On February 24, 2020, the United State Citizenship and Immigration Service (USCIS) and the Department of State (DOS) began implementing a new rule to determine who is "inadmissible" to the United States based on "Public Charge" grounds. For many of our clients, this expanded ground of inadmissibility will not prevent them from obtaining a visa or permanent residence in the U.S. However, the process of applying will be more burdensome and intrusive. We provide an overview of the new rule and guidance to assist clients with compliance to the new Public Charge rule.

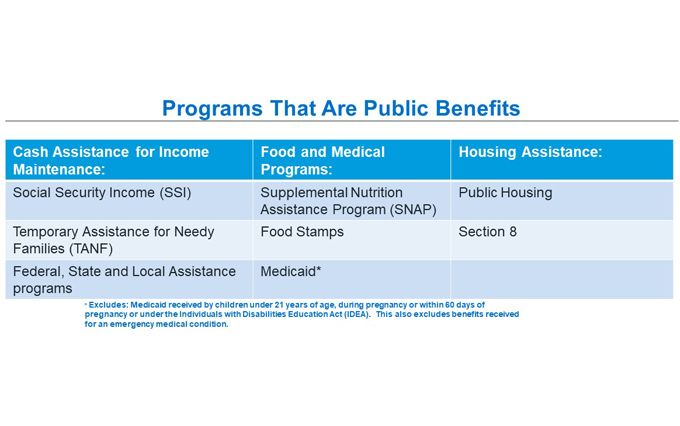

Under INA §212(a)(4)(A) any applicant who is likely at any time to become a public charge is inadmissible and, consequently, ineligible for a visa. All immigrant and nonimmigrant visa applicants, except those excluded1, are subject to the public charge ground of inadmissibility. This expanded ground of inadmissibility defines a "public charge" as an applicant who receives one or more defined public benefit for more than 12 months in the aggregate within any 36-month period. A "Public benefit" is any federal, state, local or tribal cash assistance for income maintenance (other than tax credits) including: Social Security Income (SSI) and Temporary Assistance for Needy Families (TANF); Supplemental Nutrition Assistance Program (SNAP) or Food Stamps; Medicaid, and Housing Assistance (Public housing and Section 8). Receiving any of the above after February 24, 2020 for 12 months or more means that, by definition, the applicant is a public charge.

Certain Medicaid benefits will not be considered for the public charge assessment. They include Medicaid received by children under 21 years of age, during pregnancy or within 60 days of pregnancy or under the Individuals with Disabilities Education Act (IDEA). This also excludes Medicaid benefits received for an emergency medical condition. Further, benefits are only considered if they are directly received by the applicant on the applicant's behalf, or when the applicant is listed as a beneficiary of the public benefit. Benefits are not attributed to the applicant, even if received by members of the applicant's household. The rule does not include disaster relief, national school lunch programs, foster care and adoption, student and mortgage loans, energy assistance, food pantries, homeless shelters and Head Start. Since only federally-funded Medicaid is included, receipt of free or low-cost health insurance, such as Essential Plan in New York State, would not warrant a finding of inadmissibility as a public charge.

The new rule uses a "totality of the circumstances" test to determine whether someone is likely to become a public charge. This means that the U.S. government will take into account the foreign nationals' circumstances at the time of visa application, including age, health, family status, education, skills, assets, resources, financial status, visa classification sought and how long the applicant expects to remain in the United States. The rule creates "heavily weighted negative factors" and "heavily weighted positive factors." A heavily weighted negative factor is receiving more than 12 months of public benefits in the aggregate over the 36-month period of time before submitting the application for adjustment or admission. Heavily weighted positive factors include having a household income of at least 250% of the federal poverty level and having private health insurance. As a result of the new rule, nonimmigrant and immigrant visa applicants will be required to supply substantially more documentation and information related to their personal finances.

Nonimmigrant Visa Applicants

Nonimmigrant Visas include H-1B, TN, L-1, J-1, and F-1, among others, which allow a foreign national to come to the U.S. temporarily for employment, training or a course of study. Many of our clients have employees who hold or have held these temporary nonimmigrant visa statuses. Although becoming a "public charge" has historically been a ground of inadmissibility, the new rule reinvigorates the focus and expands the programs that can be used to disqualify a nonimmigrant visa applicant.

