The importance of preparing a will could not be overemphasised. However, many people put off making one to avoid having to think of their mortality, or due to the mistaken belief that the preparation of a will is an expensive or a complex exercise. It is also common for many to have the misconception that a will is unnecessary because their properties and possessions will automatically be passed on to their spouses and children. This article will set out the reasons as to why everyone needs a will and the consequences of a person passing away without a will.

Pursuant to Section 2 of the Wills Act 1959 , a will is defined as follows:

"a declaration intended to have legal effect of the intentions of a testator with respect to his property or other matters which he desires to be carried into effect after his death and includes a testament, a codicil and an appointment by will or by writing in the nature of a will in exercise of a power and also a disposition by will or testament of the guardianship, custody and tuition of any child."

A will is an essential part of any estate as it is a straightforward method to ascertain a deceased's assets. As the adage goes, "you can't take it with you." The assets accumulated during your lifetime will eventually be transferred to the intended beneficiaries. On the other hand, without a will in place, various consequences may occur upon your death. Such consequences may include difficulty in identifying your assets and the beneficiaries that are entitled to inherit your assets and/or properties, or a part thereof.

For a will to be valid, the following requirements must be satisfied:

(a) The testator (the person making the will) must attain a minimum age of 18 (Section 4 of Wills Act 1959);

(b) The testator must be of sound mind (Section 3 of Wills Act 1959);

(c) The will must be made in writing and signed (Section 5 of Wills Act 1959); and

(d) There must be two witnesses present at the time of signing of the will. The witnesses cannot be a beneficiary or the spouse of a beneficiary in the will.

Why do I need a will?

Here are 8 reasons for having a will:

1. Right to choose your beneficiaries and to determine the manner of the distribution of your assets

A will allows you to have control over the distribution of your assets. You are free to choose the beneficiaries who will benefit from your estate and determine their respective shares in your assets.

2. Appoint and outline powers of an executor

You have the power to appoint an executor, who will administer your affairs after your death. However, it must be emphasized that you should appoint someone trustworthy and impartial to honour the terms of your will. In Peninsular Malaysia, the procedural rules on applications for Grant of Probate and Grant of Letters of Administration for the estate of a deceased, as well as the powers of executors and administrators are governed by the Probate and Administration Act 1959.

Pursuant to Section 3 of the Probate and Administration Act 1959, a probate may be granted to an executor appointed by a will. The appointment of an executor may be expressed or implied. A person may become an executor impliedly when he or she was named in the will to carry out certain duties and responsibilities as an executor. You may appoint up to four executor(s) or executrix(es) to jointly administer your estate pursuant to Section 4 Probate and Administration Act 1959. The duties and responsibilities of an executor are manifold, including identifying your assets, paying all your debts, and distributing the remainder of your assets according to the terms of your will.

3. Set up a testamentary trust

By making a will, you can also set up a testamentary trust. A testamentary trust is provided for in a will, whereby the testator appoints a trustee to manage the funds in the testamentary trust during the trust period until the beneficiary is eligible to receive the funds. Such trust will only come into effect upon your death. A testamentary trust is particularly useful if you have children who have yet to attain the age of eighteen (18). You may appoint and/or elect anyone as a trustee, but he or she should be a person whom you think will act in the best interest of your beneficiaries. Your trustee will also be subjected to the responsibilities imposed by the Trustee Act 1949. However, if the person you appointed as a trustee refuses to take on the role, another person may volunteer, or the court will appoint another trustee under Section 45(1)(a) of the Trustee Act 1949 on its own.

4. Name a guardian to take care of your children

With a will, you may also nominate a guardian to take care for your minor children's wellbeing. The guardian will administer your assets for your children until they attain the age of majority. Once your children reach the age of majority, the guardian must transfer all of the property to your children. However, if the children pass away before attaining the age of majority, all of the assets held in guardianship for them will form part of their estate.

5. Minimise family conflict

The division of assets among family members sometimes entails a myriad of emotions, with most mired in animosity and bitterness. By having a will which sets out your intended desires, this may help to minimise, if not avoid, family conflicts and speculation over what you "would have" set out in your will.

