- INTRODUCTION

The Indian legal landscape is so vast that at times different legislations which may deal with a common subject matter end up conflicting with each other. Such conflict results in no lesser than a completely different but evolved jurisprudence, with the goal to achieve the objective under that particular legislation. This also satisfies one of the principles of law that suggests that a law needs to keep evolving as per the need. On these lines, let us discuss one of those conflicts– Real Estate (Regulation and Development Act), 2016 ("RERA") versus Securitization and Reconstruction of Financial Assets and Enforcement of Security Interest Act, 2002 ("SARFAESI"). As these 2 (two) legislations play an important role in the real estate industry, it becomes important to understand how these legislations can impact the overall functioning of the market.

Also, the need for this analysis arises out of one judgment passed by the Hon'ble High Court of Judicature for Rajasthan, Jaipur bench ("Rajasthan HC") in Union Bank of India v. Rajasthan Real Estate Regulatory Authority and Ors.1 ("Rajasthan HC Order") that was upheld by the Hon'ble Supreme Court of India ("SC") in Union Bank of India v. Rajasthan Real Estate Regulatory Authority & Ors. Etc.2 ("SC Order"). Upon such seal of approval, it becomes pertinent to deep dive into the issue that may directly impact financial institutions, allottees and real estate developers, together.

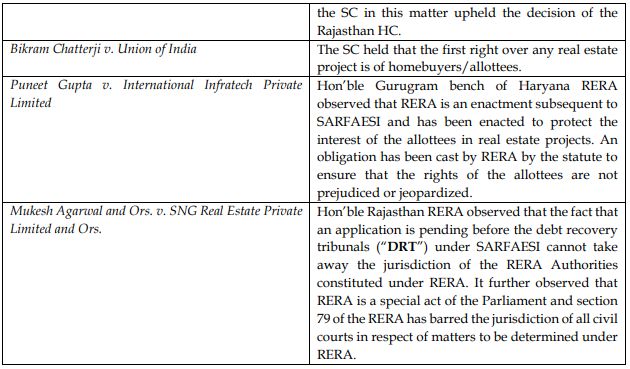

There are other related judgments on the similar issue, adjudicated by various benches of real estate regulatory authorities ("RERA Authorities") and courts. Another example of RERA being in conflict with SARFAESI can be seen in Bikram Chatterji v. Union of India3 . Recently, the Gurugram bench of Haryana RERA in Puneet Gupta v. International Infratech Private Limited4 observed that RERA is an enactment subsequent to SARFAESI and has been enacted to protect the interest of the allottees in real estate projects. An obligation has been cast under RERA to ensure that the rights of the allottees are not prejudiced or jeopardized.

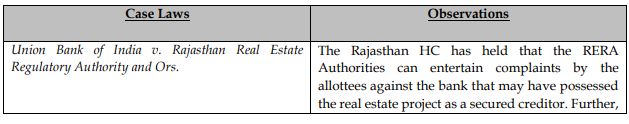

Through this article, we analyze the decision and possible conflicts that may be born out of the collision of two heavy-weight legislations. We also ponder on the positions that may be taken in such conflicts. For ease of reading, the case laws under RERA along with the relevant observations are reflected in a tabular form below:

- THE ISSUE ITSELF

Any real estate developer, as a matter of practice, raises debt and parallelly markets the project to the prospective allottees who also deposit the amount with the developer. Essentially, the project is mortgaged in favour of the financial institution as a security against the debt raised by such a developer. Now, the developer is answerable to both financial institutions as well as the allottees who have booked the units in the project. To understand the applicability of both legislations, it is important to note that any contractual or civil dispute between the developer and financial institution shall lie with the civil courts and any enforcement of security in relation to the mortgage, repayment of money, and any enforcement of security shall be dealt by the appropriate DRT under SARFAESI. In case of a dispute between the developer and the allottee in relation to the project, possession, delay in possession and such related matters will be adjudicated by the appropriate authority constituted under RERA.