Typically for an employment-based nonimmigrant visa, the employer must file a petition with USCIS in the United States outlining the employer's and foreign national's qualifications for the specific visa category. Once USCIS approves the petition, the foreign national employee is required to apply at the U.S. Consulate in their home country for the visa stamp in their passport in order to enter the U.S. However, if a foreign national is already in the U.S. in a valid nonimmigrant status, they can apply for a change of status or extension of status directly with USCIS.

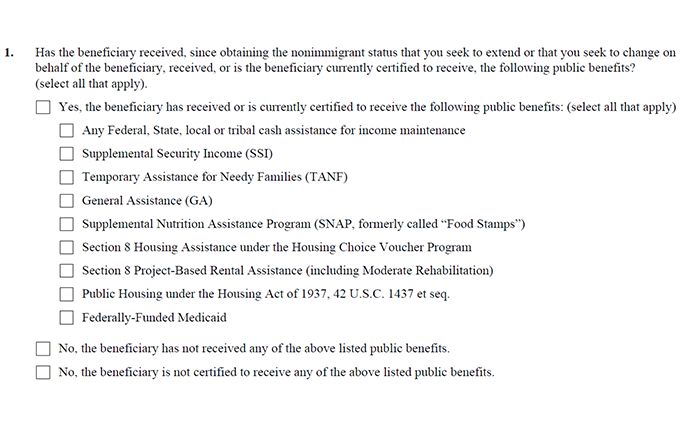

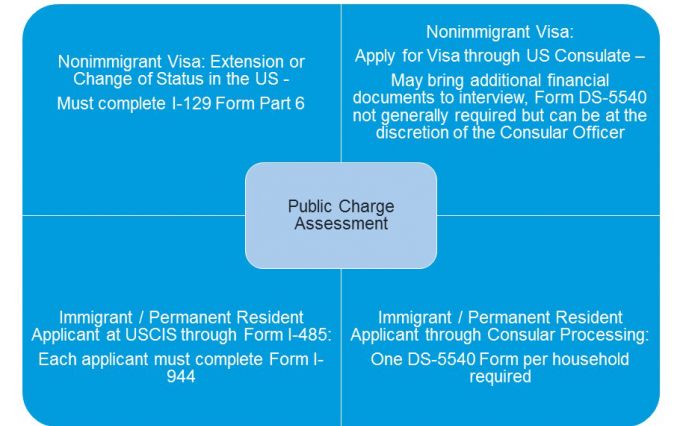

Now, with the new public charge rule, the I-129 form used for nonimmigrant employment-based visa categories, includes additional questions regarding an individual's use of public benefits that must be completed when filing for a change of status or an extension in the United States. Interestingly, the petitioner (employer) is required to complete and attest to the information contained in the I-129. Therefore, in the event that a nonimmigrant visa applicant has received any public benefits in the past this information would be shared with the petitioning company. Please see the excerpt of the form:

If not filing to change or extend status in the U.S, the public charge questions on the I-129 do not need to be completed by the petitioner. Instead, the Consular Officer will review whether the visa applicant is at risk of becoming a public charge and is therefore inadmissible. Generally in the case of a nonimmigrant visa application, the Consular Officer will not require the submission of additional forms or financial information. However, visa applicants should be prepared with some basic financial information in case they are asked. This may be: bank statements, financial statements, evidence of income, prior tax filings and property ownership. However, the Consular Officer does have the discretion to require that a nonimmigrant visa applicant complete Form DS-5540 (described below) in cases where they believe an applicant may be subject to the public charge ground of inadmissibility and further information is required to make the determination.

Immigrant Visa Applicants

Those employees who are pursuing lawful permanent residence, or a green card, in the United States also have been subjected to a public charge ground of inadmissibility historically. However, in the context of an employment-based green card petition, the review was typically limited to whether the bona fide job offer existed at the prevailing wage and whether the employer had the ability to pay the wage. Now a more thorough review of the individual immigrant applicant's finances will be required for cases filed on February 24, 2020 or later.

If filing for Adjustment of Status in the United States through form I-485, all applicants for permanent residence will be required to complete Form I-944. In addition to asking detailed information regarding the applicant's assets and liabilities, the form requests a tax transcript, credit report and score, and proof of health insurance.

If applying for lawful permanent residence via Consular Processing, one Form DS-5540 is required per family. This form is the Department of State's parallel form to the I-944 and also requires details regarding the applicant assets and liabilities. The applicant must submit a U.S. tax transcript for the most recent tax year and evidence of health insurance.

Both the I-944 and DS-5540 require that the applicant answer specific questions regarding whether they have received any public benefits.

