Malta, a sunny island nation in the Mediterranean, has been steadily growing its economy and establishing itself as an attractive destination for businesses, as well as being a wonderful place to live. One of the key incentives offered by the local government to promote investment and economic growth is the Notional Interest Rate Deduction (NIRD). This deduction, introduced in 2017, aims to encourage equity financing and stimulate entrepreneurship. In this article, we will explore the intricacies of Malta's NIRD, its benefits, eligibility criteria, and how it impacts businesses operating in Malta.

Understanding Notional Interest Rate Deduction

The Notional Interest Rate Deduction, often abbreviated as NIRD, allows companies registered in Malta to deduct a notional interest expense from their taxable income. This deduction effectively reduces the company's tax liability, providing a significant incentive for businesses to invest and expand their operations in Malta.

The concept behind The Notional Interest Rate Deduction is to provide an incentive for companies to finance their operations through equity rather than debt. By doing so, companies can strengthen their balance sheets, reduce financial risk, and promote long-term sustainability.

Unlike traditional interest expenses, which represent actual borrowing costs, the notional interest expense is a theoretical amount calculated based on the company's equity investment.

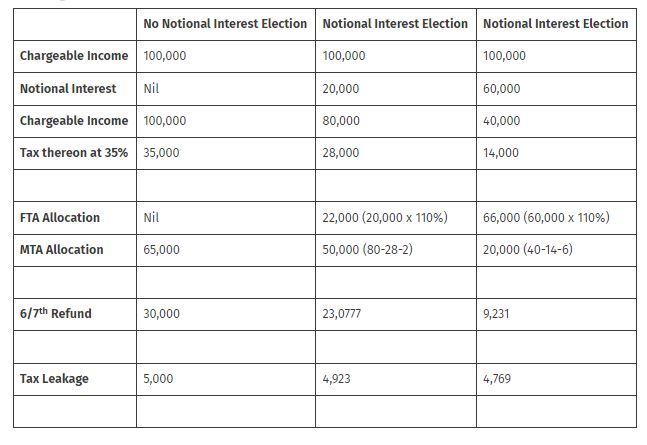

Example:

What are the Benefits of Notional Interest Rate Deduction?

The implementation of the NIRD has several benefits for businesses operating in Malta:

Tax Savings: The primary benefit of the NIRD is the reduction of corporate tax liabilities. By deducting a notional interest expense from taxable income, companies can lower their effective tax rate, resulting in significant tax savings.

Encourages Equity Financing: The NIRD encourages businesses to finance their operations through equity rather than debt. This promotes a healthier capital structure, reduces financial risk, and enhances the company's ability to weather economic downturns.

Stimulates Investment: The availability of the NIRD incentivizes both local and foreign companies to invest in Malta. This influx of investment capital contributes to economic growth, job creation, and the development of key industries.

Supports Entrepreneurship: The NIRD provides a valuable tax incentive for startups and small businesses, making it easier for entrepreneurs to access capital and fuel innovation. This, in turn, fosters a vibrant entrepreneurial ecosystem and drives economic diversification.

What's the Eligibility Criteria for Notional Interest Rate Deduction?

While the NIRD offers attractive tax benefits, not all companies operating in Malta are eligible to claim this deduction.

To qualify for the NIRD, companies must meet certain criteria:

- Registered in Malta: The company must be registered and resident in Malta for tax purposes.

- Equity Financing: The NIRD is available only for companies that finance their operations through equity rather than debt. Companies must maintain a minimum level of equity capital to be eligible for the deduction.

- Compliance with Substance Requirements: Companies claiming the NIRD must demonstrate substance in Malta, meaning they must have a physical presence, employees, and conduct genuine business activities in the country.

- Compliance with Transfer Pricing Rules: Companies taking advantage of NIRD must comply with Malta's transfer pricing rules and maintain proper documentation to support their transactions.

Conclusion:

Malta's Notional Interest Rate Deduction is a valuable tax incentive that promotes equity financing, stimulates investment, and supports entrepreneurship. By allowing companies to deduct a notional interest expense from their taxable income, the NIRD reduces tax liabilities, enhances competitiveness, and fosters economic growth.

As Malta continues to position itself as a leading business destination, the NIRD plays a crucial role in attracting investment, driving innovation, and building a sustainable economy for the future.

Additional Benefits Enjoyed by Maltese Companies

Malta does not levy withholding taxes on outbound dividends, interest, royalties and liquidation proceeds.

Maltese holding companies also benefit from the application of all EU directives as well as Malta's extensive network of double taxation agreements.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.