INTRODUCTION

Part I of this series dealt with general contracting and other considerations in developing greenfield rail and port infrastructure for resource projects. Part II will provide an overview of some of the models used in delivering this infrastructure. It will also look at the broad project structure and agreements involved in a greenfield integrated rail and port project, while the final instalment in the series will consider some of the key issues under the haulage agreements with customers and the concession arrangements with the state.

PROJECT MODELS

Historically, rail and port infrastructure for the mines was paid for, developed and owned by the state. The mining companies who used this infrastructure to export their product paid user charges and so effectively funded the development costs.

Increasingly, it is now the private sector assuming responsibility for financing and delivering essential rail lines and port terminals. The role of the state in these projects centres around granting the development (or concession) rights and tenure and helping to facilitate them through enabling legislation and approvals1.

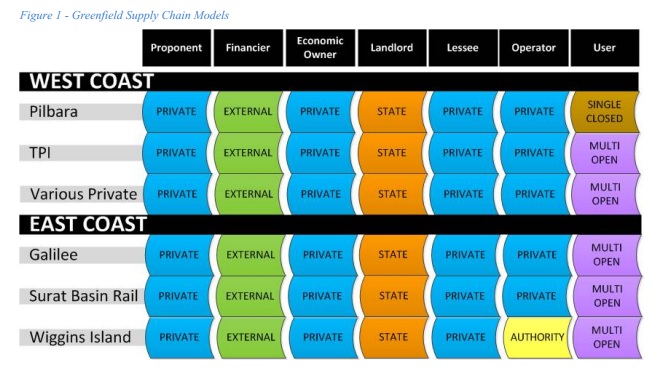

Figure 1 below shows the stakeholders and their respective roles in various rail and port (or supply chain) projects.

The key point to note is that it is private sector entities who are sponsoring, financing, building and operating the greenfield infrastructure, with some of the main differences between projects revolving around:

- The ownership structure eg industry-owned such as in the case of the Wiggins Island Export Terminal at Gladstone in Queensland

- Whether there is any form of access regime providing third parties with rights to services using the infrastructure

- The extent of integration in rail and port operations. Some of the models involve fully integrated rail and port services, the benefit of which should be improved coordination and efficiency in the supply chain.

STRUCTURE OF A GREENFIELD PROJECT

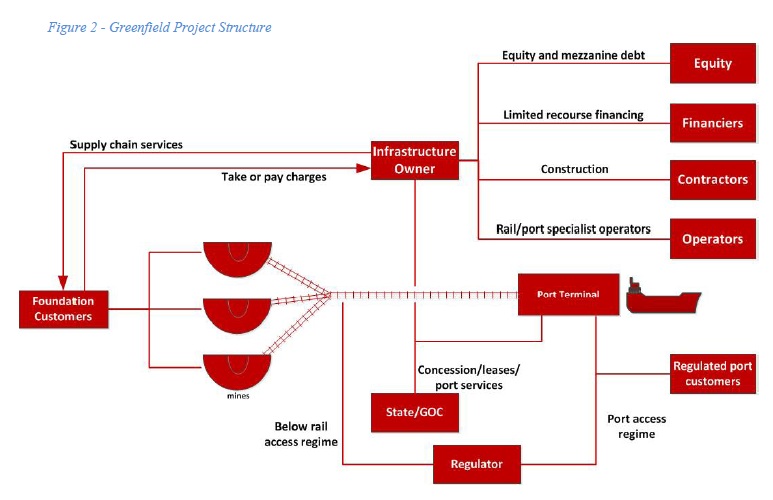

The indicative structure for a greenfield integrated port and rail project is shown in Figure 2 below. As can be seen, the key elements involve:

- The grant of development (or concession) rights to the infrastructure owner, giving it the right (and imposing the obligation) to finance, build and operate the rail line and port terminal

- The infrastructure owner providing integrated below/above rail and port handling services (referred to here as supply chain services)

- A number of foundation customers entering into longterm contracts with the infrastructure owner for those supply chain services. These will invariably be takeor-pay contracts, so that the customer is obliged to make payment irrespective of whether it uses, or is able to use, the supply chain services. This provides the infrastructure owner – and their financiers – with the certainty needed around recouping the capital costs (and commercial return)

- Rail and port access regimes (which might be voluntary regimes agreed to by the infrastructure owner under its concession/lease arrangements with the state)

- Operating leases with the state or state authorities

- Project financing ie financing where the lenders rely primarily on cash flow from the project for repayment of their loans.

