This digest outlines some of the significant legal work undertaken by Conyers on behalf of our clients around the world since the beginning of 2022. The year was challenging for many of our clients, with global uncertainty caused by a number of parallel and often related crises: the continuing legacy of COVID-19, significant worldwide inflation, a global monetary tightening cycle, a strong U.S. dollar, a war in Europe, energy supply issues and the ongoing turmoil in China's property market.

The performance of debt and equity markets in 2022 is best described as skittish. Capital raising was tested by these factors, and the volatility led to a 45% drop in global IPO numbers and 61% decrease in capital raised from the year prior. In the Americas, volumes fell to a level not seen in 13 years, with values hitting a 20-year low. Market watchers predict similarly listless markets as issuers and investors watch and wait for these financing difficulties to wane. However, some encouraging developments can be seen in Asia as rising optimism over China's economy promises a stronger 2023.

The remarkable levels of M&A activity in 2021 were slowed in 2022 by the same host of interdependent factors, and returned to pre-pandemic levels. Despite this, 2022 brought a healthy roster of 853 global deals, with an aggregate value of US $3.63 trillion. M&A activity among Conyers clients continued to reflect broader market trends, with the technology, media and telecommunications sector accounting for the lion's share of deal activity.

The restructuring market continued its relatively quiet trend through 2022, but Conyers assisted in a number of successful restructurings of PRC-based property companies. As we look to 2023 we expect corporate restructuring, both in the North American and Asian markets, to increase and to remain strong into 2024. As far back as 2019, analysts talked about a looming wave of restructuring. It hasn't happened yet — it has been put off because companies did not want to lock in losses when cheap money was available — but now money is expensive. We are forecasting an increase in restructurings in the first half of 2023.

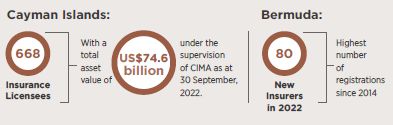

Bermuda's re/insurance industry fared well in spite of the macro headwinds, with a number of key group reorganisations, continued growth in the life sector, and strong performance in the catastrophe bond market. The Cayman Islands insurance industry also saw continued growth over the past year, reaching the highest number of licenced insurance entities since 2018: although final figures for the year had not been released at the time of writing, the jurisdiction was on track for a record-breaking year in registrations at the end of Q3.

It was an active year for Conyers, as well, in asset-based transactions, particularly in the shipping, aviation and oil and gas sectors. Bermuda is among the largest and most developed offshore jurisdictions for asset-backed securitisation transactions. In addition to container transactions, Bermuda plays a significant role in the aircraft and aircraft engines sector, the insurance industry (notably through catastrophe bonds and other insurance-linked securities) and other asset classes.

We hope this digest will be of interest to our legal colleagues, clients, and market watchers.

"The year ahead will be one of caution after the challenges

everyone has faced in 2022: we plan to continue our growth in

Cayman, to maintain our position as the leading insurance firm in

Bermuda and to be ready with one of the strongest teams in Asia as

China's reopening continues."

Christian R. Luthi, Director and Chairman, Conyers

Finance and Capital Markets

Debt and equity markets can best be described as somber in 2022. Capital raising was challenged by multiple factors, both economic and geopolitical. The volatility led to a 45% drop in global IPO numbers and a 61% decrease in capital raised from the year prior. In the Americas, volumes fell to a level not seen in 13 years, with values hitting a 20-year low1. Market watchers are predicting continued sluggishness in the near future, as issuers and investors watch and wait for these headwinds to pass. Amid this outlook, however, can be glimpsed some encouraging developments. Asian exchanges remain busy, as is reflected in several of the listings noted below. Indeed, with over 120 listings in the pipeline in Hong Kong, and APAC exchanges off to a strong start in 2023, Asia is currently the locus of growth for capital markets.

Like you, we will be watching carefully to see what 2023 brings, as the global economic landscape moves through this period of pressure.

THE YEAR IN NUMBERS2

"Conyers' BVI corporate and finance practices have seen

a number of successful transactions, particularly in the mining

sector, including Kinross Gold Corporation's sale of its

interest in the Chirano gold mine to Asante Gold Corporation and

B2Gold Corp.'s US$27.5 million acquisition of Oklo Resources

Limited. Looking forward to 2023 we expect to see a continued focus

on strategic M&A activity and debt capital markets."