Now that we are clear that how SARFAESI and RERA together may impact the developer/project, let us understand the issue and dissect the various orders passed on the subject matter in detail.

A bare reading of the SC Order suggests a few pointers for understanding the conflict between RERA and SARFAESI. The SC Order supported the Rajasthan HC Order and laid down the principle held in the Bikram Chatterji case stating that it is apparent from the perusal of RERA which is a special legislation that certain rights have been created in favour of the buyers and provisions of RERA have to prevail in the event of conflict i.e. in a situation where there could be an overlap of jurisdiction to try the case between RERA and SARFAESI, the provisions contained in RERA would prevail. Further, it stated that RERA would not apply in relation to the transaction between the borrower and the financial institutions in cases where security interest has been created by mortgaging the property prior to the introduction of RERA unless it is found that the creation of such mortgage or transaction is fraudulent or collusive. Further, most importantly, the SC held that RERA Authorities constituted under RERA has the jurisdiction to entertain a complaint by an aggrieved person against the bank as a secured creditor if the bank takes recourse under Section 13(4)5 of the SARFAESI. This, however, was coupled with a caveat by the SC which said that RERA will only have the jurisdiction to entertain a complaint by an aggrieved person against the bank as secured creditor if the complaint is initiated by the homebuyers to protect their rights. It is clear that the intention and thought process behind such a caveat was to ensure that no developer can use this provision as a defence to escape the clutches of Section 13(4)6 of SARFAESI which allows the financial institution to take possession of the secured asset, including management of the business of the borrower.

The Rajasthan HC Order also observes that the bank in this case, being an assignee of the promoter is a promoter itself and shall be covered under Section 2(zk)7 of RERA. It is pertinent to note that such a wide interpretation of Section 2(zk)8 of RERA is intentional and the definition does not only include the person who constructs or causes to construct a project but also its assignees. This essentially would mean that financial institutions can be considered to be a promoter under RERA. It was further observed in the Rajasthan HC Order that RERA would not apply in relation to the transaction between the borrower and the lender in which security interest has been created by mortgaging the property prior to the introduction of RERA unless and until it is found that creation of such security interest was fraudulent or collusive.

Usually, in a project, there are multiple allottees. In the event, there is a delay in the possession by the developer and if at the time the developer also defaults with the financial institutions, it will actually be a challenge to enforce such security because of multiple complaints by the allottees.

Haryana RERA in Puneet Gupta observed that by the virtue of investment being made by the allottees and execution of a builder buyer agreement, a vested right is created for an allottee and the same cannot be taken away by a financial institution. It is further observed that RERA is an enactment subsequent to SARFAESI and has been enacted to protect the interest of the allottees in real estate projects. This observation, however, does open up a discussion for enforcement rights of financial institutions in the case of real estate projects.

- IMPLICATIONS

The direct impact of these orders on the interplay of RERA and SARFAESI will create a situation where the recourses available with the financial institutions in the event of default by a promoter will have to be considered in light of the rights of homebuyers. In the event of enforcement of security under SARFAESI, a financial institution will be put in the shoes of the promoter, making them amenable to jurisdiction under RERA but to what extent, is a question that will be answered with time. Under SARFAESI, the court's involvement to enforce the secured property was reduced to make the process quicker. This, however, will now be subject to the rights of homebuyers through the RERA's authority. In the event of loan default, the RERA Authorities will also become relevant. However, it must be remembered that the SC Order did not provide a blanket relief to the developers from SARFAESI, and it laid down some ground rules for it. Firstly, the applicability of RERA will be tested on the ground that whether such security interest was created by the financial institution prior to the introduction of RERA unless such transaction was fraudulent in nature. Secondly, the allottees themselves shall approach with such a complaint, showing infringement of their rights as allottees in the event the financial institution decided to enforce the security.

