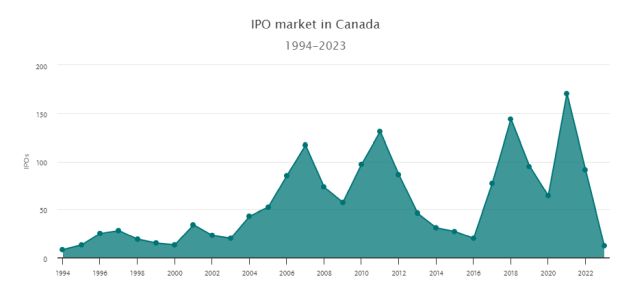

It doesn't come as breaking news that 2023 was a down year for initial public offerings (IPOs) in Canada, as companies faced a rare set of challenges in both the domestic and global markets. However, as with any downturn, there are reasons for optimism in 2024 as some uncertainties subside and interest rates are forecasted to stabilize, or even fall.

As the first month of 2024 ends, Osie Ukwuoma, a partner in the corporate commercial and securities law group at Bennett Jones, shares his insights on what companies can expect in the Canadian IPO landscape for the coming year.

How challenging have conditions been for Canada's IPO market?

There hasn't been a time in recent history that parallels the current combination of interest rates, inflation, consumer sentiment, a looming (and potentially divisive) U.S. presidential election, and geopolitical uncertainty. The last time the Bank of Canada's key interest rate was at or above 5 percent was in April 2001, and we have been experiencing our first bout of heightened inflation in a generation.1

Source: Bloomberg

The lack of IPO activity in 2023 came on the heels of a tumbling stock market in late 2022. The depressed valuations rippled to institutional investors who experienced redemptions that caused them to further pull back their capital allocation, which depressed the market further. This is not to say that companies did not publicly list their shares in 2023. The difficult market conditions caused companies to become more creative and use other listing techniques, such as a reverse takeover transaction or by filing a non-offering prospectus to list shares on a stock exchange without an associated offering. Additionally, cash-strapped junior issuers were able to leverage alternative capital raising techniques, like the listed issuer financing exemption, which permits issuers, subject to certain conditions, to make offerings in Canada of freely tradeable securities without a prospectus.

How is the Canadian IPO market performing compared to the United States?

The Canadian market is not alone in its recent slump. There has been a dearth of IPOs globally and the past two years have been slow in the U.S., though the U.S. market seems to have fared better than the Canadian market toward the end of 2023, causing analysts to see reasons for optimism. South of the border there is momentum for increased IPO activity, which is reflected by the anticipated blockbuster IPO of aggregator, Reddit, and recent large high-profile IPOs, including offerings completed by Arm Holdings, Birkenstock and Instacart.

Though there are similarities, the IPO market in Canada is not the same as in the United States. Not only is the U.S. market much larger overall, but pre-IPO valuations for U.S. companies tend to be much higher, which supports a deeper pipeline of potential IPOs.2However, the U.S. market can be seen as a bellwether for the Canadian market, and an uptick in the U.S. IPO market typically spurs increased, but delayed, activity in the Canadian market.

Are there reasons to expect increased IPO activity in Canada for 2024?

Expected interest rate cuts (by both the Bank of Canada and the Federal Reserve in the United States) and pent-up demand from the previous 12 months are the primary reasons to expect increased capital-raising activity. Typically, IPO activity correlates with broader market activity and is thought of as a lagging indicator. The boom in IPOs in 2021 and early 2022 came toward the end of an unprecedented bull market in 2020 and early 2021 that saw valuations skyrocket. It typically benefits a company to raise capital in the market that provides the most attractive valuation, which, in 2020 and early 2021, was the public market. In addition to the above noted rate cuts and demand, rising valuations toward the end of 2023 (8 percent during Q4 2023 for the S&P/TSX Total Return Index) and IPO momentum in the United States are potential indicators for increased IPO activity.3

Is the recent drop in IPOs in Canada externally driven by market conditions, or is there a fundamental shift in whether companies want to go public or not?