Rachael Pape

Counsel, BVI

" Venture capital and growth investments in Latin America

slowed in 2022 as startups and investors navigated a challenging

environment. Notwithstanding this, Conyers saw a good deal of

activity at the seed and early stage, working for both founders and

investors. We were also involved in various strategic M&A

transactions and an increasing number of venture debt deals -

trends we expect to continue in 2023."

Nicholas Pattman

Partner, London

Deals

Advised BoardWare Intelligence Technology Limited on its US$17

million share listing on the Main Board of the Stock Exchange of

Hong Kong

Hong Kong: Flora Wong, Partner, Rita Leung, Associate

Sector: Technology

Advised SPAC Financials Acquisition Corp (FAC) on its US$172

million IPO on the Main Market of the London Stock Exchange

Cayman: Matthew Stocker, Partner, Alex Davies, Counsel, Matthew

Harkness, Associate

Sector: Asset Management

Advised InnoCare Pharma Limited on its pioneering red-chip IPO

on the Science and Technology Innovation Board of the Shanghai

Stock Exchange, raising over US$410 million

Hong Kong: Wynne Lau, Partner, Alexander Doyle, Associate, Yvonne

Lee, Associate, Charlie Chan, Associate, Sara Zou, Legal

Manager

Sector: Pharmaceuticals & Life Sciences

Advised Intelligent Living Application Group Inc. on its Nasdaq

Global Market IPO, raising approximately US$20 million

Hong Kong: Richard Hall, Partner, Rita Leung, Associate

Sector: Manufacturing

Advised Jianzhi Education Technology Group Company Limited on

its NASDAQ IPO, raising approximately US$25 million

Hong Kong: Flora Wong, Partner, Ryan McConvey, Associate, Michelle

Au, Legal Manager

Sector: Education

Advised Kamaroopin in connection with their recent R$100 million

Series D investment into Brazilian healthcare technology firm

Dr.Consulta

Cayman: Nicholas Pattman, Partner

London: Barnabas Finnigan, Counsel

Sector: Technology

Advised Marwyn Acquisition Company II Limited on numerous

matters including the successful launch of its 12-month placing

programme and Marwyn Acquisition Company III Limited in respect of

a subsequent 12-month placing programme facilitating the ability to

raise up to US$615 million

BVI: Anton Goldstein, Partner, Rachael Pape, Counsel Sector:

Asset Management

Advised Odfjell Technology Ltd. on its issuance of US$113

million floating rate senior secured bonds, net proceeds of which

were used in connection with restructuring related to spinoff of

the company from Odfjell Drilling Ltd., and listing on the Oslo

Stock Exchange

Bermuda: Guy Cooper, Director, Elizabeth Blankendal,

Associate

Sector: Oil & Gas

Advised Pegasus Asia, a SPAC incorporated in the Cayman Islands,

in connection with its approximately US$170 million IPO on the

Singapore Exchange, the first SPAC listed on the SGX-ST to be

backed by international sponsors.

Hong Kong: Rita Leung, Associate

Singapore: Preetha Pillai, Director, Stacie Seetho, Counsel

Sector: Asset Management

Advised Readboy Education Holding Company Limited on its US$46.5

million share listing on the Main Board of The Stock Exchange of

Hong Kong

Hong Kong: Teresa Tsai, Partner

Sector: Education

Advised Sequoia Investment Management in connection with a

US$250 million bilateral secured credit facility with Golar LNG

Limited.

Bermuda: Guy Cooper, Director, Jacari Brimmer- Landy,

Associate

Sector: Oil & Gas

Advised Shelf Drilling (North Sea), Ltd. on its continuance to

Bermuda from the Cayman Islands, completion of its private

placement of new shares in connection with its acquisition of five

jack-up rigs from various subsidiaries of Noble Corporation, and

its admission to and listing on the Euronext Growth Oslo at a

market value of US$200 million

Bermuda: Guy Cooper, Director, Andrew Barnes, Associate

Sector: Oil & Gas

Advised Vanov Holdings Company Limited on its approximately

US$18 million listing on the Main Board of The Stock Exchange of

Hong Kong Limited involving a Hong Kong Public Offering and

International Placing

Hong Kong: Anna W.T. Chong, Partner, Rita Leung, Associate

Sector: Textiles

"2022 has been a challenging year across sectors. The IMF

has lowered its growth outlook for 2023, and risk of a global

recession is real. While we expect negative factors to continue in

2023, the relaxation of COVID restrictions and the introduction of

domestic policies in mainland China to strengthen the financial

conditions of Chinese property companies indicate that some

normality is returning. Business appetite will improve."