Another major impact that may be seen from the SC Order is that now financial institutions will be made to assume the role of the promoters instead of enforcing the secured property to settle its debt. While the rights of homebuyers need to be protected at the same time a secured interest created in favour of a lender should not be diluted and there has to be some sort of balancing act by the stakeholders. This creates a peculiar problem for financial institutions as they cannot be made liable or assume the defaults/latches that have already occurred in the project. While financial institutions may opt for other reliefs such as approaching the National Company Law Tribunal under Insolvency and Bankruptcy Code, 2016 and insist on taking additional securities that may not form part of the mortgaged project.

- CONCLUSION

For financial institutions, it may not be an ideal situation as the SC Order has put certain qualifiers in their exercise of rights under SARFAESI. It is crucial that all stakeholders' interests should be protected. Stakeholders will eventually be able to protect their interests, only if the project is completed. So, all measures taken will have to be towards completion, so that outstanding dues can be recovered, and possession be handed over. It is also important that the rights of a lender under SARFAESI should not be diluted as it may lead to reluctance in financing real estate projects and/or increase the cost of borrowing for developers. Such issues will eventually lead to an increase in project costs, which will have to be borne by homebuyers.

Footnotes

1 Civil Writ Petition No. 13688/2021 & 69 other connected writ petitions, passed on 14th December 2021

2 Petition for Special Leave to Appeal (C) Nos. 1861-1871/2022, passed on 14th February 2022

3 Writ Petition (C) No. 940/2017 & 40 other connected writ petitions, passed on 23rd July 2019

4 CR/255/2023, passed on 23rd January 2023

5 Section 13(4) of SARFAESI: In case the borrower fails to discharge his liability in full within the period specified in sub-section (2), the secured creditor may take recourse to one or more of the following measures to recover his secured debt, namely—

(a) take possession of the secured assets of the borrower including the right to transfer by way of lease, assignment or sale for realising the secured asset;

(b) take over the management of the business of the borrower including the right to transfer by way of lease, assignment or sale for realising the secured asset: Provided that the right to transfer by way of lease, assignment or sale shall be exercised only where the substantial part of the business of the borrower is held as security for the debt: Provided further that where the management of whole of the business or part of the business is severable, the secured creditor shall take over the management of such business of the borrower which is relatable to the security for the debt;

(c) appoint any person (hereafter referred to as the manager), to manage the secured assets the possession of which has been taken over by the secured creditor;

(d) require at any time by notice in writing, any person who has acquired any of the secured assets from the borrower and from whom any money is due or may become due to the borrower, to pay the secured creditor, so much of the money as is sufficient to pay the secured debt.

6 Supra

7 Section 2(zk) of RERA: "promoter" means—

(i) a person who constructs or causes to be constructed an independent building or a building consisting of apartments, or converts an existing building or a part thereof into apartments, for the purpose of selling all or some of the apartments to other persons and includes his assignees; or

(ii) a person who develops land into a project, whether or not the person also constructs structures on any of the plots, for the purpose of selling to other persons all or some of the plots in the said project, whether with or without structures thereon; or

(iii) any development authority or any other public body in respect of allottees of—

(a) buildings or apartments, as the case may be, constructed by such authority or body on lands owned by them or placed at their disposal by the Government; or (b) plots owned by such authority or body or placed at their disposal by the Government, for the purpose of selling all or some of the apartments or plots; or

(iv) an apex State level co-operative housing finance society and a primary co-operative housing society which constructs apartments or buildings for its Members or in respect of the allottees of such apartments or buildings; or

(v) any other person who acts himself as a builder, coloniser, contractor, developer, estate developer or by any other name or claims to be acting as the holder of a power of attorney from the owner of the land on which the building or apartment is constructed or plot is developed for sale; or

(vi) such other person who constructs any building or apartment for sale to the general public. Explanation—For the purposes of this clause, where the person who constructs or converts a building into apartments or develops a plot for sale and the person who sells apartments or plots are different person, both of them shall be deemed to be the promoters and shall be jointly liable as such for the functions and responsibilities specified under this Act or the rules and regulations made thereunder.

8 Supra

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.