INDONESIA

OVERVIEW |

|

| JURISDICTION | LANGUAGE |

| Civil law | Indonesian (Bahasa Indonesia) |

BUSINESS ENVIRONMENT |

||

|

||

| POPULATION | INCOME | GNI CAPITA (PPP TERMS) |

| 242.3 million | Lower middle | $4,500 |

PROFILE

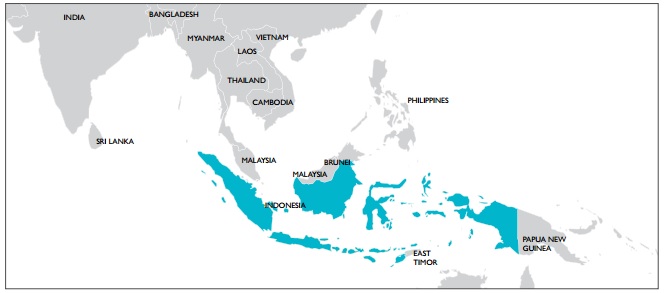

Indonesia is an archipelagic nation located in South East Asia. It is the fourth most populous country in the world and is home to the world's largest Muslim population. Its 13,466 islands foster a diverse range of cultures, languages and ethnicities, which inspired the country's motto of "unity in diversity". Indonesia was once a Dutch colony and declared its independence shortly after Japanese occupation ended in 1945. After a long period of political instability, Indonesia held legislative elections in 1999 and is now regarded as the third-largest democracy in the world. Important issues within Indonesia include combating poverty and domestic terrorism, the implementation of reforms and the promotion of transparency in its governmental institutions.

ELECTRICITY INDUSTRY OVERVIEW

- Total installed electricity capacity in 2011 was 28.6GW. Of this amount:

-

- coal accounted for 44%;

- oil accounted for 23%;

- natural gas accounted for 21%;

- hydropower accounted for 7%; and

- geothermal accounted for 5%.

- Despite an abundance of indigenous fossil fuel reserves and renewables capacity, Indonesia is not self-sufficient in energy supply.

- It is estimated that just 65% of the population has access to electricity or modern forms of energy, with electrification rates lower in remote and rural areas. Despite significant growth in electricity infrastructure in the last decade, per capita capacity remains low.

- An additional 54GW of electricity capacity will need to be developed by 2020 to meet continued growth in demand. Accordingly, the Government has sought to diversify the country's energy supplies with an increased renewable energy contribution while also attempting to foster competition in the electricity market.

Government

- The Ministry of Energy and Mineral Resources (MEMR) is the overarching government body for the energy sector. MEMR oversees the electricity master plan, which lays out the future goals and targets for the sector

- The Directorate General of Electricity and Energy Utilisation, which is under the Department of Energy and Mineral Resources (DEMR), is the chief regulator of the energy sector.

Generation

- The state-owned electricity company, Perusahaan Listrik Negara (PLN), owns most of the generation assets, transmission and distribution infrastructure.

- In 1994, PLN's status was changed from a general company to a corporation. It also became the only "authorised agency of electricity business" (PKUK)permitted to provide electricity to the public. However, in 2009 PLN's role was further reformed when it was restructured to become a state-owned enterprise (BUMN).

- Two wholly owned subsidiaries of PLN, Pembangkit Jawa-Bali and Indonesian Power, are now the primary generators of electricity. Overall, PLN effectively controls 86% of generation assets. Independent Power Producers (IPPs) and various electricity cooperatives also generate electricity, however PLN is the sole buyer of electricity and retains the right of first refusal.

Distribution and transmission

- The low rate of electrification in Indonesia is largely due to distribution and transmission infrastructure shortages. Experts have warned that unless Indonesia's electricity infrastructure is updated, then the country could face an energy crisis within a decade.

- Five distribution entities now act semi-autonomously from PLN to distribute electricity to the east, west, central Java, Bali and Jakarta regions.

- The Indonesian interconnected system encompasses Java, Bali and Madura. The islands of Java and Sumatra are connected by a 39km submarine cable.

- Despite the increased privatisation of the electricity sector, PLN controls all transmission infrastructure.

Electricity laws

- Electricity Law No. 15/1985 allowed limited private participation in the generation phase through IPPs who sold electricity to PLN. However, PLN was granted exclusive powers over the transmission, distribution and ultimate sale of electricity. The impact of the Asian financial crisis, however, significantly limited the IPPs operation. This law has been revoked and replaced by Electricity Law No. 30/2009.

- Electricity Law No. 20/2002 sought to further privatise the industry by allowing market-driven tariffs and independent regulation whilst also amending Law No. 15/1985. However, Law No. 20/2002 was ruled as unconstitutional by the Constitutional Court. In its decision, the Court considered that electricity is an industry sector that the Indonesian Government must control because it is "important to the state and affects the lives of most people". As a result, Law No. 15/1985 was reinstated.