Flora Wong

Partner, Hong Kong

"Changes to listing rules in HK increased the

profits/turnover threshold to qualify for listing. Combined with

the impact of COVID on businesses, this drastically reduced the

number of candidates for small/mid-cap listings in Hong Kong. A

number of IPO candidates are now listing on alternative markets: JE

Cleantech and Jianzhi Education Technology Group Company Limited

are examples of those to have taken this alternative

approach."

Richard Hall

Partner, Hong Kong

Mergers, Acquisitions & SPACs

The remarkable highs of 2021 calmed in the past year, as 2022 saw a return to pre-pandemic levels of M&A activity. The previous year's unprecedented deal making pace was slowed by a host of interdependent factors, including an increasingly challenging regulatory landscape, geopolitical tensions, supply chain bottlenecks and economic pressures—including global inflation and pervasive interest rate hikes. A relatively robust first half of 2022 gave way to increasingly low deal volume in Q3 and Q4.

Despite this, 2022 presented some substantial global deals, as is reflected in the Conyers engagements highlighted below. M&A activity among Conyers clients continues to reflect broader market trends, with the technology, media and telecommunications sector accounting for the lion's share of deal activity: over half of the deals represented below are connected to the TMT space. SPACs also continue to feature regularly, propelling several of our featured transactions.

"The IHS Markit story is one of impressive growth and

demonstrates that Bermuda is an ideal jurisdiction from which to

take a company public and then foster its development. The merger

with S&P Global that just completed was the biggest M&A

deal announced in 2020."

Niel Jones

Director, Bermuda

Deals

Advised 3i Infrastructure plc on its acquisition of Global Cloud

Xchange for approximately US$512 million

Bermuda: Jason Piney, Director, Kathleen McBeath, Associate

London: Karoline Tauschke, Counsel, Sophia Collis, Associate

Sector: Telecommunications

Advised ARA Asset Management Limited on its acquisition by ESR

Cayman Limited for US$5.2 billion

Bermuda: Jacqueline King, Director

Hong Kong: Angie Chu, Partner

Singapore: Preetha Pillai, Director, Stacie Seetho, Counsel,

Fadhilah Tan, Paralegal

Sector: Asset Management

Advised B2Gold Corp. on its approximately US$27.5 million

acquisition of Oklo Resources Limited

BVI: Rachael Pape, Counsel

Sector: Mining

Advised Cameco Corp. on its US$7.9 billion joint acquisition,

with Brookfield Renewable Partners, of nuclear power plant

equipment maker Westinghouse Electric

Bermuda: Robert N. Alexander, Director, Jason Piney, Director,

Kathleen McBeath, Associate

Cayman: Matthew Stocker, Partner, Nicholas Ward, Associate

Sector: Energy

Advised Chefs' Warehouse in its acquisition of Chef Middle

East from Gulf Capital

Cayman: Alan Dickson, Partner, Alexandra (Ali) R. Low,

Associate

Sector: Food & Beverage Distribution

Advised Digicel Group Holdings Limited on its sale of Digicel

Pacific Limited to Telstra Corp. Ltd., valuing the company at up to

US$1.85 billion

Bermuda: Robert N. Alexander, Director, Marcello Ausenda, Director,

Jacari Brimmer- Landy, Associate, Alexis Haynes, Associate

Sector: Telecommunications

Advised Israeli online merchant bank and payment service

provider Finaro (formerly Credorax Inc.) in connection with its

acquisition by US fintech company Shift4 in a cash and share deal

worth at least US$575 million

BVI: Anton Goldstein, Partner, Tameka Davis, Partner, Nicholas

Kuria, Counsel, Rachael Pape, Counsel, Allana-J Joseph, Associate,

Ben Mellett, Associate

Sector: e-commerce

"Despite a noticeable shift in capital markets

sentiment, the outlook for 2023 in the M&A space remains fairly

bullish. The buy-side driver is the expected availability of

undervalued targets, with the sell-side driver expected to be

distressed situations. We expect less predatory M&A and a move

towards market consolidation amongst peers where merger

consideration can take the form of scrip for scrip

exchanges."

