Technology and innovation are the future and the Republic of Cyprus has been taking positive steps to ensure that it will be at the forefront in these areas. In line with the need to advance innovative minds and radical technological developments, in 2016 the Republic of Cyprus implemented a competitive IP Regime offering tax exceptions to income from Intellectual Property ("IP").

The Cyprus IP Regime has been reviewed by the EU Code of Conduct and has been assessed as fully compatible with EU standards.

To whom is the Cyprus IP Regime addressed to

Start-ups, established international IT and technology companies, and innovative businesses may qualify for the Cyprus IP Regime.

Pursuant to the relevant regulations, the Cyprus IP Regime is addressed to certain qualifying taxpayers i.e., to (a) residents of the Republic of Cyprus, (b) permanent establishments, within the Republic of Cyprus, of non-Cyprus residents, and (c) permanent establishment of non-Cyprus residents but who are subject to taxation in the Republic of Cyprus.

Qualifying assets under the IP Regime

A "qualifying intangible asset" is deemed to be any asset which has been acquired, developed or utilized from a person in the course of its business and which is subject to copyright, such assets are, among others, patents, copyrighted software programs and other non-obvious, useful and novel intangible assets. Qualifying assets do not include trademarks and copyrights.

Deduction Rate under the Cyprus IP Regime

80% of the qualifying profits generated from the qualifying assets is deemed to be a tax-deductible expense for qualifying taxpayers. Thus, 80% of the profits qualifying for the IP Regime in conjunction with the corporate tax rate of 12.5%, make Cyprus a competitive destination for IP Owners who may be eligible to enjoy an effective tax rate of as low as 2,5% i.e, a percentage within the lowest end, among the EU countries who offer such regimes.

The effective tax rate could be further reduced by combining the IP Regime with the notional interest deduction, which is another tax incentive implemented by Cyprus for the purpose of creating an attractive environment for businesses.

Qualifying profits under Cyprus IP Regime

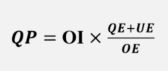

In calculating the qualifying profits, the IP Regime follows the 'Nexus' approach i.e.: –

Whereas: –

QP means the qualifying profits.

OI means the overall income which is calculated as the gross income less any direct expenditure (including the capital allowances) of this asset, i.e. the gross profit. Overall income includes, but is not limited to, royalties received for the use of the intangible asset, trading income from the disposal of qualifying asset and embedded income earned from the qualifying asset. Capital gains arising from the disposal of a qualifying asset are not included in the overall income and are fully exempt from tax.

QE means the qualifying expenditure which includes salary and wages, direct costs, general expenses associated with R&D activities and R&D expenditure outsourced to unrelated parties. It does not include any acquisition costs of the IP, interest paid or payable, any amounts payable to related persons carrying out R&D and costs which cannot be proved to be directly associated with a specific qualifying asset.

UE means the uplift expenditure which is the lower of 30% of the qualifying expenditure and the total acquisition cost of the qualifying asset and any R&D costs outsourced to related parties.

OE means the overall expenditure which is the sum of the qualifying expenditure and the total acquisition costs of the qualifying assets and any R&D costs outsourced to related parties incurred in any tax year.

The nexus approach is an additive approach; the calculation requires that (i) qualifying expenditure includes all qualifying expenditures incurred by the taxpayer over the life of the IP asset and (ii) overall expenditure includes all overall expenditures incurred over the life of the IP asset.

If you are interested in exploring further the Cyprus IP Regime, our team is ready to help you in order to access the benefits that this regime may offer to your business.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.