With global compliance legislation expected to tighten in the future, what will this mean for business complexity? In the second of three themes explored in TMF Group's Global Business Complexity Index 2023 (GBCI), we will explore how changes in rules and regulations have been exacerbated or expedited by the geopolitical situation, and how increasing compliance requirements are making some jurisdictions more attractive than others.

Global compliance requirements remain in line with 2022

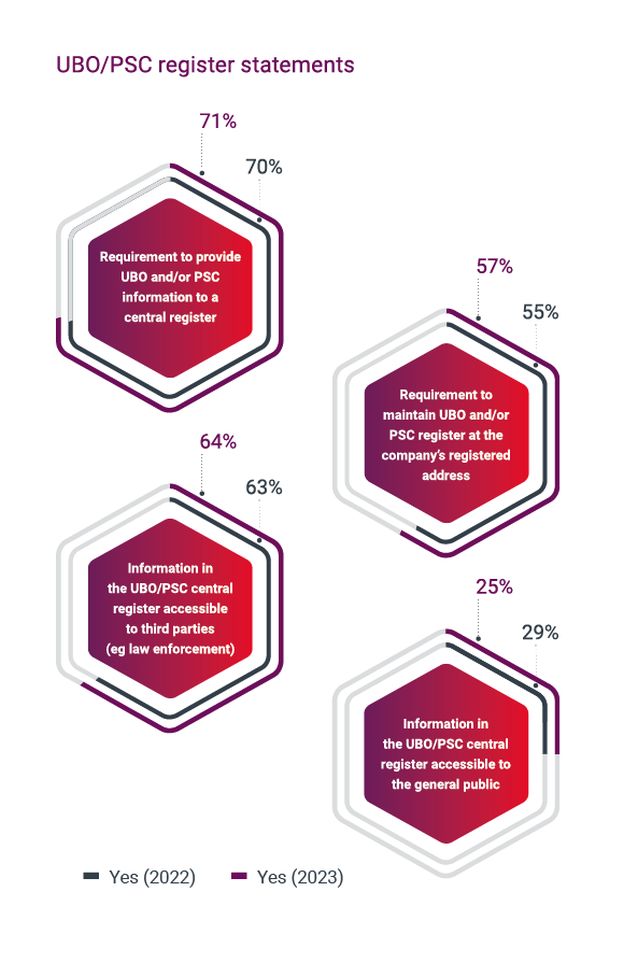

Compliance requirements, such as reporting on ultimate beneficial owners (UBO) and persons of significant control (PSC), are in place to ensure that businesses and those who manage them remain transparent when incorporating and operating in foreign jurisdictions. They have been a core part of compliance processes in locations around the world for a number of years. Year on year, the requirement to provide UBO and/or PSC information to a central register has remained stable at around 7 in 10 (71%) jurisdictions.

Regulations such as know your customer (KYC) and anti-money laundering (AML) have been adopted by at least some industries across all jurisdictions. This has been the case over recent years, demonstrating that these regulations have been an important and stable method of holding businesses to account over operational transparency and safety.

These regulations have tended to become more stringent over time. For instance, in Hong Kong the tightening due diligence checks, KYC requirements and transaction monitoring has significantly increased the burden on client due diligence. This is alongside greater monitoring of Hong Kong-based corporate services providers' activities for clients, especially around payments.

Global regulations such as these can create more localised complexity. In Mexico, for example, UBO reporting requirements were introduced in January 2022 and the information gathering is extensive, adding a significant reporting burden for clients. Additionally, unclear requirements meant it was open to widespread interpretation. Public notaries could refuse to incorporate organisations as a result.

"Local regulations in response to wider international rules and directives have increased and are complex to handle."

