Introduction

As part of its continuous efforts to promote the Electric Vehicle (EV) sector in India, the Indian government unveiled a scheme i.e., "Scheme to Promote Manufacturing of Electric Passenger Cars in India" (Scheme) last week. According to the Indian government, this Scheme is expected to encourage investments in India, generate employment, and promote the "Make in India" campaign by fostering domestic manufacturing capabilities in the EV sector.1

This note provides a high-level overview of the Scheme, along with a snapshot of India's import and export performance in electric passenger cars i.e., electric four-wheelers (e-4W), key considerations arising out of the implementation of the Scheme as well as the pivotal role the Scheme may play towards sustainable mobility and India's competitiveness in the global market.

Scheme to Promote Manufacturing of Electric Passenger Cars in India

The Scheme aims to attract investment from global EV manufacturers and promote EV manufacturing in India. To achieve this objective, the Scheme offers certain benefits to certain companies subject to fulfilling certain criteria.

|

Eligibility Criteria to Qualify for Benefits: § Incorporated in India: The applicant under the Scheme should be (i) a company or its group company* incorporated under the Companies Act in India, (ii) engaged in the automotive sector and/or manufacturing, and (iii) the applicant company or its group company should meet the criteria set forth below. § Minimum Investment in India: The applicant or its group company will set up a manufacturing facility in India to manufacture e-4W with a minimum investment of INR 4,150 Crores (~ USD 500 Mn) in the Indian market during a 3-year window. § Revenue: The applicant or its group companies' global group revenue from automotive manufacturing based on the latest audited financial statements at the time of the application is a minimum of INR 10,000 Crore. § Global Investment: The applicant or its group companies' global investment in fixed assets (gross block) is INR 3,000 Crore. § Domestic Value Addition Criteria (DVC): The applicant or its group company has to achieve certain DVC during the manufacturing i.e., 25% DVC to be achieved within 3 years and 50% to be achieved within 5 years from the date of issuance of approval letter by the Ministry of Heavy Industries (MHI). Eligibility Criteria for Availing Benefits: § An approval letter should be issued by the MHI. § A bank guarantee of INR 4,150 Crores (~ USD 500 Mn) should be submitted. However, if the duty foregone is more than INR 4,150 Crores (~ USD 500 Mn), an additional bank guarantee equivalent to the additional benefit sought should be submitted. Benefits Offered: § The applicant or its group company, subject to fulfilling the above criteria, can import e-4W with a minimum CIF value of USD 35,000 at a 15% duty rate for a period of 5 years from the approval date. § However, such imports are capped at 8,000 e-4W per year. |

* According to the Scheme, a "Group Company(ies) shall mean

two or more enterprises which, directly or indirectly, are in a

position to: Exercise twenty-six percent or more of voting rights

in the other enterprise;"

It is pertinent to note that, while imports are capped at 8,000 e-4W per year, the maximum number of e-4W (with a minimum CIF value of 35,000 USD) that can be imported at a 15% duty rate is contingent on the lower of the following:

- The maximum duty foregone per applicant which is limited to INR 6,484 Crores (~ USD 781 Mn); or

- Committed investment in INR Crores of the applicant.

