. . . the largest market potential for complex Japanese legal services is not in Asia but instead in North America and Europe.

M&A, private equity, arbitration, general commercial and patent litigation, and government investigations are all expanding with the continued globalization of Japanese industries.

Introduction

The world economy is rapidly changing—numerous enterprises are decoupling from established supply chains and alliances, creating new demand for scalable and ethical mass production capabilities, methodical R&D practices, and trading company expertise that are abundant here in Japan but generally scarce elsewhere in the world.

Much of Japanese industry is already scaled internationally with about 65% of industry earnings originating from global sales. Also, Japan continues to maintain significant investment in research and development with annual R&D investments in excess of 3.5% of GDP (US about 2.8% of GDP). And so, it is of little surprise to see Berkshire Hathaway's recently announced investments in Japan's trading companies as well as Sequoia Capital's announcement that it will now be focusing upon Japanese investment opportunities.

In its survey announced last year, Japan's External Trade Organization (JETRO) found that over 56% of Japanese companies surveyed last year indicated plans to expand their overseas operations. See JETRO Survey Results. Collectively, Japanese companies have amassed cash reserves equaling 125% of GDP that can finance their overseas expansions well into the future—investments in new and expanded manufacturing facilities, business and technology acquisitions, broadened sales and distribution channels, and a host of other deals and financial arrangements.

Although the investment numbers flattened in 2020 due to the pandemic, in 2019, Japan's outbound foreign direct investment reached approximately $249 billion—a record high in a year's long upward trend. The regional breakdown of that amount is important to law firms competing for Japanese business. Japanese companies invested over 65% ($160 billion) of their foreign direct investment in North America and Europe—dwarfing the combined Japanese investment in neighboring Asian countries, including China. Stated differently, the largest market potential for complex Japanese legal services is not in Asia but instead in North America and Europe.

The data discussed below show that Japanese companies are actively responding to global demand for increased diversification in supply chains. The expertise of Japan's trading companies, the mass production capabilities of its manufacturing sectors, and general neutrality of its government, among other things, all combine to cast Japan and its businesses in leading roles within the rapidly evolving world economy. There are tremendous opportunities ahead—both for Japanese companies and the law firms that serve them. And, as discussed later, the law firms in demand by Japanese companies for their overseas expansion are increasingly the local and regional commercial firms that can handle a broad range of labor, real estate, regulatory, and other issues requiring local experience and expertise.

The data further show tremendous inbound investment activity by private equity and other corporate dealmakers. In 2019, foreign inbound investment reached a record high, exceeding 33 trillion yen (approximately $314 billion). Over 70% (roughly $224 billion) of that inbound investment originated from Europe and North America, representing growing interest in Japan by private equity and other investors. Viewing the potential legal market for Japan-related business as a whole, the total of outbound and inbound Japanese investment traffic now exceeds $560 billion. See JETRO Invest Japan Report.

Opportunities Arising from Japanese Overseas Expansion

As a result of its declining and aging population, rising domestic production costs, limited natural resources, etc., Japanese producers remain focused on expanding their overseas operations. Their geographic focus, however, is very much in flux, and the bulk of their foreign direct investment points to increasing activities in the United States and Europe.

For example, in a recent 2019 year-end JETRO survey of 3,563 Japanese companies, over 56% of respondents indicated that they plan to either expand existing overseas operations or to initiate new overseas operations in the future. See JETRO Survey Results. Of those respondents, 1,582 companies indicated that, at the time of the survey, they had at least one overseas base in one of the following top-five-ranked countries: 1. China (56.4%), 2. Thailand (34.1%), 3. United States (28.0%), 4. Vietnam (27.7%), and 5. Taiwan (22.3%).

The following table, however, reveals that this status quo is undergoing dramatic change and that Japanese companies are actively relocating their overseas bases of operation within Asia—largely away from China to other Southeast Asian countries.

See JETRO Survey Results.