TMF Germany expert

Global regulatory burden expected to increase

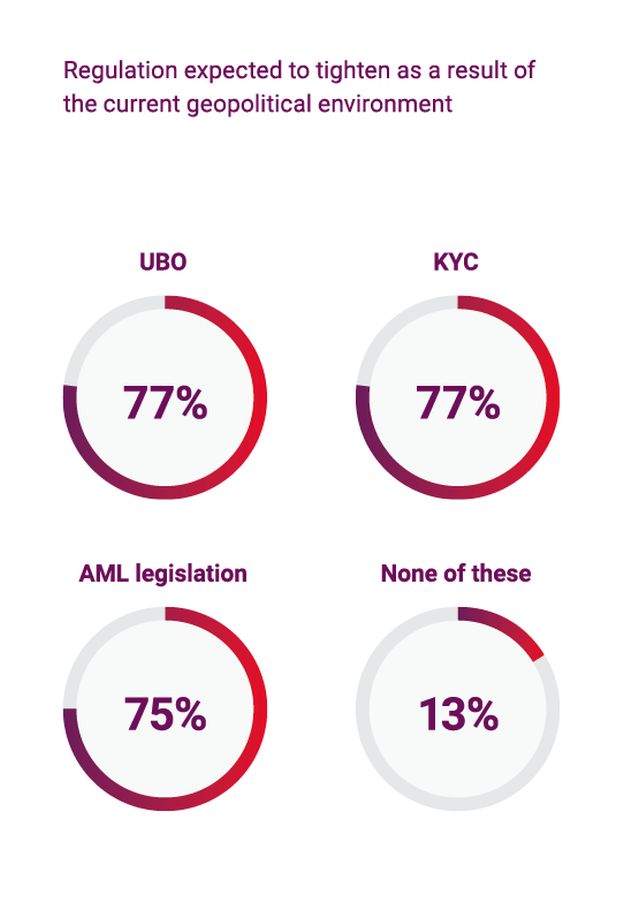

While the implementation of global compliance regulation remains stable, jurisdictions are observing a tightening of global compliance regulation such as KYC and UBO reporting. This is a trend that is set to continue in light of geopolitical tensions, such as the war in Ukraine.

Only 13% of locations do not expect to see compliance regulations tighten, with global tensions driving the need for greater transparency and understanding of who exactly is investing into jurisdictions.

In Curaçao, sanctions introduced against Russian businesses and individuals mean that KYC checks have become more detailed and more rigorous, creating complexity for Russian-owned organisations. The same can be said for jurisdictions like the UK, Hungary, Australia and Malaysia, with the impacts of the war being felt worldwide.

Interestingly, jurisdictions such as Serbia are not placing any sanctions or increased global compliance requirements on Russian businesses and individuals, meaning they are able to attract Russian investment. This demonstrates the different approaches jurisdictions can take during challenging times and how this impacts both complexity and attractiveness.

Increased reporting requirements can impact global expansion goals

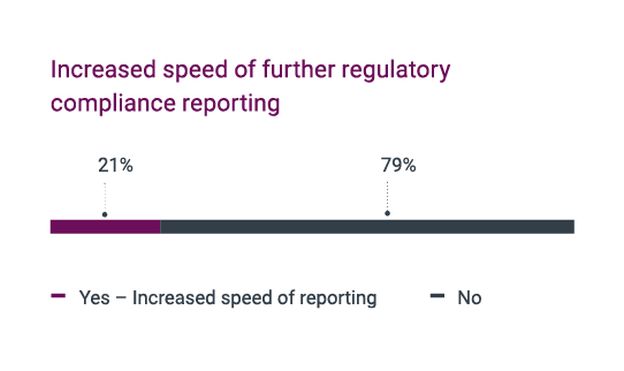

43% of jurisdictions expect further regulatory compliance reporting for businesses within the next year. Organisations can struggle to understand and meet new reporting requirements. One in five (21%) of jurisdictions expect that the required speed of reporting will increase alongside the addition of new rules. This will mean that businesses not only have to navigate greater reporting demands, but they also may be expected to do so in a more rapid manner than previously.

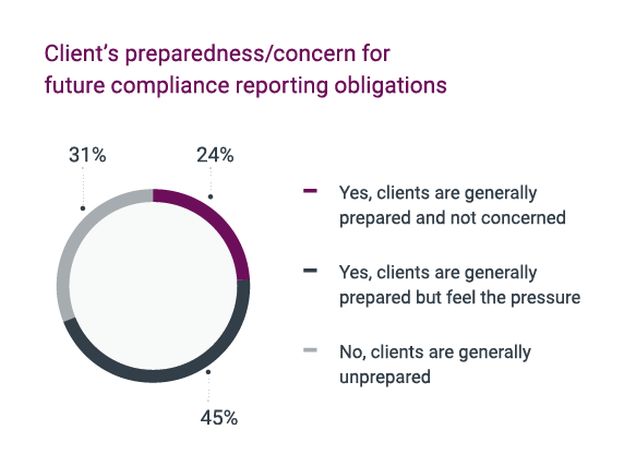

Due to such changes, clients are feeling the pressure. Only 24% of jurisdictions report that their clients are generally prepared for increased reporting requirements and are not feeling pressured. 31% of jurisdictions report that clients are generally unprepared, demonstrating that they may not yet realise the complexity of what is to come.

