According to the SEBI (Prohibition of Insider Trading) Regulations, 2015 (PIT Regulations), any buy/sell trade, undertaken by a Designated Person (DP)1 and their immediate relatives, within 6 months of an earlier sell/buy trade, respectively, where both the trades have been done in open market, will tantamount to contra-trade.

Contra-trade restrictions are applicable only on open market buy/sell transactions. For the purpose of determining contra-trades, shares acquired by way of Rights issue, Follow-on Public Offer, Offer for Sale, Bonus issue, Share Split, Merger/Amalgamation or Demerger, are not considered as open market transactions. Therefore, if a DP has sold shares through the stock exchange mechanism, in compliance with other provisions of the PIT Regulations, within 6 months of acquisition of shares through any of the aforesaid modes, that set of sale and acquisition transactions would not constitute contra-trades. Also, contra-trade restrictions would not be attracted to acquisition of shares or sale of shares acquired pursuant to ESOPs.

An informal guidance provided by the Securities and Exchange Board of India (SEBI), has clarified the position with respect to contra-trades executed by promoters in a listed company. An informal guidance is an interpretation of the provisions of the securities laws provided by a particular department of SEBI in the context of a proposed transaction in securities or a specific factual situation. The interpretation provided by SEBI is not binding on it, though it may generally act in accordance with such interpretation.

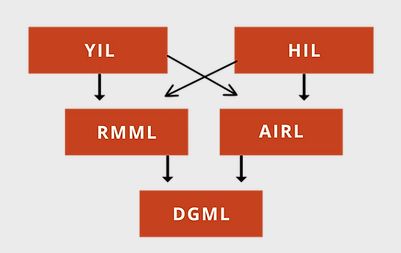

The acquirers/promoters of the Deccan Gold Mine Ltd. (DGML) had sought informal guidance with respect to the contra-trades proposed to be executed by a set of promoters with respect to the shares of DGML. Rama Mines (Mauritius) Ltd. (RMML) and Australia Indian Resources Ltd. (AIRL) are the promoter entities of DGML. Furthermore, both RMML and AIRL have been promoted by Yandal Investment Pty. Ltd. (YIL) and Halycon Investments Ltd. (HIL). Such an arrangement makes DGML a second-tier subsidiary of both YIL and HIL.

As the shareholding of DGML stands so, AIRL was issued equity shares of DGML in March 2023, pursuant to a share swap agreement. Thereafter, in June 2023, within 6 months of issuing equity shares to AIR, RMML proposed to sell some shares of DGML in the open market. DGML requested SEBI to clarify whether the provisions of contra-trades apply to trades made by a single promoter or whether the provisions would apply to the whole promoter group.

In the specific circumstances of the matter, SEBI has clarified that since the promoters of DGML, i.e. RMML and AIRL, are controlled by the same corporate entities, viz. YIL and HIL, the provisions of contra-trades apply to RMML and AIRL jointly. Hence, if AIRL has acquired shares of DGML through open market transactions, then RMML cannot undertake a sell trade in the open market within 6 months of the acquisition by AIRL.

The interpretation provided by SEBI assumes significance in the light of the revamped rules of beneficial ownership brought in after the Adani-Hindenburg saga. In the guidance, SEBI has conceded that, generally, the provisions of contra-trades would apply to trades made by a promoter individually. However, the informal guidance given by SEBI, in the instant case, takes into consideration the common and tiered shareholding of corporate entities in the listed company. The guidance signifies the focus of the regulator in identifying the ultimate beneficiaries of transactions in the shares listed in India and the underlying objectives of such transactions.

The promoters or promoter groups that have adopted a layered investment strategy in Indian listed companies will do well being cautious regarding earlier transactions completed by its constituents prior to engaging in any buy/sell transaction in the open market. In case of execution of an inadvertent contra-trade, the profits from such trade shall be disgorged and remitted into the Investor Protection and Education Fund administered by SEBI. This would be apart from the penalty that may be imposed by SEBI. Therefore, it would be ideal if the promoters maintain a centralized database of transactions undertaken by its constituents, so that open market trades by common promoters or promoter group entities can be monitored to avoid any inadvertent contra-trades.

Footnote

1. Designated Persons and classes of their immediate relatives are required to be determined by a listed company through its internal code of conduct for dealing in securities, which is framed as per Regulation 9 read with Schedule B of the PIT Regulations.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.