Alex Davies

Counsel, Cayman Islands

Advised Freightos Limited with their migration and

re-domiciliation from Hong Kong to the Cayman Islands in

preparation for being taken public through a proposed combination

with SPAC Gesher I Acquisition Corp. Post-merger, the combined

structure will have an enterprise value of US$435 million

Cayman: Nicholas Pattman, Partner, Alex Davies, Counsel, Matthew

Harkness, Associate

London: Barnabas Finnigan, Counsel

Sector: Technology

Advised IHS Markit Ltd. on a Bermuda-law-governed merger with a

subsidiary of S&P Global Inc. creating a leading information

services provider with an enterprise value of approximately US$140

billion

Bermuda: Niel Jones, Director, Edward Rance, Director, Jacari

Brimmer-Landy, Associate

London: Karoline Tauschke, Counsel

Sector: Data Analytics

Advised Kinross Gold Corporation in the sale of all its interest

in the Chirano mine in Ghana to Asante Gold Corporation, through

the sale of Red Back Mining Pty Ltd, for a total consideration of

$225 million in cash and shares

BVI: Anton Goldstein, Partner, Rachael Pape, Counsel

Sector: Mining

Advised Ligand Pharmaceuticals Inc. on a proposed business

combination with Avista Public Acquisition Corp. II resulting in a

combined company with an initial pre-money equity valuation of

US$850 million

Cayman: Matthew Stocker, Partner, Alex Davies, Counsel, Matthew

Harkness, Associate

Sector: Pharmaceutical and Life Sciences

Advised MariaDB Corporation Ab, one of the world's fastest

growing and most popular open source database software companies,

on its proposed business combination with Angel Pond Holdings

Corporation. The combined company has an implied enterprise value

of approximately US$672 million

Cayman: Matthew Stocker, Partner, Alex Davies, Counsel, Matthew

Harkness, Associate

Sector: Technology

Advised Marti Technologies Inc. on its merger with Galata

Acquisition Corp., a SPAC led by Callaway Capital with US$146.6

million in trust

Cayman: Alan Dickson, Partner, Alexandra (Ali) R. Low,

Associate

Sector: Telecommunications

Advised Rock Mountain Capital, LP in connection with its and

Olayan Group's joint venture structure and US$500 million

acquisition of 48% of PurposeBuilt Brands

BVI: Robert J.D. Briant, Partner

Sector: Private Equity Investment/Consumer Goods

Advised SES Holding Pte Ltd, a spin-out company of the

Massachusetts Institute of Technology, on its proposed business

combination with Ivanhoe Capital Acquisition Corp. The combined

company has a pro-forma implied equity value of approximately

US$3.6 billion

Cayman: Matthew Stocker, Partner, and Alex Davies, Counsel

Sector: Technology

"The BVI continues to be a popular jurisdiction for

incorporating joint venture vehicles. We were delighted to act for

Rock Mountain Capital on structuring its BVI joint venture

acquisition vehicle. The matter involved complicated issues of BVI

law to ensure that the joint venture with Olayan was structured as

agreed."

Robert J.D. Briant

Partner and Head of Corporate, BVI

"Freightos' migration and redomiciliation from Hong

Kong to the Cayman Islands in anticipation of their proposed SPAC

combination is one example of several instances in which a company

has chosen Cayman as the jurisdiction from which to go public, in

this case through a proposed SPAC combination. We will be watching

this trend of companies utilising Cayman to structure SPAC

combinations and public listings in 2023."

Barnabas Finnigan

Counsel, London

Corporate Restructuring

Despite the restructuring market having been relatively quiet for some time, as we look to 2023 the global economy faces a critical juncture. A number of parallel and often related crises are at play, including the legacy of COVID-19, significant inflation, a global monetary tightening cycle, a strong U.S. dollar, a war in Europe, energy supply issues and the ongoing turmoil in China's property market. It is against this backdrop that we expect corporate restructuring, both in the North American and Asian markets, to increase in the first half of 2023 and remain strong into 2024.