The response to the recent drop in IPOs seems to vary by industry. During 2020 and 2021, a disproportionate number of companies (not including special purpose acquisition companies) that raised capital, whether through the public markets or private markets, were technology-focused companies. These companies raised capital at high, and sometimes unrealistic, valuations based on the success of then-recent tech IPOs. The valuations of these emerging technology-focused companies have sagged since the highs of 2021 and there has been a shift by market participants to focus on companies in traditional industries (e.g., energy, utilities, real estate). This can be expected to result in sponsor-backed businesses that generate positive earnings turning to the public markets to allow sponsors and other early investors to monetize their investment. The unique mix of falling valuation and recent market forces has caused a shift away from "growth at all costs" to a focus on profitability. Many of the notable 2023 IPOs completed in the United States were completed by profitable, cash flow generating businesses.

How might companies respond if interest rates don't get cut in 2024 and stay higher for longer?

A company's appetite to access the public market, either by completing an IPO or as a follow-on offering, will be influenced by its immediate need for capital. The downturn of the stock market in 2022 and early 2023, coupled with the ease of raising capital in the preceding two years, provided conditions that allowed companies to be more choiceful about raising additional capital. If interest rates continue to increase or remain unpredictable, a company with dwindling cash reserves may only resist raising additional capital for so long and their cash reserves, or lack thereof, may force the issue. Companies may look to strategic investors or accept less attractive financing terms to meet their capital requirements.

Market participants prefer to be more active when there is a sense of clarity, especially with respect to metrics that have historically had a material impact on valuations. Though falling interest rates are preferred, a stable and predictable interest rate environment provides a sense of clarity, which in turn supports increased capital raising and allows companies to understand their new cost of capital. A stable environment also provides investors with a clearer view to a positive return. If nothing else, this recent mix of market forces has caused investors, market participants, and companies alike to become acutely aware, at least more so than in the past, of announcements from the Bank of Canada releasing its key interest rate or Statistics Canada publishing the consumer price index.

Why do some companies not pursue the IPO route? What are the benefits of staying private?

Publicly listed companies are subject to enhanced regulatory oversight, financial disclosure requirements, and continuous disclosure obligations. Additionally, scrutiny from analysts and potentially activist investors may affect a company's ability to operate effectively. Private companies can maintain greater control over their operations and management, without being overly concerned with broader capital market movement. In recent years, increased activity by private equity, venture capital, and private debt providers has given private companies additional flexibility in navigating capital constraints that may have been addressed by completing a public offering in the past.

A company's decision not to pursue an IPO and still achieve its desired growth will be based on several factors, but will be heavily influenced by its ability to access capital in the private market and the nature of its shareholders. A private company will need to determine whether it can fund its growth and achieve its strategic milestones, while balancing early investors' desire for liquidity and return on investment.

What are some advantages of being a public company?

Oft-cited reasons for a company to complete an IPO include ease of access to capital, liquidity, and flexibility. The public markets allow a company to raise money rather quickly from a broader pool of investors, and use offering mechanisms such as a "bought deal" financing that eliminates their financial risk of failing to raise enough money. Consumer-facing companies also stand to benefit from the visibility gained from being a public company. A publicly listed company's shares can be used as a relatively liquid currency for future transactions, acquisitions, and compensation for employees and executives – features that can't easily be replicated in the private market. In the short‑term, the wider access to capital and flexibility can accelerate growth, and, in the long‑term, the additional visibility and reduced cost of capital that come with a public listing pave the way for sustained profitability.

To discuss Canada's IPO and capital market landscape and what it may mean for your enterprise, contact Osie Ukwuoma or another member of our corporate commercial and securities law group.

Footnotes

1. Bank of Canada website: https://www.bankofcanada.ca/rates/interest-rates/key-interest-rates.

2. The aggregate value of the U.S. equity market is US$49 trillion vs US$3 trillion for the Canadian market (Securities Industry and Financial Markets Association data).

3. Bloomberg database.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.