- Electricity Law No. 30/2009 is now the key piece of

legislation regulating the electricity sector. Under Law No.

30/2009, the Government (Central or Regional) has the authority to

issue licenses that are needed by entities to conduct activities in

the electricity sector.

Under Law No. 30/2009, PLN is treated as a BUMN and no longer has a monopoly power in the electricity sector. Law No. 30/2009 also provides for competition in the supply and distribution of electricity to end customers and establishes the basic framework for private entities to participate in the electric power business. Unlike Law No. 20/2002, which was intended to privatise the industry by allowing market-driven tariffs and independent regulation, Law No. 30/2009 still gives authority to the Government to control the energy sector. - Energy Law No. 30/2007 established the National Energy Council.

RENEWABLES INDUSTRY OVERVIEW

- Renewable energy currently plays a minor role in Indonesia's energy supply, however the Government is seeking an increase in renewable generation to 17% of the total energy consumption by 2025.

- Current estimates place total renewable energy capacity at 2.9GW (on-grid) and 3.2GW (off-grid). Given a total renewable energy potential within the country of 163.3GW, this amounts to an undeveloped renewables potential of 96%.

- The Government is aiming for 10.1GW of new capacity comprising of 3.9GW of geothermal and 1.2GW of hydropower by 2014.

- Indonesia has introduced a Climate Change Trust Fund to ensure that climate change is integrated into the development planning. The Government is seeking to become a regional leader on climate change mitigation and in 2009 voluntarily committed to reduce greenhouse gas emissions by 26% by 2020.

- The US$400 million Clean Technology Fund was created to promote renewable energy, improve electrification rates and enhance energy efficiency within Indonesia. The fund's predominant focus is on developing Indonesia's large-scaled geothermal projects.

- The Directorate General of Renewable Energy and Energy Conservation, which sits under the MEMR, is the chief regulator in the renewable energy area.

Hydropower

- Indonesia has a significant hydropower potential of approximately 75GW, of which about half lies in isolated Papua.

- The current total installed capacity for hydropower is estimated by MEMR to be 4.3GW.

Wind energy

- Wind speeds averaging between 3m and 6m/s have encouraged government investment in small and medium sized wind projects, however large-scale wind farms are not feasible with such wind speeds.

- Much like in Mongolia and China, Indonesia's most productive wind sites are located far from population centres, thus requiring extensive transmission infrastructure.

- Indonesia is seeking a total installed wind capacity of 970MW by 2025.

Solar energy

- The installed capacity of solar energy in Indonesia is just 12MW.

- In 2009, 77,433 50W solar PV home systems were distributed to Indonesian households.

Geothermal energy

- Geothermal energy is Indonesia's most feasible renewable energy source given that it accounts for roughly 40% of known geothermal capacity worldwide. Indonesia is currently the third largest geothermal generator.

- Climate change activists like Al Gore have proclaimed that Indonesia can become the global geothermal superpower, while other analysts have called on the country to replicate its success in thermal coal production in the geothermal field.

- Indonesia's total geothermal potential is reportedly 28.1GW, with current capacity of 1.2GW – a figure considered quite low given the country's potential.

- A target of 5GW production by 2014 has been announced by the Government.

- There is a separate legal regime for geothermal energy production in Indonesia compared to other forms of electricity. It is regulated by Geothermal Law No. 27/2003. A geothermal business requires a geothermal business licence, as well as the standard electricity supply business licence to generate electricity.

- In April 2012, Indonesia signed an extensive geothermal cooperation agreement with New Zealand.

Biomass energy

- The installed capacity of biomass in 2010 was 5.7GW, while biomass potential is approximately 50GW.

- Indonesia is a leading exporter of palm oil.

- Like East Timor, remote villages in Indonesia rely heavily on traditional biomass sources for energy.

Ocean energy

- With 54,716km of coastline, Indonesia has vast potential for ocean current, wave and tidal energy. However, at present the country has no installed ocean energy capacity and just one demonstration project has been developed.

- The estimated potential of ocean energy in Indonesia is between 10MW and 35MW per kilometre of coastline.

CURRENT ISSUES IN THE RENEWABLES INDUSTRY

- Around 80% of Indonesia's geothermal resources lie in conservation forests, which are protected under Indonesian law. The Government has proposed to allow drilling in these conservation forests on the condition that the processing plant is located outside the conservation forest area. Still, developments within these areas require presidential approval and in May 2011 the Indonesian Government committed to a twoyear moratorium on forestry development as part of a US$1 billion forestry agreement with Norway. It will thus be difficult for Indonesia to balance its voluntary emission reduction targets which rely on reducing deforestation whilst also reaching its geothermal potential that is crucial for the country to avoid an energy crisis.

