The construction sector in Australia has long been affected by insolvency and broader liquidity issues. In the last year, construction companies accounted for 26% of businesses that entered into insolvency, and insolvencies in the construction sector more than doubled. This year, contractors have been further squeezed by inflation, supply chain issues and labour market shortages. As the federal government has wound back its COVID-19 economic stimulus packages, further collapses seem inevitable.

In this White Paper, we set out the reasons for why the construction industry is particularly vulnerable to insolvency issues, outline the risks and red flags that owners, principals and head contractors should be aware of, and discuss how these risks can be managed.

INTRODUCTION

Australian construction companies have historically been overrepresented in the insolvency space and recent data confirm that this trend persists. In the last year, construction companies accounted for 26% of businesses that entered into insolvency,1 and insolvencies in the construction sector more than doubled.2 Inflation, supply chain issues and labour market shortages are adding to the existing pressures contractors are facing as they recover from the impacts of the pandemic, especially when squeezed by fixed-price contracts.

As interest rates rise, further insolvencies in the construction sector appear inevitable.

In this White Paper, we outline how the insolvency regime in Australia plays out in the construction sector, discuss the red flags and warning signs and address how owners, principals and head contractors can manage the risks at every level of the contracting chain

KEY ISSUES FOR CONTRACTORS

In the 2021-22 financial year, 1,282 construction companies entered into external administration and controller appointments, more than any other single industry.3 According to the Reserve Bank of Australia's Financial Stability Review, more than one-fifth of businesses with low cash buffers-less than one month's worth of expenses-are businesses in the construction sector.4 Additionally, contractors typically have unpaid receivables of around 1.25 times their monthly turnover.5

Contractors engaged under fixed-price contracts are uniquely vulnerable to inflationary pressures as costs increase and margins become thinner or disappear. These costs are only exacerbated by supply chain issues and infrastructure bottlenecks. Likewise, labour shortages can create delays or cause contractors to miss major milestones.

Principals and head contractors generally have less oversight of these sorts of issues and how they impact contractor and sub-contractor liquidity, as the shift towards the pyramid-style relationship in construction projects means that there are multiple layers of smaller, more specialised sub-contractors at the bottom. Nevertheless, the impact of delays and lower-level insolvencies for the head contractor can be significant.

AUSTRALIA'S INSOLVENCY REGIMES

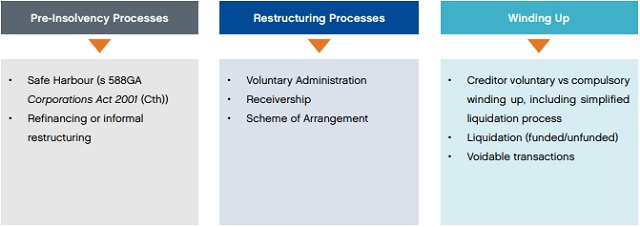

Broadly, Australian insolvency regimes can be split into three categories.

Footnotes

1 Australian Securities & Investments Commission, ASIC Insolvency statistics, Series 1A: Companies entering external administration and controller appointments by industry, July 2013-August 2022 (August 2022).

2 Ibid.

3 Ibid.

4 Reserve Bank of Australia, Financial Stability Review (April 2022), p. 31.

5 Ibid., p. 32.

Kane Kersaitis and Lucy Shanahan contributed to the preparation of this White Paper.

To read the full article click here

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.