Below is a sampling of the restructuring work undertaken by the Conyers Corporate Recovery Group in 2022.

Deals

Negotiated with noteholders of Atlas Financial Holdings, Inc. to

enter into a Restructuring Support Agreement, leading to the

successful granting of a Scheme of Arrangement and Chapter 15

recognition

Cayman: Jonathon Milne, Partner, Matthew Stocker, Partner, Alex

Davies, Counsel

Sector: Insurance

Advised Golden Wheel Tiandi Holdings Company Limited on the

successful restructuring of its 3 tranches of New York law governed

senior notes in an aggregate principal amount of approximately

US$450 million

Cayman: Erik Bodden, Partner, Alex Davies, Counsel

Hong Kong: Richard Hall, Partner, Ryan McConvey, Associate

Sector: Property Development

Advised Paratus Energy Services Ltd. (formerly Seadrill New

Finance Limited) on its pre-packaged chapter 11 cases and

restructuring of its joint venture, SeaMex Ltd., via a provisional

liquidation process in Bermuda

Bermuda: Niel Jones, Director, Christian R. Luthi, Director,

Jennifer Panchaud, Director, Rhys Williams, Director, Angela F.

Atherden, Counsel, Kathleen McBeath, Associate

London: Karoline Tauschke, Counsel

Sector: Oil & Gas

Advised an ad hoc group of note holders of the Stoneway Capital

Corporation on the restructuring of over US$900 million of

indebtedness

BVI: Robert J.D. Briant, Partner, Christopher Smith,

Associate

London: Oliver Cross, Associate

Sector: Asset Management

Advised Teekay Corporation on its internal restructuring to

facilitate the merger of Teekay LNG Partners L.P. with investment

vehicles managed by Stonepeak. Teekay received gross cash proceeds

of approximately US$641 million as consideration

Bermuda: Marcello Ausenda, Director, Andrew Barnes, Associate

Sector: Oil & Gas

"Golden Wheel is one of the handful of successful

restructurings of a PRC based property company to have completed in

2022. Given the current stage of the business cycle, we expect to

see more such restructurings."

Richard Hall

Partner, Hong Kong

" The Stoneway transaction was a complicated restructuring

concerning four power generation facilities located in Argentina

with an aggregate installed capacity of 737 MW, involving a Chapter

11 Plan and a Plan of Arrangement under the Canadian Business

Corporations Act. Our team was delighted to work on behalf of the

ad hoc group of noteholders and with all counsel, including 5

different BVI counsel, to close this US$510 million

deal."

Robert J.D. Briant

Partner and Head of Corporate, BVI

Insurance

Despite global uncertainty over the course of 2022, activity within the Bermuda re/insurance industry remained robust with a number of notable group reorganisations, continued growth in the life sector and strong performance within the catastrophe bond market.

Examples of this healthy activity include Athene Holding Ltd.'s reorganisation of its Bermuda subsidiaries in connection with its merger under Apollo Global Management, Inc., and Aquarian Holdings and Somerset Re's agreement for Aquarian to acquire a controlling interest in Somerset Re. RenaissanceRe Holdings Ltd. also completed an underwritten public offering of 20 million depositary shares valued at US$500 million. In the catastrophe bond space, newly formed special purpose insurers Gateway Re Ltd. and Hestia Re Ltd. issued a total of US$150,000,000 Series 2022-1 Class A Principal At-Risk Variable Rate Notes and US$175,000,000 Series 2022-1 Class A Principal At- Risk Variable Rate Notes, respectively. Conyers was pleased to assist on all of these transactions.

The Cayman Islands insurance industry saw continued growth over the last 12 months, and although end of year figures were not available at the time of writing, was expecting a potentially record number of insurance licences to be issued for the calendar year. Conyers advised on the majority of these new licence applications, with the total number of licensees in the jurisdiction reaching almost 700 as at Q3 2022. Approximately 70% of all new licence applications are for commercial insurers and reinsurers (Class B(iii) licensees), with well-known private equity and reinsurance groups, as well as insurtech companies, driving interest in the jurisdiction. Cayman continues to be the leading jurisdiction for healthcare captives, representing almost one third of all captives globally.