Factors to Be Considered for the Public Charge Ground of Inadmissibility

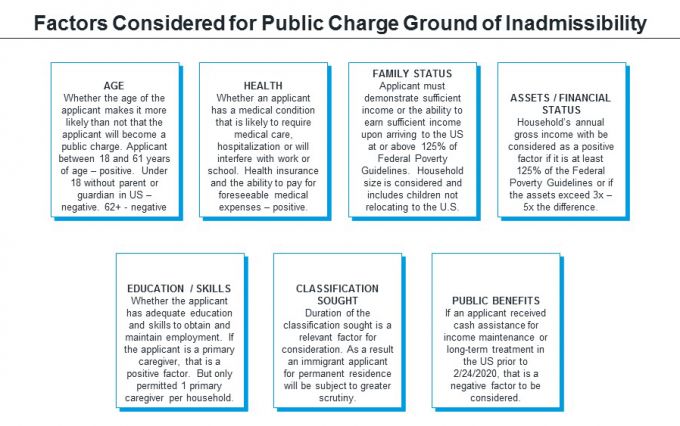

As indicated above, USCIS and the DOS will use a "totality of the circumstances" test to determine whether an individual is inadmissible. Officers will only consider a public benefit that was received after the enactment of the rule (February 24, 2020) and will consider only the public benefits as defined in the rule. The following criteria will be considered, including:

AGE: Officers will consider whether the age of the applicant makes it more likely than not that the applicant will become a public charge. This includes whether the applicant's age will affect his/her ability to work; specifically whether the applicant is between 18 years old and 62 years of age (early retirement age for Social Security). If the applicant is under 18 years old and not accompanied by a parent or following to join a parent or guardian, then age is a negative factor in the totality of the circumstances; just as 62 years of age and over is a negative factor if it affects the applicant's employability or there is an increased change of healthcare related costs.

HEALTH: Health is considered to determine whether an applicant will become a public charge; whether an individual has a medical condition that is likely to require medical care, hospitalization or will interfere with the applicant's ability to attend school or work. In the case of an immigrant visa applicant, the panel physician's report will be reviewed for these purposes. Health insurance and the ability to pay for reasonably foreseeable medical expenses is considered a positive factor in the analysis.

FAMILY STATUS: The applicant must demonstrate sufficient income or the ability to earn sufficient income upon arriving to the U.S. at or above 125% of the Federal Poverty Guidelines for the household size. Household size includes children who are not relocating to the U.S. with the visa applicant.

ASSETS, RESOURCES, AND FINANCIAL STATUS: The household's annual gross income will be considered as a positive factor if it is at least 125% of the Federal Poverty Guidelines. If not, assets should exceed 3 – 5 times the difference, depending on application/petition type. Assets, liabilities and overall financial status will be reviewed.

EDUCATION AND SKILLS: Whether the visa applicant has adequate education and skills to obtain and maintain employment will be considered. Whether a visa applicant is a primary caregiver can be considered as a positive factor, considering the difficulty in monetizing contributions to the household. Only one applicant per household may be considered the primary caregiver.

VISA CLASSIFICATION SOUGHT AND EXPECTED PERIOD OF ADMISSION: Duration of the admission is relevant to determine whether the visa applicant has the requisite financial ability to support himself/herself and the household while in the U.S. As a result, an immigrant wishing to reside permanently in the U.S. will be subject to greater scrutiny than an applicant for a temporary nonimmigrant visa.

PUBLIC BENEFITS RECEIVED PRIOR TO FEBRUARY 24, 2020: An applicant who has received any cash assistance for income maintenance or long-term treatment at the U.S. government's expense prior to February 24, 2020 is a negative factor.

Takeaway

Although the public charge ground of inadmissibility has always been a factor for nonimmigrant and immigrant applicants, the new rule formalizes and broadens the review by including an assessment of whether the applicants will become a public charge at any time in the future. Although this review will likely not prevent the issuance of nonimmigrant and immigrant visas for most employment-based cases, the totality of the circumstances assessment has increased the paperwork burden of nonimmigrant and immigrant petitions. Moreover, foreign nationals are forewarned that accepting public benefits may affect their ability to acquire future immigration benefits. Should you have additional questions, please contact the Proskauer Immigration Group.

Footnote

1. Asylees, Refugees, U and T Visa Applicants, VAWA Self-Petitioners, Special Immigrant Juveniles, Applicants for Temporary Protected Status (TPS) and Applicants for the Cuban Adjustment Act are excluded from the public charge ground of inadmissibility.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.