The top-five Japanese law firms have been actively responding to these changes by opening offices and acquiring practices in Southeast Asian countries such as Vietnam, Thailand, and Indonesia. Japanese banks likewise have opened local branches to service their clients' expanding operations in those countries.

The transactional work in Southeast Asia, however, represents only a very small percentage of Japanese foreign direct investment. The following table provides a snapshot overview of Japan's outbound investments in 2019, breaking down those investments by region.

Sources: Prepared by JETRO from "Balance of Payment Statistics" (Ministry of Finance, Bank of Japan) and "Foreign Exchange Rate" (Bank of Japan).

Although lagging this year due to the pandemic, in 2019, Japanese foreign direct investment continued its year-over-year increases, reaching an all-time-record high of $248.7 billion ($180 billion of equity capital and the remainder debt instruments and earnings re-investment). However, only 5.8% ($14 billion) of the FDI was directed to China and 15.0% ($37.8 billion) to ASEAN countries as a whole.

In contrast, Japanese companies spent 44.5% ($110.8 billion) of their FDI in Europe and 20.8% ($52.0 billion) of their FDI in North America. In other words, over 65% ($162.0 billion) of Japanese FDI was directed to the United States and Europe. These slices of the Japanese foreign direct investment pie are not only the largest, they are also the most desirable—feeding a broad spectrum of complex transactional, regulatory compliance, and other legal work.

The magnitude of Japan's US and European expenditures results from investments in not only manufacturing capabilities but also the financing of expanded sales operations, distribution channels, and access to and acquisition of leading industry technologies within the world's largest markets.

Japan, in fact, has the largest FDI in the United States—with approximately $645 billion of direct investment in the US as of 2019. (By comparison, China is far down the list with only about $59 billion of FDI in the United States.) See SelectUSA Fact Sheet. As discussed above, Japanese companies retain enormous cash balances (125% of GDP) and are well positioned to continue their extensive and expanding investments in Europe and North America—feeding continued demand for transactional, corporate, tax, labor, and other legal services.

The large, global U.S. and European law firms are well positioned to service the larger transactions resulting from this inbound Japanese investment, such as the $21 billion acquisition of Marathon Petroleum's Speedway gas stations by Japan's Seven & i Holdings (owner of Japan's chain of 7-Eleven convenience stores and banking). See Japan's Seven & i seals $21 billion deal for Marathon Petroleum's Speedway gas stations, CNBC (August 3, 2020). However, a growing majority of the legal work will continue to flow to local and regional firms that are best equipped to handle issues arising from local government ordinances and regulations, real estate and tax law, and a host of other legal issues requiring localized experience and expertise.

Japanese inbound investments into the U.S. and Europe continue to reach the heartland. For example, Nissei America recently announced its intention to move its U.S. headquarters from Anaheim, California to San Antonio, Texas—the move involves more than relocation of administrative staff but also the purchase of land and construction of a state-of-the-art manufacturing plant in Texas. See Samantha Gowen, Nissei America Sells Anaheim HQ, Leaving OC for Texas, Orange County Register (April 15, 2021). Betting on the rebounding U.S. housing market spurred on by families fleeing cities for suburbs, Kubota Tractor is spending $52 million to build a manufacturing plant in Kansas. See Kosuke Toshi, Kubota Bets on US Suburban Construction Boom with New Plant, Nikkei Asia (August 13, 2020). These and other Japanese investment projects in North America and Europe offer new and expanding opportunities to domestic law firms in capturing this high-value work.

Japanese Transactional Market

Unnoticed during the "lost decades" since the bursting of Japan's economic bubble in 1990 are the steady recovery and remarkable stabilization of Japan's industries. The lost market capitalization of Japan's publicly traded companies from a high of about 590 trillion yen in 1989 has been recovered with current capitalization fluctuating around 600 trillion yen this year. Today's publicly traded companies, however, barely resemble their 1989 predecessor companies.