The Cayman Islands continues to see momentum on the reinsurance

front with the establishment of a significant number of both

commercial carriers, affiliate reinsurers and side car

transactions. Captives remain the bedrock of the local industry and

numbers are also steadily growing."

Derek Stenson

Partner, Cayman Islands

" Bermuda's re/insurance industry plays an important

role in providing risk capacity to the rest of the world. The

response to Hurricane Ian, which made US landfall in September,

demonstrates Bermuda's unique positioning. A Bermuda Monetary

Authority survey showed that Bermuda re/ insurers are expected to

pay a significant portion of Hurricane Ian's losses, totalling

as much as 25% (approximately US$13 billion) of the expected

losses."

Sophia Greaves

Director, Bermuda

Deals

Advised Aran Re, a Class B(iii) licensed reinsurer focused on

the long-term care market, on its entry into a US$75 million letter

of credit facility with CIBC Bank USA

Cayman: Michael O'Connor, Partner, Philippa Gilkes, Associate,

Jarladth Travers, Head of Conyers FIG (Cayman) Limited

Advised Athene Holding Ltd. on the successful reorganisation of

its Bermuda subsidiaries carried out in connection with its merger

under Apollo Global Management, Inc

Bermuda: Charles G.R. Collis, Director, Alexandra Macdonald,

Director, Hailey Edwards, Associate

Advised Augusta Healthcare, Inc. in relation to a

quasi-partnership dispute involving a captive insurance company

incorporated in the Cayman Islands to provide insurance solutions

for not-for-profit healthcare systems

Cayman: Derek Stenson, Partner, Alex Potts KC, Partner, Jonathon

Milne, Partner Spencer Vickers, Counsel

Advised on the establishment and licensing of special purpose

insurer Gateway Re Ltd., including the issuance of a total of

US$150,000,000 Series 2022-1 Class A Principal At-Risk Variable

Rate Notes due May 12, 2025

Bermuda: Alexandra Macdonald, Director, Davina Hargun, Associate,

Hailey Edwards, Associate

Advised Hestia Re Ltd. on its establishment and licensing as a

special purpose insurer. The transaction included the issuance of a

total of US$175,000,000 Series 2022-1 Class A Principal At-Risk

Variable Rate Notes due April 22, 2025

Bermuda: Alexandra Macdonald, Director, Davina Hargun, Associate,

Hailey Edwards, Associate

Advised Ivy II Limited on the establishment of Ivy Co-Investment

Vehicle II LLC, designed to co-invest approximately US$1 billion

with Global Atlantic and its subsidiaries in qualifying reinsurance

transactions

Cayman: Derek Stenson, Partner, Michael O'Connor, Partner, Kiah

Estwick, Associate, Philippa Gilkes, Associate, Jarladth Travers,

Head of Conyers FIG (Cayman) Limited

Advised J.P. Morgan on the development, in partnership with

Swiss Re, of a hybrid transaction combining bank financing and

insurance linked securities to protect Swiss Re for severe

underwriting-related losses over a 5 year period. The transaction

utilised a newly established segregated account of an existing

Bermuda special purpose insurer, Matterhorn Re Ltd

Bermuda: Chris Garrod, Director, Elizabeth Blankendal,

Associate

Advised Performance Insurance Company SPC on issues involving

insolvent segregated portfolio Hudson York Insurance SP, and on the

appointment of receivers to conduct the orderly winding down of the

business

Cayman: Derek Stenson, Partner, Spencer Vickers, Counsel

Advised RenaissanceRe Holdings Ltd. on the creation of Fontana

Holdings L.P. and its subsidiaries, including two new commercial

insurers licensed by the Bermuda Monetary Authority, a reinsurance

capital-backed joint venture dedicated to writing casualty and

specialty risks

Bermuda: Jennifer Panchaud, Director, Chiara T. Nannini, Director,

William Cooper, Associate, Lauren Pereira, Associate

Advised RenaissanceRe Holdings Ltd. in connection with its

underwritten public offering of 20,000,000 depositary shares valued

at US$500 million

Bermuda: Jennifer Panchaud, Director, Chiara T. Nannini,

Director

Advised SiriusPoint Bermuda Insurance Company Ltd. on its

investment into the establishment of Banyan Risk Capital Ltd.