6. Shorter time frame to obtain a grant of representation

Contrary to common belief, all estates must go through the court probate process in order to have the assets duly transferred to the beneficiaries, will or without a will. However, the time taken to obtain a Grant of Probate for a deceased's estate is relatively shorter in comparison with an application for Grant of Letters of Administration.

7. Support a charity or an organisation

The ability to support a charity or an organisation, even after your passing, is also an excellent reason to have a will because it allows your legacy to live on and reflect your values and interests.

8. Flexibility

Finally, you may amend your will at any time before your death. This enables you to consider the change in your life circumstances. For instance, upon the birth of your new child, you may wish to include your newborn as one of the beneficiaries in your will. Hence, a will offers you the flexibility to reflect and decide on whom you wish to name in your will. While a divorce does not affect the validity of a wilI, it is crucial to note that your will is automatically revoked upon your marriage or remarriage under Section 12 of the Wills Act 1959. An exception is where your will expressly provides for an expected marriage in a 'contemplation of marriage' clause. Your will may also be revoked in the following circumstances: (i) when you make a subsequent will; (ii) on your written declaration with regards to your intention to revoke the will; (iii) upon the intentional destruction of the will by you or some other person in your presence and under your direction; or (iv) upon your conversion to Islam.

What happens if I die without a will?

If you do not have a will at the time of your death, you are said to have died intestate. Your estate will be distributed according to a designated formula in the Distribution Act 1958 unless you are a Muslim in West Malaysia and Sarawak or is a native of Sarawak. If you are domiciled in the state of Sabah, then the Intestate Succession Ordinance 1960 will apply.

1. The manner of distribution of assets will be dictated by the Distribution Act 1958

In the absence of a will, you have no say in what happens to your assets. Upon your demise, the estate will be distributed amongst your immediate family members – parents, spouse, and issues (children), allowing them to receive a percentage of your assets. However, this distribution may not be reflective of your wishes. If you do not have an immediate family member, your assets will be distributed between your siblings and their children, your grandparents, or your uncles, aunts, and their children.

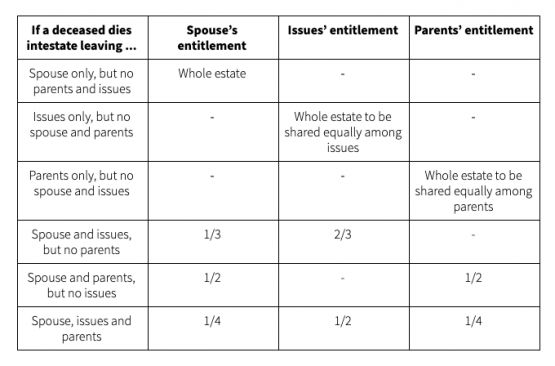

The distribution of the estate of an intestate is shown in the following table:

2. Possible family disputes

There may be added pressure on your surviving spouse, family, and relatives (heirs) to spend additional time, money, and emotional energy to settle your affairs because information on your intentions was unknown at the time of death.

3. You lose the right to appoint an executor

In the event that you do not have a will or you leave a will without appointing an executor, the court will have the discretion to grant the Letters of Administration to the person that the High Court Judge thinks fit to administer your estate. However, this may give rise to disputes between family members or beneficiaries on who should be selected to take on this role.

4. You lose the right to nominate a guardian of your choice

Without a will, in the event of the simultaneous passing of both you and your spouse, further complications may arise if your children are minors. In such an event, the court will appoint an administrator under Section 30 of the Probate and Administration Act 1959 who can act as a guardian. Alternatively, the court will appoint a guardian under Section 8 of the Guardianship of Infants Act 1961 to look after your children's interests. However, the person appointed may not be of your preference. Similarly, family disputes may arise as to who is the most appropriate guardian.

5. Lengthy distribution process

The process to apply for and obtain a Grant of Letters of Administration will entail more cost and time, typically requiring an administration bond and the appointment of two sureties to guarantee the proper administration of the estate, as well as further court orders to effect the transfer of real property.

Conclusion

In conclusion, it is pertinent for you to have a will to safeguard the interest of your loved ones. In addition, it is always advisable to first consult a lawyer to ensure that your will is in compliance with all the necessary statutory requirements.

Originally Published by MahWengKwai & Associates, January 2021

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.