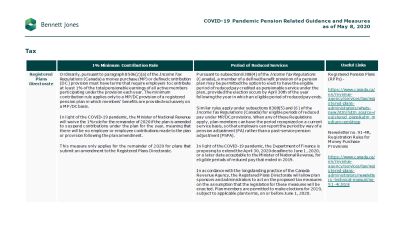

In response to the recent market declines and interruptions to businesses amid the COVID-19 pandemic, federal and provincial pension regulators have announced measures to provide relief to sponsors and administrators of registered pension plans and to protect member benefits, including relief from solvency funding requirements, extensions to required filings and disclosures, and measures to limit commuted value transfers.

Download this quick reference table which provides an overview of the measures announced to date.

Check back regularly as this table is updated as COVID-19 related measures are added or changed.

Recent Updates:

May 8, 2020: Changes made to Federal with respect to automatic consent to portability transfers under certain conditions.

May 7, 2020: Changes made to Saskatchewan with respect to suspension of contributions in a defined contribution pension plan.

May 6, 2020: Changes made to Nova Scotia with respect to extensions to filing deadlines for certain documents.

May 5, 2020: Changes made to add COVID-19 related tax measures announced by the Canada Revenue Agency, with respect to Registered Pension Plans.

May 1, 2020: Changes made to Ontario with respect to Pension Benefits Guarantee Fund assessments.

Originally published May 08, 2020

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.