Bermuda: Jacqueline King, Director, Chiara T. Nannini, Director

Advised Sixth Street, a global investment firm with US$60

billion AUM, on the establishment and licensing of Talcott Life

& Annuity Re, Ltd., and provided legal and regulatory advice on

its entry into a reinsurance transaction with Principal Financial

Group pursuant to which it reinsured approximately US$25 billion of

liabilities, making Talcott Life & Annuity Re, Ltd the largest

reinsurer in the Cayman Islands

Cayman: Derek Stenson, Partner, Philippa Gilkes, Associate

Advised Somerset Reinsurance Holdings Ltd. on the acquisition by

Aquarian Holdings of a controlling interest in the company

Bermuda: Sophia Greaves, Director, Lauren Pereira, Associate, Sarah

Lusher, Associate

Advised White Mountains Insurance Group, Ltd. on its

"modified Dutch auction" self-tender offer to purchase up

to US$500 million of its common shares

Bermuda: Chris Garrod, Director, Elizabeth Blankendal,

Associate

Asset-Backed Finance and Securitisation

It has been an active year in asset-based transactions for Conyers, particularly in the shipping, aviation and oil and gas sectors. Bermuda has a close connection with the Oslo market, which remains important for the offshore drilling and shipping industry, and Conyers was pleased to advise the Oslo- and New York-listed Seadrill Limited on aspects of its disposal of seven jack-up drilling rigs to ADES Arabia Holding Ltd. for total cash consideration of approximately US$628 million.

Bermuda has long played an integral role for container securitisation transactions, and is valued among market-leading companies for offering flexible and innovative securitisation structures. Conyers recently advised Global Container Assets 2016 Limited on its US$230 million asset-backed securitisation (ABS) of a portfolio of container boxes with a net value of US$358 million. The transaction was the first time a recycled entity had been used on a container box ABS in circumstances where 100% of the portfolio comprised existing assets without the acquisition by the issuer of any additional assets.

"Bermuda is among the largest and most developed offshore

jurisdictions for asset-backed securitisation transactions. In

addition to container transactions, Bermuda plays a significant

role in the aircraft and aircraft engines sector, the insurance

industry (notably through catastrophe bonds and other

insurance-linked securities) and other asset classes."

Julie McLean

Director, Bermuda

Deals

Advised Aircastle Limited in connection with a US$100 million

senior unsecured revolving credit facility with Mizuho Marubeni

Leasing America Corporation, a US-based wholly-owned subsidiary of

Mizuho Marubeni Leasing Corporation

Bermuda: Jason Piney, Director, Andrew Barnes, Associate, Elizabeth

Blankendal, Associate

Sector: Aviation

Advised Global Container Assets 2016 Limited on its US$230

million asset-backed securitisation of a portfolio of 174,157

units/251,521 CEU container boxes with a net value of US$357.8

million

Bermuda: Julie McLean, Director, Andrew Barnes, Associate Kathleen

McBeath, Associate

Sector: Shipping & Marine Transport

Advised Seadrill Limited on its disposal of seven jack-up

drilling rigs located in the Kingdom of Saudi Arabia to ADES Arabia

Holding Ltd. for total cash consideration of approximately US$628

million

Bermuda: Jennifer Panchaud, Director Lauren Pereira,

Associate

London: Karoline Tauschke, Counsel

Sector: Oil & Gas

Advised Sunrise Aircraft Irish HoldCo Designated Activity

Company on its listing on the official list of the Cayman Islands

Stock Exchange of up to US$350,000,000 unsecured Tranche A Notes

and up to US$150,000,000 Unsecured Tranche B Notes issuances due 22

December 2028

Cayman: Mark Mugglestone, Vice President at Conyers FIG (Cayman)

Limited, Nicholas Ward, Associate

London: Barnabas Finnigan, Counsel

Sector: Aviation

Advised Textainer Group Holdings Limited on its subsidiary

Textainer Limited's amendment to renew and extend the term on

its revolver facility, increasing the aggregate commitment amount

from US$1.5 billion to US$1.9 billion

Bermuda: Sophia Greaves, Director, Jacari Brimmer-Landy,

Associate

Sector: Shipping & Marine Transport

Footnotes

1. EY, "Global IPO market went from record-breaking to full-on abating", 15 December 2022

2. S&P Global Market Intelligence, Global IPO Activity cut nearly in half in 2022

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.