I. Overview

The U.S. Department of the Treasury announced a proposed rule establishing fees for parties filing voluntary notices of transactions for national security review by the Committee on Foreign Investment in the United States ("CFIUS"),1 further implementing the Foreign Investment Risk Review Modernization Act of 2018 ("FIRRMA"). The proposed fee schedule would apply to "covered transactions" and "covered real estate transactions" under Part 800 and Part 802, respectively, of FIRRMA, which are discussed in our memorandum here.

II. Proposed Fee Structure

Under the proposed rule, parties would be required to pay the applicable fee to the Treasury Department when they file a notice to trigger the start of the initial CFIUS review period. Although fees do not apply to declarations (short-form filings), they apply when the Committee's review of a declaration results in a request for parties to file notice.2

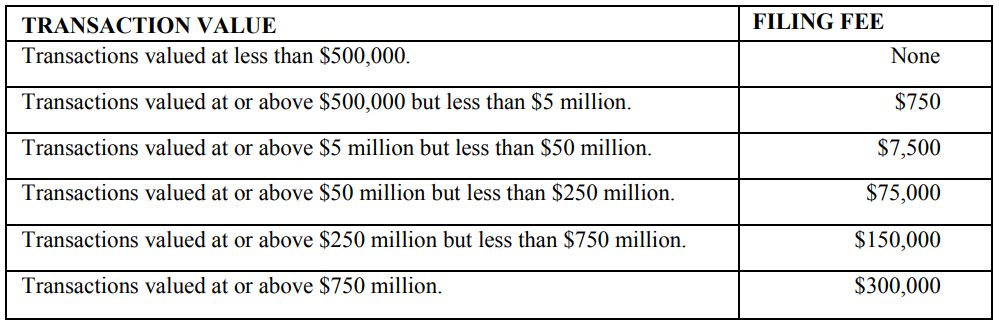

The proposed tiered fee structure is based on transaction value. For the purpose of determining the applicable fee, transaction value is "the total value of all consideration that has been or will be paid in the context of the transaction by or on behalf of the foreign person who is a party to the transaction, including cash, assets, shares or other ownership interests, debt forgiveness, services, or other in-kind consideration."3 Generally, the global transaction value will apply to covered transactions that include one or multiple non-U.S. businesses. We anticipate the Treasury Department may provide additional guidance and interpretations about how to value transactions, not unlike how the Federal Trade Commission provides guidance to value transactions pursuant to the Hart-Scott-Rodino Antitrust Improvements ("HSR") Act.

Footnotes

1. Filing Fees for Notices of Certain Investments in the United States by Foreign Persons and Certain Transactions by Foreign Persons Involving Real Estate in the United States, 85 Fed. Reg. 13586 (March 9, 2020) available at https://www.federalregister.gov/documents/2020/03/09/2020-04641/filing-fees-for-notices-of-certain-investments-in-theunited-states-by-foreign-persons-and-certain. Comments on the proposed rule will be accepted until April 8, 2020.

2. The proposed fees will apply where parties to a transaction requiring a mandatory filing choose to submit a full notification in lieu of a declaration. Parties who are unable to pay the fee may file a declaration. As referenced generally above, parties who choose to file a declaration still may be asked to submit a full filing upon CFIUS's review which would also be subject to applicable fees. In extraordinary circumstances, the Staff Chairperson may waive the fee.

3. Id.

Originally published 18 March, 2020

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.