Fraud has many faces and it does not distinguish between geography, industry or company size. It not only drains earnings, but it can also significantly damage companies' most valuable assets – their reputation and brand value. Taking the proper measures to prevent and detect fraud in an efficient and timely manner is critical to safely manage fraud risk.

Why does fraud happen?

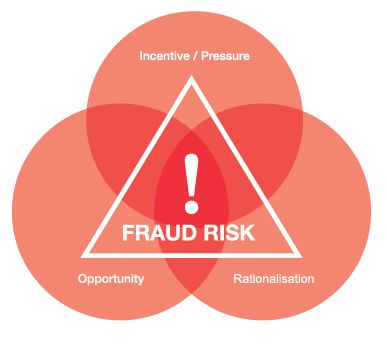

Fraud practitioners often point to three common factors when fraud occurs (the "Fraud Triangle"). The perpetrators experience some Incentive or Pressure to engage in misconduct. There must be an Opportunity to commit fraud and the perpetrators are often able to Rationalise or justify their actions.

The global economic decline experienced over the last years has contributed to the incidence of each of these three factors. The line separating acceptable and unacceptable behavior can, for some, become blurred, especially when someone's livelihood, or the company's future is at stake. With cost cutting measures weakening the control environment, like lesser segregation of duties and fewer dedicated resources to the internal audit and compliance function, the opportunities to commit fraud rise.

Did you know?

- Organisations lose 5% of their revenue to fraud each year1

- It takes between 12 to 36 months for reported fraud incidents to be detected1

- Small organisations are victims of fraud more frequently than larger organisations1

- The Communications and Insurance industries, together with the Public Sector top the table of reported fraud2

- Asset misappropriation, accounting fraud and corruption schemes are the most common types of fraud2

- Two-thirds of the reported economic crimes are committed by employees2

- Customers are the main perpetrators of external economic crimes2

- Suspicious transaction monitoring, tip-offs and Internal Audit are the three most effective methods to detect fraud2

- Organisations that have performed fraud risk assessments have detected and reported more incidents of fraud2

Responding to risk – a proactive approach makes good business sense

Organisations should consider a proactive approach to fraud risk management through the implementation of a fraud risk strategy.

There are five key aspects to be considered to ensure an effective strategy. There needs to be the right organisational tone starting from the top and reaching every part of the organisation. Management requires proper risk identification mechanisms and mitigating controls to assess the organisation's exposure to fraud in the various business areas and to implement best practice preventive and detective measures. The effectiveness of managing fraud risk should be kept in check through monitoring and auditing structures, in terms of multiple lines of defense including internal audit. Finally, incident response and remediation procedures should be considered to direct management in handling fraud allegations or occurrences.

How PwC can help

Our Forensic Services team can help you anticipate fraud and prevent a crisis or be by your side to find out what really is happening when you suspect the worst. PwC Malta's Forensic Services practice offers a full spectrum of forensic solutions including:

Fraud risk management

- Are you aware which areas of your business are vulnerable to fraud?

- Do you have adequate controls in place to mitigate fraud risks?

Investigations

- Do you require expert help in investigating suspected fraudulent activities?

Dispute analysis

- Do you need assistance in the analysis and valuation of claims?

Forensic technology solutions

- Have you considered electronic data analysis to identify or follow up irregularities?

Regulatory compliance

- Are you concerned on the adequacy of your anti-money laundering or whistleblower procedures?

Why PwC

We have a local team of well-established experts with diverse industry backgrounds, including forensic accountants, lawyers, forensic technology experts and research specialists.

In addition, we have access to a global PwC network of forensic specialists in a range of areas, with more than 1,400 experts in over 150 countries worldwide. Our diverse background and skill-sets will benefit you in your investigations and forensic undertakings, regardless of how big or small the project.

Footnotes

1 Association of Certified Fraud Examiners, 2012 Report to the Nations on Occupational Fraud and Abuse

2 PwC, 2011 Global Economic Crime Survey (issued every two years) Did you know?

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.