In 1989, the stock of Japanese companies had an average P/E of about 61 times earnings. Today, Japanese companies are much more reasonably valued and trade at around 12 times earnings—favorably priced for acquisitions and other deals. In 1989, foreign holdings accounted for only about 4% ownership and foreign trading only 8% of market activity. Today, foreign holdings have grown to 31%, and foreign trading accounts for 69% of market activity. Return on equity has also grown from about 1.9% in 1989 to about 9.5% today. Foreign management talent is now appearing in many large Japanese companies—Takeda Pharmaceuticals is a notable example with its French born CEO who has 20 years prior experience at GlaxoSmithKline.

Significantly, the cross holding of stock within Japan's "keiretsu" conglomerates has fallen from a high of about 50% in 1989 to about 4% today—greatly facilitating the restructuring and sale of modern Japanese corporate entities and business divisions. However, the shadow of the conglomerates' misallocation and underutilization of capital remains outstretched over many Japanese industries. For example, Japan's listed companies maintain aggregate cash balances in excess of 125% of GDP—France and China have the next largest corporate cash balances at just under 60% of GDP. US listed companies, by comparison, have cash balances of about 30% GDP.

One, perhaps cynical, view of Japan's extraordinary corporate cash balances is that this "cash hoarding" represents an underutilization of capital and lack of direction in corporate risk taking and investment—resulting in large conglomerated entities, lacking in focus and internal synergies. In many ways, Japanese conglomerates are like old oak trees that grew erratically in all directions.

Private Equity & Acquisitions

Under these circumstances, much of Japanese industry is likely undervalued due to so-called "conglomerate discounts" that arise when the true value and growth potential of subsidiaries and business units within a conglomerate are constrained by competing demands within the overarching organization. Foreign private equity and other investors have been responding to these favorable opportunities in the Japanese economy with increasing year-over-year inbound investment into Japan. According to JETRO data, in 2019, foreign inbound investment exceeded 33 trillion yen (roughly $314 billion) for the first time. See JETRO Invest Japan Report.

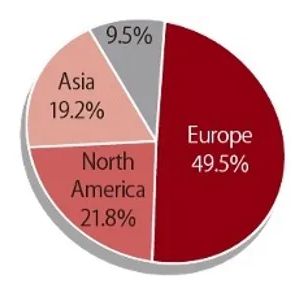

The following chart provides a regional breakdown of the sources of that inbound investment. Roughly 49.5% ($156 billion) of the investment came from Europe, and 21.8% ($69 billion) was sourced from North America. In other words, investors from Europe and North America poured approximately $224 billion into the Japanese economy and its businesses.

See JETRO Invest Japan Report.

Without surprise therefore, acquisition and other transactional activities have been on a fairly steady pace. Even during the pandemic, new spin offs are announced almost daily such as Olympus's divestiture of its camera business, Takeda's spinoff of its over-the-counter drug business to Blackstone, and Panasonic's recent sale of its semiconductor business to Nuvoton and Winbond. See also York Faulkner, Corporate Spinoffs – Unlocking Wealth in Japan's Economy, YMF Law Tokyo (2021).

Other forces in the form of shareholder activism within the Japanese investment community provide further motivation to move public entities into private ownership. In an environment where arguably half of Japanese companies are trading below book value, the number of investor campaigns by dissatisfied shareholders has sharply increased in recent years—increasing from less than 10 events in 2010 to at least 75 events in 2019. Spin-offs, restructurings, and management shakeups have resulted from these campaigns, which reflect the growing strength of equity investment in the face of waning bank and lender influence over the direction of corporate Japan.

Under these conditions, many Japanese boardrooms are likely filled with "qualified leads"—directors who are already receptive and predisposed to the idea of new value propositions through structural change but who lack clear direction, perspective, and expertise. Private equity investors (and foreign law firms) who can provide that leadership and vision will undoubtedly find heightened interest in deals that not only expand the value of Japanese companies but also pioneer new opportunities for Japanese industry in meeting the increasing demand for diversified supply chains, relocated manufacturing bases, and novel products and services.

