With effect from 1 January 2015, telecommunications, broadcasting and electronic services supplied to non-taxable persons (B2C) which are established, have their permanent address, or usually reside in the EU will be taxable in the Member State of the customer.

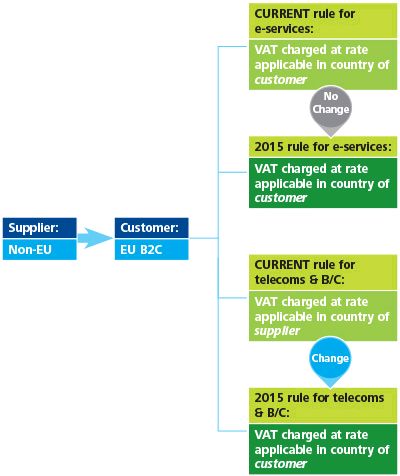

The rule which currently applies to non-EU suppliers of e-services will be extended to all suppliers (EU and non-EU) of telecommunications, broadcasting and e-services to private consumers.

As a result, the VAT rules and rates in the country of establishment of B2C suppliers of telecommunications, broadcasting and e-services will no longer be relevant, and suppliers will have to charge VAT to their customers at the rate applicable in their customer's EU Member State.

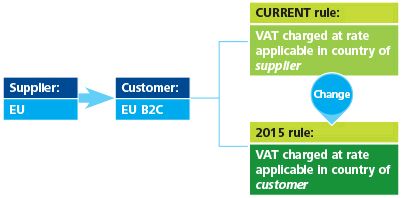

The rules today

Currently, B2C supplies of telecommunications, broadcasting and electronic services within the EU are treated as taking place in the country of the supplier. Therefore, today, the Malta VAT rules and rates apply to such services when supplied by Maltese businesses

The 2015 changes

As of 1 January 2015 the place of B2C supplies of telecommunications, broadcasting and electronic services by EU suppliers will shift to the country where the customer is established or usually resides. EU-established operators having customers in different EU Member States will have to charge VAT at the rate applicable in the Member State of their customer.

This means that the operator will have to either register for VAT in the Member State of their customer, or can opt to register in only one Member State and to report the VAT due in other Member States in one single electronic declaration (under the so-called 'mini one-stop-shop' scheme).

The changes also impact non-EU businesses who supply telecommunications and broadcasting services B2C within the EU (B2C supplies of e-services by non-EU suppliers will continue to be taxable in the Member State of the customer).

What does this mean for businesses?

The 2015 changes will have a significant impact on EU providers of telecommunications, broadcasting and electronic services, at a number of levels. As operators you should be thinking about:

- Whether your services classify as "telecommunications", "broadcasting" or "electronic services"

- The location of your clients and the measures you should be taking to identify the location

- The VAT rate in those jurisdictions

- The extent to which the changes in VAT rates will affect your pricing structure

- The systems and invoicing changes that will be required to cater for the changes

- The overall impact at an administrative level

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.