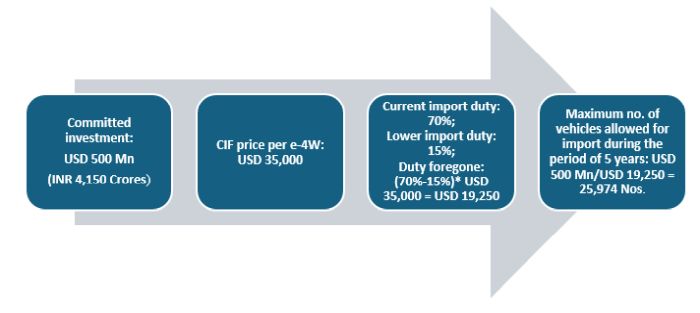

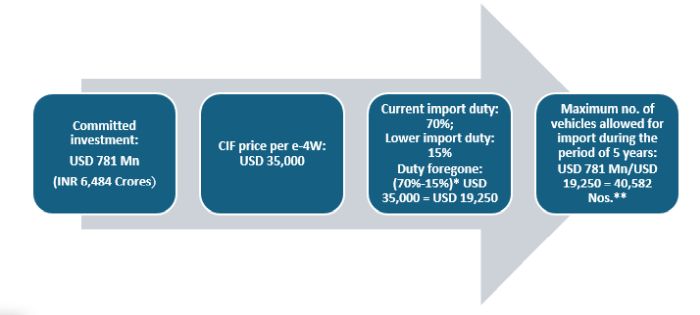

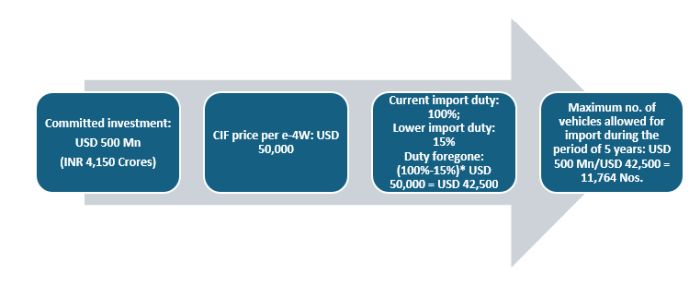

Given the complexity involved in ascertaining the maximum number of e-4W that can be imported at a lower duty rate of 15%, the Scheme itself has set forth a few illustrations – the same are reproduced below.

Illustration 1:

Illustration 2:

** Given that the imports of 2-4W are capped at 8000 per year, the maximum number of EVs that can be imported within a period of five years would be 40,000 Nos. as opposed to 40,582 Nos.

Illustration 3:

Additionally, the Scheme sets forth modalities for filing applications, details of the implementing agency and their obligations thereof to assess the progress and performance of the applicant, and the approval process under the Scheme to avail lower customs duties. Notably, certain consequences are also set forth for any misrepresentation or non-fulfillment of investment commitments among others. For example:

- If the applicant has met the eligibility criteria or benefits under the Scheme by obtaining any misrepresentation of facts or falsification of information, such applicant is required to refund the duty forgone along with certain interest.

- The bank guarantee (as provided by the applicant) can be

invoked for non-fulfillment of the following.

- Minimum investment of INR 4,150 crore (~ USD 500 Mn) within 3 years;

- DVA of a minimum of 25% within 3 years at the applicant's manufacturing facility;

- Investment made within 5 years should be at least equivalent to duty foregone, or USD INR 4,150 crore (~ USD 500 Mn), whichever is more;

- DVA of a minimum of 50% within 5 years at the applicant's manufacturing facility.

The MHI has indicated that certain additional guidelines for implementing this Scheme will be issued. Furthermore, the modalities of the Scheme as they currently stand may be reviewed and revised by the Indian government from time to time.

India's Performance in the EV Market

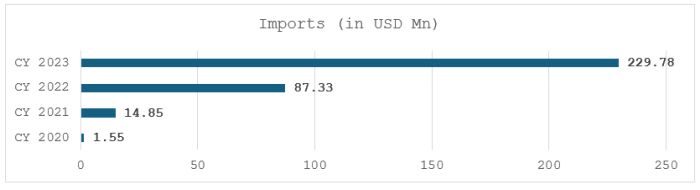

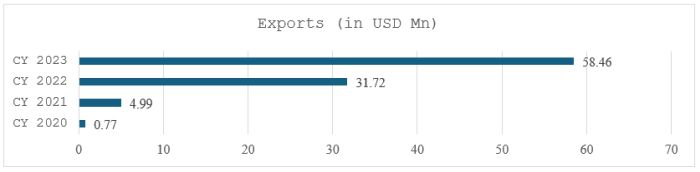

India is currently a net importer of e-4W i.e., EV passenger cars. In CY 2023, India's imports2 were valued at USD 230 Mn vis-a-vis exports3 which were valued at USD 58.46 Mn.