The overall structure will be influenced by the specific requirements of the project and, in particular:

- The service offering ie in the scenario shown above, it is a bundled below/above rail and port handling service

- How the project is to be financed eg the source of funding and which components of infrastructure

- Third-party access requirements

- How the infrastructure owner itself is structured

- The contracting approach for construction of the infrastructure

- Whether the owner will provide the services itself or contract some or all of these out to specialist operators.

KEY PROJECT AGREEMENTS

The contractual documents for a greenfield project will be extensive and can take considerable time to negotiate and conclude, particularly those involving the state. A critical aspect of preparing the agreements will be identifying and addressing the various interfaces and interdependencies – technical, commercial and contractual – between the agreements. This will involve ensuring that relevant provisions are flowed-down and/or aligned – for instance:

- Underlying design and construction obligations eg the technical description of what is being built; milestones; completion/commissioning requirements

- Relief provisions eg force majeure

- Performance obligations

- Expansions ie future works to increase the throughput capacity of the rail or port

- Event of default and termination regimes

- Dispute resolution.

In many cases, there will be a tension between the competing objectives of the stakeholders involved in the project. For instance, the infrastructure owner for its part will want to begin hauling iron ore or coal and levying charges as soon as possible. It will also want to ensure that it can recover the development costs together with its return.

On the other hand, it will be important to the customers signing up to take supply chain services that the tariff for those services is not so onerous as to make it uneconomic for them to get the iron ore or coal to port and onto a vessel. They will also be concerned to ensure that the rail and port infrastructure is capable of handling the tonnages contracted for under the supply chain agreements.

Last but not least, the state will have its own objectives. These may include an access regime addressing the rights of third parties to obtain services using the rail and port infrastructure. The state will very often also seek to limit its financial liability and exposure and will expect the infrastructure owner to bear most, if not all, of this risk.

Drafting and negotiation of the project documents will therefore need to be an iterative process as commercial positions and risk profiles are developed and agreed and these are aligned in the documentation.

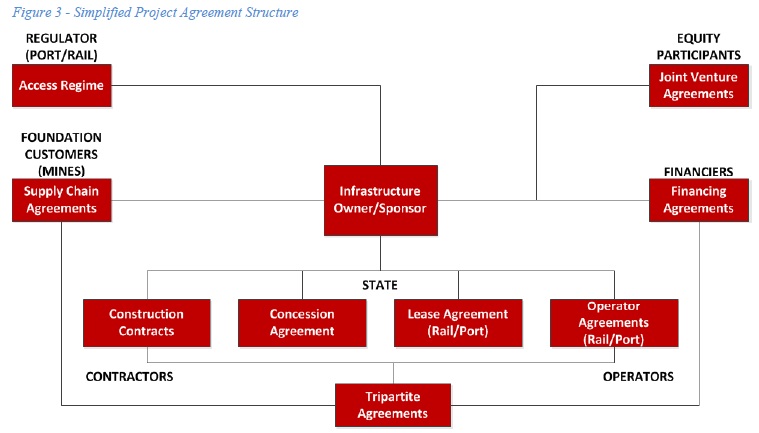

Figure 3 below shows the main agreements involved in a greenfield project. As can be seen, the key agreements revolve around:

- Concession arrangements with the state, under which the infrastructure owner is given the right (and assumes the obligation) to finance, develop and operate the infrastructure

- Supply chain services with foundation customers

- Financing

- Equity or joint venture arrangements sitting behind the infrastructure owner

- Construction of the infrastructure

- Tenure and operations

- Third-party access.

THE FINAL INSTALMENT

The final part in this series will look at some of the key issues under the supply chain agreements with customers and the concession arrangements with the state.

Footnotes

1 See for instance The Surat Basin Rail (Infrastructure Development and Management) Bill 2012 for the Surat Basin Rail project in Queensland. The Bill contains various measures to facilitate the project and establish a specific legislative framework for the development and management of the railway.

© DLA Piper

This publication is intended as a general overview and discussion of the subjects dealt with. It is not intended to be, and should not used as, a substitute for taking legal advice in any specific situation. DLA Piper Australia will accept no responsibility for any actions taken or not taken on the basis of this publication.

DLA Piper Australia is part of DLA Piper, a global law firm, operating through various separate and distinct legal entities. For further information, please refer to www.dlapiper.com