- Commentators suggest that the Directorate General of Electricity and Energy Utilisation, which regulates the electricity industry, has no clearly defined role or free autonomy to balance the various interests in the energy sector. Additionally, the absence of an independent regulator, as well as infrastructure shortages, had led to cautiousness from foreign investors.

- There is a large backlog of pipeline projects, particularly for geothermal projects. For instance, the World Bank has estimated that there are 580MW of geothermal projects in the pipeline and just 5MW of total capacity that have reached financial close.

- The cost of electricity, like in Australia, is a politically sensitive issue. In 2011, the Government gave US$8 billion in subsidies to PLN to offset the renewable energy feed-in tariff scheme (see below). An ensuing proposal to raise the cost of electricity by 20% was met with mass strikes and demonstrations, ultimately defeating the proposal. It is estimated that only an 80% increase in electricity prices would cover production costs, which brings into question the financial viability of Indonesia's state-dominated electricity system.

RENEWABLES LAWS

- Green Energy Policy 2004 is an MEMR Decision No. 2/2004 which aims to reduce the country's reliance on oil.

- Geothermal Law No. 27/2003 gives power to the regional governments to develop geothermal energy and establishes a separate regime for geothermal licensing.

- Governmental Regulation No. 70/2009 on Energy Conservation forms the National Energy Conservation Plan, promotes energy efficiency and offers incentives for the importation of energy-saving devices.

- Presidential Regulation No. 5/2006 on National Energy Policy sets out the definition of renewable energy and the target for renewable energy production.

GOVERNMENT INCENTIVE PROGRAMS

- Indonesia currently offers tax concessions for renewable energy projects, particularly geothermal energy projects. Incentives for geothermal projects include an investment credit of 20% of the qualifying capital investment, an extended tax loss carry forward period for up to 10 years, accelerated depreciation rates and a maximum dividend withholding tax of 10%.

- The Ministry of Finance's Regulation No. 21/PMK. 011/2010 provides similar tax and also custom incentives for other renewable energy technologies.

- Importantly, since 2002, the MEMR has also established a feed-in tariff scheme for renewable energy. However, international developers have not been as attracted by the feed-in tariff given the fixed end-user energy prices, which are regarded by many as unsustainably low.

MAJOR PROJECTS/COMPANIES

- Ulumbu Geothermal Power Plant, which supplies electricity to neighbouring districts, has a capacity of 5MW.

- There are a number of other geothermal plants that have recently become operational, including a 20MW plant in Lahedong.

- Cisokan hydropower plant has a capacity of 1GW. The project is substantially funded by the World Bank.

- As part of Indonesia's Power Transmission Development Phase II, PLN is undertaking extensive repairs to the transmission infrastructure on grids in Java-Bali, Sulawesi and Kalimantan. This is being funded by the World Bank.

- The Itochu Corporation of Japan has been one of the largest sponsors of renewable energy projects in Indonesia.

FOREIGN INVESTMENT/OWNERSHIP

- Investment Law No. 25/2007 requires foreign investors in the electricity sector to obtain a foreign investment license from the Capital Investment Coordinating Board (BKPM). In order to obtain the foreign investment license, an Indonesian company must be established under the Investment Law. The Indonesian company can then apply to MEMR for a licence to engage in the energy sector.

- BKPM provides a one-stop integrated service to handle the investment application process.

- Like the Philippines, Indonesia has a "negative list" for foreign investment. It is set out in Presidential Regulation No. 77/2007 (Perpres), as amended by Perpres 36/2010. Generally, this list limits foreign ownership in the production, transmission and distribution of electricity up to 95%. However, since Perpres No. 36/2010, foreign ownership is allowed for small-scale power plants of 1 to 10MW throughpartnerships or cooperatives. Geothermal facility services may have foreign ownership of up to 90%. Clearly though, there are limits on foreign ownership for larger renewables projects.

- Industry analysts have recognised an increase in foreign investment as crucial to growing renewable energy development in Indonesia.

RELEVANT INTERNATIONAL TREATIES

- Indonesia is a signatory to the United Nations Framework Convention on Climate Change, however it has no emissions reduction targets. Like other non-annex one countries, Indonesia has voluntarily committed to reducing emissions.

- It is a member of the Association of South East Asian Nations (ASEAN), which promotes sustainable energy through the ASEAN Centre for Energy.

© DLA Piper

This publication is intended as a general overview and discussion of the subjects dealt with. It is not intended to be, and should not used as, a substitute for taking legal advice in any specific situation. DLA Piper Australia will accept no responsibility for any actions taken or not taken on the basis of this publication.

DLA Piper Australia is part of DLA Piper, a global law firm, operating through various separate and distinct legal entities. For further information, please refer to www.dlapiper.com