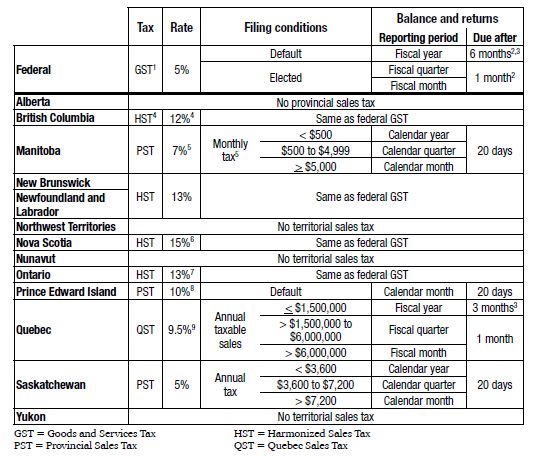

Footnotes

1. Instead of the GST, a 5% First Nations Goods and Services Tax (FNGST) applies in certain First Nations.

2. Every insurer that is a Selected Listed Financial Institution (SLFI) must file Form GST494 "Goods and Services Tax/Harmonized Sales Tax Return for Selected Listed Financial Institutions" within six months of its fiscal year. Every insurer (except a SLFI that has a fiscal-year reporting period) must file Form GST34 "Goods and Services Tax/Harmonized Sales Tax Return for Registrants" within either six months of its fiscal-year reporting period or one month of its quarterly or monthly reporting period.

3. Federal and Quebec instalments may be due one month after each quarter.

4. British Columbia will replace its 12% HST with a 7% PST and a 5% GST on April 1, 2013. See page 7 for more information.

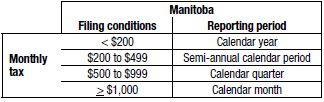

5. For Manitoba, a 7% retail sales tax applies on various insurance services, starting July 15, 2012. See page 8 for more information. The filing frequency noted in the table applies after June 30, 2012. Before July 1, 2012, the filing frequency was as follows:

6. Nova Scotia will reduce its HST r ate from 15% to 14% by July 1, 2014, and to 13% by July 1, 2015 (i.e., the provincial portion of the HST will decrease from 10% to 9% and to 8%, respectively).

7. Ontario imposes a retail sales tax of 8% on other insurance premiums, with certain exceptions, e.g., individual lifeand health, and automobile premiums.

8. In Prince Edward Island the 10% PST rate is imposed on GST. On April 1, 2013, a 14% HST (i.e., 9% provincial component plus the 5% GST) will replace the combined PST/GST rate of 15.5%.

9. The QST rate increased from 8.5% to 9.5% on January 1, 2012. The rate is imposed on the GST-inclusive consideration. The QST will be further harmonized with the GST on January 1, 2013, with an effective rate of 14.975%. See page 10 for more information. Quebec also imposes a retail sales tax of 5% on automobile premiums and 9% on insurance premiums, with certain exceptions, e.g., individual life and health.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.