Continued transaction momentum and the emergence of Canadian champions are trends that are defining Canada's M&A landscape as the first quarter of 2022 comes to a close. ESG will play a growing role in deal making as the year moves on.

New themes are developing as well with the loosening of pandemic restrictions, an expected uptick in distressed M&A, regulatory imposed transactions and the potential impact of Russia's invasion of Ukraine and related trade sanctions. The Canadian mid-market should remain robust for the remainder of the year.

The Start to 2022

All numbers are in US$ unless otherwise stated.

M&A activity is off to a strong start in Canada in 2022. The factors that drove last year's record growth—including excessive private equity capital, the low cost of debt financing and a robust equity sector—largely remain in place.

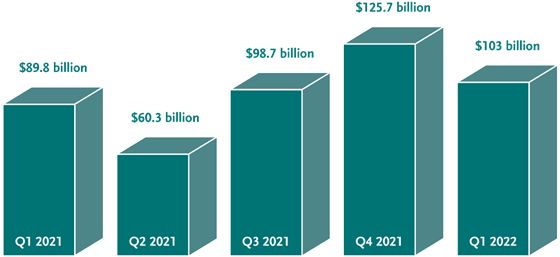

The total volume of Canadian M&A in the first three months of 2022 was $103 billion, according to Bloomberg data (announced, completed or pending deals, excluding those that have been terminated or withdrawn). This was below the previous quarter ($125.7 billion) and above Q3 2021 ($98.7 billion). The past nine months have been remarkable in Canadian deal making with $327.4 billion in activity.

Canada M&A Volume Q1/21 to Q1/22

Source: Bloomberg

The biggest M&A deal in the first quarter of 2022 is Brookfield Business Partners' partnership to acquire Nielsen Holdings plc for $16 billion, announced on March 29. With this deal, the consumer (non-cyclical) sector led the way in the first quarter in Canada with $20.9 billion in volume. Q1 2022 M&A activity in other sectors included:

- REITS – $10.9 billion

- Energy – Alternate Sources – $9.7 billion

- Industrial – $9.4 billion

- Retail – $6.8 billion

- Utilities – $6.8 billion

Consolidation in the cannabis industry continues. The latest examples are Cresco Labs' acquisition of Columbia Care for $2 billion—which is one of the largest mergers in the Canadian cannabis industry to date—and the announced acquisition of Hexo Corp.'s debt by Tilray Brands. Both transactions were announced in March 2022. Sundial Growers' acquisition of Alcanna Inc., which was announced in Q4 2021, was completed at the end of Q1 2022.

The strength in commodity prices is allowing energy companies to start putting debt relief behind them. Some are now moving to share buybacks, commencing or increasing dividends and the environment is ripe for deal-making. More energy deals could be expected in the second half of the year.

Interest rates are not expected to be a factor in the foreseeable future in Canadian M&A, as we are coming off historic lows. For private equity, there remains a surplus of money yet to be deployed and funds continue to successfully fundraise for new capital while continuing to benefit from leverage with low debt financing costs. For these reasons, PE funds are considering transactions at near-historically high volumes.

Canadian Champions

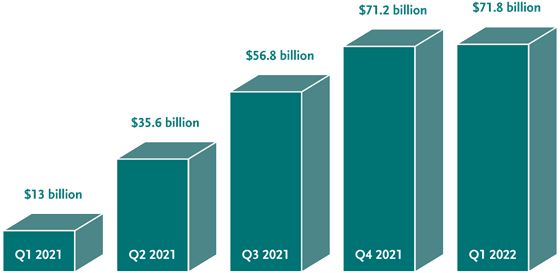

Canadian outbound M&A has been on a tear since the second half of last year. Volume hit $71.8 billion in Q1 2022, just above the total for the previous quarter and up from $13 billion in Q1 2021. In the past three quarters, there has been $200 billion in announced outbound M&A deals, where a Canadian company has been the acquirer.

Canadian banks have been very active in the United States, with TD acquiring First Horizon for $13.4 billion in February 2022. In December 2021 BMO acquired Bank of the West for $16.3 billion. In the UK, RBC announced its proposed acquisition of Brewin Dolphin for C$2.6 billion in March 2022.

The increase in outbound deal making illustrates the limitations of domestic M&A growth within Canada and the need for companies to look globally to keep growing.

Canada Outbound M&A Volume Q1/21 to Q2/22

Source: Bloomberg

ESG in M&A

ESG will continue to gain prominence as an integral consideration in M&A. Although we have yet to see its full impact, the increasing importance of ESG considerations in corporate strategy will inevitably percolate through as a driver to M&A. Some companies will see M&A as an opportunity to advance ESG shortcomings—through changes to their board, improved climate change policy, the acquisition of desirable assets, new approaches to EDI and more.

The prominence of ESG considerations is giving rise to a host of factors that historically have not been considered as central considerations in M&A. These include responsible supply chain sourcing and durability, anti-corruption measures, working and investing with Indigenous communities, carbon reduction and social diversity within a company.

On March 21, 2022, the U.S. Securities Exchange Commission released their proposed climate-related disclosure for investors, which will bring additional rigor and standardization to the area. Once implemented, the new disclosure requirements will inevitably increase investor scrutiny and perhaps start to drive market participants to consider M&A as an avenue to improve metrics and compliance.

The risks of not meeting ESG expectations in M&A will become more acute as increased standardization brings greater scrutiny from institutional investors.

Loosening of Pandemic Restrictions

The logistics of deal making have likely forever been changed after two years of working remotely. As pandemic restrictions are lifted in Canada and around the world, in-person meetings and travel are returning and more is expected. Gatherings such as road shows and kick-off meetings for IPOs and M&A deals should become more rare, however. There is a lot of convenience with the way transactions are done now and 2021 was the busiest year ever for M&A. Companies and deal makers can expect the best practices of the past two years to be continued.

Additional Trends to Watch For in 2022

- With fewer restructurings in Canada than the market expected in certain key industries last year, it is expected there will be an uptick in distressed M&A in 2022.

- As investors continue to focus on public companies adhering to best governance practices, we believe that the failure of reporting issuers to adopt modern day governance initiatives will result in increased shareholder activism.

- We expect to see more regulatory induced M&A transactions in Canada as a result of increased regulatory involvement in mergers by regulators in North America and Europe (including Canada).

- Economic sanctions against Russia by Canada and other countries may add to the complexity of certain M&A deals. Such complexities will depend on the nature of the transaction, the applicable industries impacted and the parties involved.

- We expect to see the Canadian mid-market remain robust for the remainder of the year with Canadian targets and financing alternatives remaining attractive to domestic and foreign buyers, even as interest rates continue to gradually increase.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.