain non-primary residences in New York City. The prior version of the pied-à-terre tax, S44A, was aptly covered here with a very detailed explanation of how this tax would work. The main change between the original version and the current version of the proposed pied-à-terre tax in S44B is that a condominium or cooperative owner could now obtain an appraisal to demonstrate the property has an appraised value of less than $5 million and therefore should be exempt from the tax. New York City's Independent Budget Office is pitching the pied-à-terre tax as a revenue raiser and would hike property taxes for high-value second homes in New York City.

- S7677 –

Proposing a New Millionaire's Tax

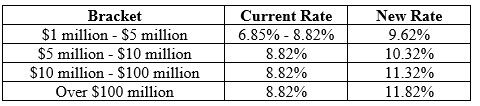

This bill would raise the personal income tax rates for individuals with income over $1 million per year. Presently, the tax rate for the highest bracket tops out at 8.82% however this bill seeks to create new brackets with the highest bracket (income over $100 million) subject to a tax rate of 11.82%. According to the bill, the applicable tax rates would be increased as follows:

The bill is estimated to increase state revenues over $4.5 billion. The stated purpose for this new income tax bracket is to promote economic equity and avoiding cuts in spending to public education and Medicaid, as half the revenue generated would go to funding public education and the other half would go to funding Medicaid.

- S9037A –

Forgiven PPP Loans Exempt from Income

This bill would exclude from adjusted gross income ("AGI") loan expenses forgiven under the Federal Paycheck Protection Program ("PPP"). This proposed legislation seeks to clarify that PPP loans given to small businesses that are converted to grants would not be included in AGI, as was intended when the CARES Act was passed. The PPP was part of the $2.2 trillion CARES Act passed by Congress in March to help keep small businesses afloat during the current pandemic. If PPP loan proceeds are used for qualifying costs – payroll; health insurance for paid sick, medical, or family leave; mortgage interest payments; rent; and utility payments – and 60% of the loan proceeds are used for payroll costs, then the federal government will forgive the loan. The recently enacted Consolidated Appropriations Act, 2021, signed into law on December 27, clarifies that qualifying expenses paid with proceeds from a forgivable PPP loan are deductible for federal income tax purposes. It remains to be seen how New York will respond.

- S8627 –

Short-Term Rental Tax

This bill would amend the Tax Law to authorize the collection of state sales tax and short-term rental taxes on certain short-term rental hosts and hosting platforms located outside of New York City. The justification states that the revenue generated from this bill would help the state collect revenue to maintain important state-run programs and support in an effort to offset the significant financial hardship New York is experiencing due to the COVID-19 pandemic. Importantly, this bill would expand tax collection obligations by establishing that hosting platforms will have the same tax collection duties as an operator or host, unless there is an agreement with the operator or host relieving the hosting platform of its tax collection duties.

- S5686 – Taxes on

Vacant Ground Floor Commercial Premises

This bill would allow New York City to impose and collect the commercial vacancy tax, a tax on vacant ground floor commercial premises. The tax would be imposed on the owners of any ground floor commercial premises that has been vacant for six months or more. The bill would establish both a minimum period of vacancy (six months) before any premises would be subject to the tax and a maximum amount of tax ($2,000 per square foot annually). The applicable period of vacancy would not be deemed to have begun until at least thirty days after an owner of a ground floor commercial premises was required to register such premises in accordance with local vacancy registration requirements, subject to certain exemptions. The tax is intended to incentivize landlords with vacant space and options to lease the space to tenants to take advantage of those options in order to "restore vibrancy to the city's streetscapes."

- S8872 – Removing

the "Knowing" Requirement From the False Claims

Act

The New York False Claims Act is a powerful and effective civil fraud-fighting and whistleblowing tool, providing a cause of action that may be brought by the Attorney General, a local government, or a private citizen in a qui tam suit for false claims that have been submitted to New York State or a local government. The bill would allow the New York False Claims Act to be used as a tool to recover large unpaid tax obligations based on false claims made by wealthy individuals or businesses without the statutory requirement that such false claims were made knowingly. The damages in such claims would be limited to the tax obligation owed, plus consequential damages including any interest owed on the unpaid obligation, as opposed to the (often significant) treble damages and statutory civil penalties found elsewhere in the New York False Claims Act.

Again, while these noteworthy pieces of legislation are set to expire today at the end of the current legislative session, these bills will likely be reintroduced when the new two-year legislative session begins next month. For example, Senate Bill 5686 has already been proposed for the 2021-2022 legislative session as Senate Bill 83. While some of these efforts may fail, New York is experiencing multibillion-dollar revenue shortfalls and will be increasingly looking to high earners to pay for more of the costs to ease the revenue shortfalls being faced due to the COVID-19 pandemic.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.