Indian Imports of EV Passenger Cars

Source: Tradestat, Ministry of Commerce, Government of India.

CY = Calendar Year

Indian Exports of EV Passenger Cars

Source:Tradestat, Ministry of Commerce, Government of India.

CY = Calendar Year

That said, India's imports have expanded from USD 1.55 Mn in CY 2020 to about USD 230 Mn in CY 2023 - which is a 14800% increase in imports. India's exports on the other hand expanded from USD 0.77 Mn in CY 2020 to USD 58.46 Mn in CY 2023. In other words, the imports and exports have risen in the last few years signalling strong demand in the EV sector in India as well as globally. Indeed, according to NITI Aayog4, overall EV adoption rates are expected to reach 10-12% by FY 26 and 30-35% by FY 30 in India.

Additionally, as regards the global EV market, India has a small footprint. Basis the ITC Trademap data (available as of 2022),5 the global EV trade across all categories of EVs6 was valued at about USD 94 billion and India's trade constituted only 0.001% of global trade. That said, given the worldwide increase in trade in EVs in the last few years, there is a rampant demand for EVs.

Conclusion

The Scheme signifies a strategic move aimed at bolstering domestic production and enhancing competitiveness in the domestic market and also indicates India's willingness to adapt to evolving global trade dynamics and capitalize on emerging opportunities in the EV sector. Indeed, the Scheme represents a departure from India's historical hesitation in liberalizing tariffs on passenger cars/ automobiles. Needless to say, the Scheme presents an opportunity for India to lead the global transition from traditional Internal Combustion Engine (ICE) powertrains to more efficient and eco-friendly EV technology.7 Further, the potential influx of global manufacturers is likely to increase competition in the domestic market leading to an increase in quality, choices, and innovation at competitive prices while at the same time meeting the goals of climate change and less dependence on fossil fuels and import bills.

Businesses looking to benefit from the Scheme should also take note of the treatment of investments originating in border countries, particularly China. While Foreign Direct Investment (FDI) in automobiles is under the automatic route, investments from such countries require specific approval from India's Ministry of Home Affairs.8 Furthermore, under the Scheme, investments from China would be subject to MHI's approval adding a layer of approval requirements.

The success of the Scheme would also depend upon its objective implementation and certainty:

First, the Scheme appears to benefit certain companies upon meeting certain criteria, thereby paving the way for such companies to set up manufacturing facilities to capture consumer choices. This conditional liberalization of tariff available to companies that meet additional criteria of committed investment into India may raise questions concerning WTO compatibility, particularly with the Most Favoured Nation principle.

Second, investors could be wary of a possible dispute with the Indian government in the future in light of the government's recent dispute with E-scooter makers where the government claimed a refund of subsidies on account of an alleged violation of localization requirements. Therefore, it is imperative that the government implements the Scheme transparently and objectively and that investors comply with all conditions in letter and spirit.

Footnotes

1. Ministry of Heavy Industries, Notification no. S.O. 1363(E). – Scheme to Promote Manufacturing of Electric Passenger Cars in India, dated 15 March 2024.

2. India has imported largely from Germany, followed by Sweden, Korea RP, China PR, UK, and USA among others.

3. India's exports were made to Nepal, France, Germany, Korea, Australia, and Vietnam among others.

4. NITI Aayog-BCG-ADB report on "Promoting Clean Energy Usage Through Accelerated Localization of E-Mobility Value Chain", May 2022.

5. ITC Trademap data for HS 870380.

6. HS 870380 - Motor cars and other motor vehicles principally designed for the transport of <10 persons, incl. station wagons and racing cars, with only electric motor for propulsion (excl. vehicles for travelling on snow and other specially designed vehicles of subheading 8703.10).

7. Ministry of Heavy Industries, Notification no. S.O. 1363(E). – Scheme to Promote Manufacturing of Electric Passenger Cars in India, dated 15 March 2024.

8. Ministry of Commerce & Industry's Press note no. 3 (2020 series) concerning the Review of FDI policy for border countries.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.