Venture capital spending in Canada is still not back up to what it was prior to 2008, according to a recent report published by the Organisation for Economic Co-operation and Development (the "OECD").1 The OECD found that Canada's venture and growth capital spending in 2012 was down by about 20% compared to 2007 levels.

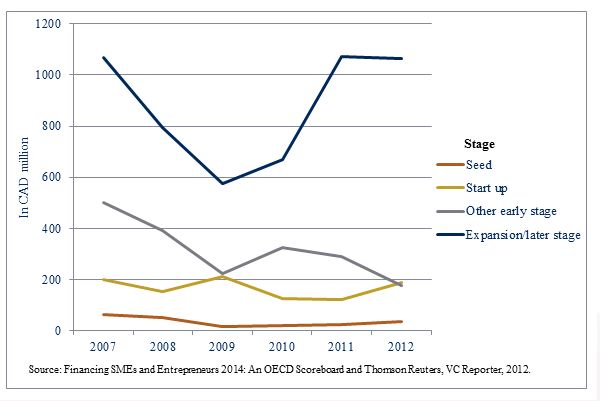

Business loans in Canada were up during that time by about 5% for SMEs and total business loans were up by about 14%. In the US, business loans for SMEs were down by about 15% between 2007 and 2012, and, while venture capital spending during that period was also down in the US, it was down by 5% less than it was in Canada. Further, expansion and later stage funding in Canada is back up to 2007 levels, however, seed, startup and other early stage funding is not. The graph below highlights these trends.

While Canada is a good place for SMEs to obtain business loans, it is lagging when it comes to raising venture capital. Access to more early stage funding is essential for promising startups, as well as for the development of an innovative economy.

Recognizing the difficulty for startup companies to obtain venture capital, the Canadian federal government announced the Venture Capital Action Plan ("VCAP") in January 2013, discussed in more detail here. VCAP will make between $300 and $400 million available to various funds of funds over the next 7 to 10 years. The managers of those funds of funds will select the recipients of funding based on various selection criteria.

Footnotes

1 The OECD is an organization headquartered in France, with the primary goal of promoting "policies that will improve the economic and social well-being of people around the world."

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.