University startups are increasing in number and quality and, in some cases, offer attractive acquisition opportunities. University startups in Japan are typically out licensed to corporate venture groups such as NTT Venture Capital and Ricoh Ventures or to government sponsored venture groups such as INCJ (Innovation Network Corporation of Japan) that invest in and develop the startups—most often with a limited focus on the Japanese domestic market. There are many such portfolio companies that, although scalable internationally, out of mismanagement or complacency, are operated only domestically despite strong earnings and performance.

Finally, Japan's trading companies present additional opportunities for deal development. In addition to their import/export services, the seven major trading companies are actively involved in the formation, acquisition, and sale of various businesses in response to the operational needs of their companies. The trading companies are well financed and managed, and they consistently attract the top finance, management, and technical talent from Japan's major universities. They are responsive and well positioned to profit from global shifts in supply chains and production, which likely explains Berkshire Hathaway's recent and extensive investments in these companies.

Litigation, Arbitration & Other Disputes

Japanese business expansion in the United States and Europe will undoubtedly continue to create opportunities in dispute resolution. The sources of the disputes are varied with many disputes arising out of transactional settings, especially in the context of acquisitions, the so-called "busted deal" litigation. Legal "cleanup" of contract non-performance, postponed acquisitions, failed financing etc. resulting from the pandemic will likely continue into the near future. Although Japanese companies notoriously do their best to avoid litigation, given their international exposure and "deep pockets," they continue to stand out as litigation and arbitration targets.

Exposure to government regulatory and white-collar investigations will continue to be a challenge for Japanese companies. Increasing Japanese expansion into the United States and Europe will not only increase the number of investigations of Japanese companies but also will continue to materially alter the context, scope, and procedural aspects of those investigations. Historically, Japanese companies enjoyed geographical and trans-national advantages in government investigations. Witnesses were generally unavailable in the U.S., and federal investigators were largely forced to painstakingly develop evidence from overseas sources through diplomatic channels spelled out in Mutual Legal Assistance Treaties (MLATs). However, those advantages are evaporating as more and more Japanese companies establish U.S. domestic operations.

Japanese nationals residing in the U.S. as well as their domestic employees and business partners are subject to administrative summons, grand jury subpoenas, local surveillance, and other forms of evidence gathering. Japanese-held assets in the U.S. that are potentially subject to civil or criminal forfeiture further provide investigators with leverage in "persuading" Japanese companies to cooperate through the voluntary production of evidence located outside the United States. With these advantages falling into the hands of federal investigators, both the number and complexity of investigations can be expected to increase in the future.

The scope of investigations is also expanding as a result of increased inter-agency cooperation within the federal government. While in the DOJ, I worked within several "task forces" with agents assigned from IRS, SEC, and FBI, investigating a broad scope of crimes arising out of a common group of facts and circumstances. These types of cooperative investigations have become commonplace and complicate both the defense of investigation targets and the negotiation of pleas and other accommodations. Japanese companies can expect expanding scopes of investigations into tax, securities, FCPA, antitrust, cartel, and other crimes that increase the complexities in balancing the risks of defense strategies.

Although the number of patent litigations has stabilized in recent years, Japanese producers and importers continue to face significant risk of patent infringement suits. They continue to be targeted by patent assertion entities. Their products are increasingly complex with onboard semiconductor, robotics, and other "smart" features which expand the risk of IP disputes. And, their own patents are increasingly challenged in inter-partes review and other administrative challenges before U.S Patent and Trademark Office.

Conclusion

As discussed, various social, geographic, and economic forces have combined to compel Japanese industries to expand their overseas R&D, manufacturing, and sales operations. Although Japanese investment in neighboring Asian countries will continue at an increasing pace, and impressively large percentage of that investment will continue to pour into North America and Europe with attendant needs for legal services.

Those services are broad in scope and increasingly focused on local and regional sectors of the economy, where many smaller and mid-sized U.S. and European law firms have specialized capabilities—especially in dealing with local regulators and courts. For many years, Japanese companies operating overseas have been the captives of the large global firms. Going forward, they will be well served by a much broader group of practitioners who can offer sophisticated services at much more competitive rates.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.