A public consultation regarding the proposed levy order for the period spanning from January 1, 2024, to December 31, 2024, under the Broadcasting Act 2009 (as amended) (the "Act") commenced on Monday, 2 October 2023. Coimisiún na Meán (the "CNaM") has issued a Opens in new windowConsultation DocumentOpens in new window containing comprehensive information about the proposed levy order. The consultation period will run until 31 October 2023.

Background

Under Section 21 of the Act, the CNaM has the power to impose a levy order on:

- Providers of audio-visual media services;

- Providers of sound broadcasting services; and

- Providers of designated online services.

The levy will be required to fund the CNaM's functions in relation to these services.

Proposed Levy Models

The CNaM's initial view is that there should be four distinct levies addressing the following segments:

- TV broadcasters;

- Radio / Sound broadcasters;

- Video-On-Demand ("VOD") providers; and

- Designated online services, including Video Sharing Platforms ("VSPs").

1. Proposed Levy Approach for TV Broadcasters

The CNaM's initial stance is that it should preserve the current broadcasting levy structure for TV broadcasters in the 2024 levy order. The levy model for TV broadcasters utilises a regressive sliding scale, whereby the levy amount paid (expressed as a percentage of the total qualifying income) falls as the value of qualifying income rises. The levy percentage for each band of qualifying income is calculated via the following table in the Consultation Document, with "B" calculated to reach the estimated costs of regulation of that segment.

Levy Percentage by Qualifying Income (TV Broadcasters)

| BASE YEAR QUALIFYING INCOME | PERCENTAGE LEVY |

|---|---|

| €1 to €1,000,000 |

B %

|

| €1,000,001 to €10,000,000 |

(B-0.25) %

|

| €10,000,001 to €20,000,000 |

(B-0.50) %

|

| €20,000,001 to €45,000,000 |

(B-0.75) %

|

|

€45,000,001 and above

|

(B-1.75) % |

2. Proposed Levy Approach for Radio/Sound Broadcasters

The CNaM's initial stance is that it should preserve the current broadcasting levy structure for sound broadcasters in the 2024 Levy Order. The model for the radio / sound broadcaster levy would also utilise a sliding scale. The CNaM states that these bands would be calculated using the same approach as seen in respect of TV broadcasters, but that they would likely have different levy percentages due to the differing costs of regulation and qualifying income in the segment as a whole.

Levy Percentage by Qualifying Income (Radio/Sound Broadcasters)

| BASE YEAR QUALIFYING INCOME | PERCENTAGE LEVY |

|---|---|

|

€1 to €1,000,000

|

C %

|

|

€1,000,001 to €10,000,000

|

(C-0.25) %

|

|

€10,000,001 to €20,000,000

|

(C-0.50) %

|

|

€20,000,001 to €45,000,000

|

(C-0.75) %

|

| €45,000,001 and above | (C-1.75) % |

3. Proposed Levy Approach for Video-on-Demand Providers

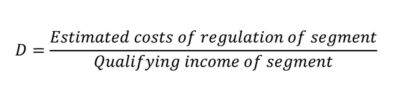

The CNaM's initial plan for the 2024 VOD levy suggests a fixed percentage charged to registered audio-visual on-demand media service providers, omitting the sliding scale used in TV and radio/sound broadcasting levies. This approach aims to maintain regulatory consistency, simplicity, and recognition of provider differences, although a banded approach is being considered for future years. The proposed levy would consider qualifying incomes of broadcasters and the CNaM's operating costs, determining the levy percentage ("D" below) based on regulation costs and segment income. This formula would be as follows:

4. Proposed Levy Approach for Providers of Designated Online Services

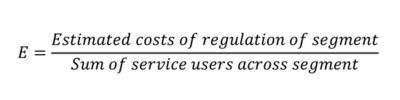

In 2024, the CNaM's preliminary plan is to levy designated online service providers, including VSPs, based on monthly active users. This approach suggests a fixed amount per monthly active user, mirroring the European Commission's supervisory fee for Very Large Online Platforms and Search Engines, for the sake of simplicity, predictability, and recognizing differences in provider scale and funding. The levy model aims to be cost-effective and proportionate, ensuring full cost recovery and aligning with expenses and working capital needs for regulatory functions. The charge per user ("E" below) will be determined by the estimated regulation costs for the segment and the total number of users across the segment. The formula would be as follows:

Other Key Points to Note

It is important to note the following:

- At present there is no information on how the CNaM will estimate its costs per service;

- The figures and levy methodologies used for the first time for this purpose may have wider consequences, as they may be carried across to other potential new levy regimes to fund EU/Irish content creation and other similar levies;

- The proposed levy, consistent with the existing BAI policy, excludes income from Section 71 contracts. The CNaM plans to replace fees for these contracts with a fixed levy equal to the fee, ensuring no change in payments by Section 71 contractors in 2024. This approach reflects differences in regulation and maintains consistency with Section 71 of the Act;

- The CNaM's initial view is that qualifying income and monthly active user metrics should be EU-wide;

- There is no information on how global providers are expected to allocate "qualifying income" to the EU or elsewhere. We note that consistency among providers is essential for the levy to be fair for all;

- The CNaM's initial stance is that metrics should be based on amounts known at the beginning of the levy period as opposed to estimates. Therefore the preliminary view of the CNaM is that a levy for TV providers, sound broadcasters and VOD providers should be based on audited qualifying income for 2022, and that the levy for online service providers should be based on monthly average customer numbers published on 17 August 2023;

- In 2024, the CNaM expects to receive exchequer funding in the form of a grant from the Minister for Tourism, Culture, Arts, the Gaeltacht, Sports and Media ("the Minister"). This grant will fund the discharge of the functions intended to be conferred on the CNaM in respect of its role as Ireland's Digital Services Coordinator ("DSC") under the EU Digital Services Act ("DSA") and as a competent authority under the Terrorism Content Online Regulation ("TCOR") only. The query arising from this is to whether less than the full costs of the DSA are to be covered by the levy proposal for that cohort;

- If the levy collected exceeds the costs of the CNaM's functions, the Act provides for refunds or for the surplus to be set against future levies;

- It is the initial view of the CNaM that the levy be charged on a per-service basis, so that each service within a segment is liable to the same levy, regardless of its ownership; and

- The initial position of CNaM is that designated services will be exempt from the levy if their turnover is below €500,000. This marks a departure from previous arrangements where providers with a turnover of less than €500,000 were required to pay a levy of €750. This adjustment aligns CNaM with the €500,000 levy threshold set by ComReg, as specified in section 30 of the Communications Regulation Act 2002 (as amended).

Takeaways

This document invites comments on the CNaM's proposals for a levy order in respect of the levy period from 1 January 2024 to 31 December 2024. The CNaM will consult again during the course of 2024 before making a levy order for 2025 and subsequent periods. Stakeholders should review the Consultation Document carefully and submit a response to the CNaM if they see fit.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.