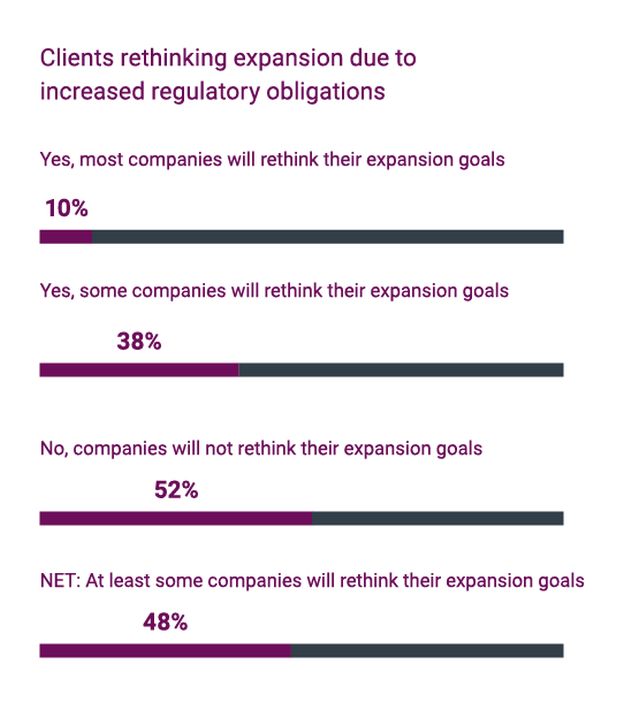

Due to this pressure and increased complexity, we see that almost half (48%) of jurisdictions report that at least some companies will rethink their expansion goals. For instance, pausing incorporation within a jurisdiction with hefty global compliance reporting requirements, or perhaps looking for another jurisdiction with more lenient rules. This demonstrates the true impact that global compliance legislation and reporting can have, and how it can limit the attractiveness of a jurisdiction and encourage businesses to look elsewhere.

"We've observed an increase of global regulatory propositions for all countries, not just for Turkey. Adapting to these local propositions is the main challenge for both compliance service providers and clients."

TMF Turkey expert

Global compliance requirements can offer stability and security for high-net-worth individuals

Global compliance requirements like UBO, KYC and AML can create complexity for businesses, and can cause concern for clients looking to invest across borders. However, this increased focus on global compliance is seen as inevitable and it is not going away. It's also well established in certain jurisdictions, particularly those in the EU, where directives are handed down to be implemented locally across multiple jurisdictions. This means that multinational businesses may already have a better understanding of certain compliance requirements when entering new jurisdictions. That being said, there can be nuances that can cause complexity and take time to be understood by businesses.

However, while global compliance incentives can increase complexity, they can also drive the attractiveness of jurisdictions, particularly for private wealth and family office (PWFO) individuals who are seeking safety and security. For instance, in Singapore, a strong and stable regulatory framework and political stability are the key factors that attract foreign investments. Singapore also offers attractive tax incentive schemes that appeal to high-net-worth individuals.

Legislative U-turns are impacting nearly 15% of jurisdictions

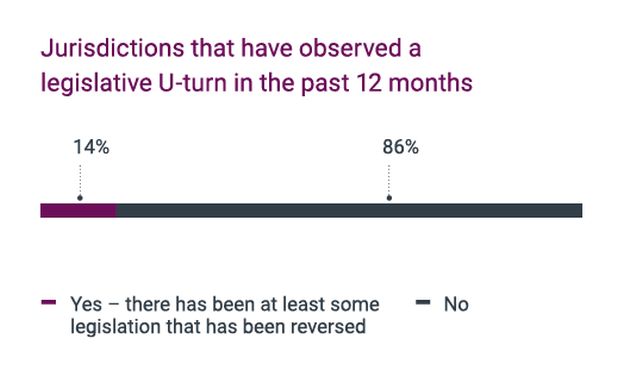

Although there is an increased focus on stable, consistent compliance requirements globally, some jurisdictions have observed legislative U-turns over the past 12 months.

More than 1 in 10 (14%) have observed such U-turns. For example, in the UK, where 2022 was characterised by unprecedented political turmoil, several pieces of legislation were introduced and then reversed, typically related to tax.

In China, the government also backtracked on the preferential tax rate on employee stock income, annual bonuses and tax exempted benefits for expatriate employees, which were due to terminate in January 2022. Although this change does benefit foreign workers and their international businesses, changes can create complexity for organisations who can struggle to keep up with contradicting messages from governments.

Moving forward, we may continue to see legislative U-turns as governments deal with geopolitical instability and a changing global business environment. However, the increased focus on global compliance and legislation should work to offer stability in such challenging times. While increased focus on global compliance can create complexity, it also works to drive consistency and predictability for foreign businesses entering new jurisdictions and pressing forward with global expansion.

The Global Business Complexity Index 2023

This article is an extract from TMF Group's latest report: The Global Business Complexity Index 2023.

Explore the GBCI rankings, analysis and global trends, to help you cut through the layers of corporate compliance complexity – download the report in full here.

To find out more about the drivers of business complexity in the jurisdictions that matter to you, why not explore our Complexity Insights Dashboard?

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.