The European Commission ("Commission") has published a https://ec.europa.eu/info/law/better-regulation/have-your-say/initiatives/13961-Report-on-the-Sustainable-Finance-Disclosure-Regulation/public-consultation_en public consultation and a https://finance.ec.europa.eu/regulation-and-supervision/consultations/finance-2023-sfdr-implementation_en targeted consultation relating to its review of the Sustainable Finance Disclosure Regulation ("SFDR"). This review of SFDR Level 1 had been flagged in a speech by Commissioner McGuinness late last year and is separate from the European Supervisory Authorities' ("ESAs") consultation on amendments to SFDR Level 2 (see our briefing note in relation to the ESAs' consultation here).

While the Commission indicates that it has not decided on any proposals as yet, the questions posed in the consultation demonstrate a clear direction of travel and portend significant changes to the SFDR regime. The key potential reforms of SFDR are:

- the introduction of sustainability disclosure requirements for all funds, including funds currently classified as Article 6 SFDR funds;

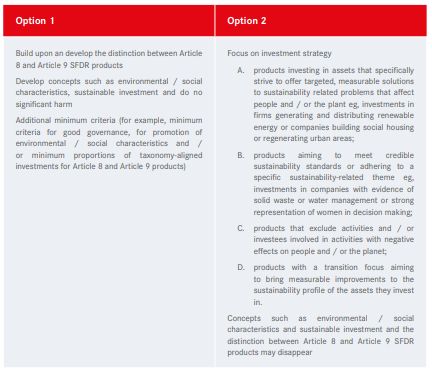

- the introduction of a new opt-in product labelling regime by either: (a) expanding on the requirements currently applicable to Article 8 and Article 9 SFDR funds, including the introduction of minimum sustainability requirements; or (b) introducing four entirely new product labels based on the investment strategy, which would cover impact and transition strategies. The second approach bears similarity with the UK approach under its Sustainability Disclosure Requirements ("SDR").

Format of the Consultations

Sections 1 and 2 are common to both the public and targeted consultation, with the targeted consultation adding two further sections and being aimed at national competent authorities, financial market participants ("FMPs"), investors and non-governmental organisations. The four sections included in the targeted consultation are as follows:

- Current requirements of the SFDR

- Interaction with other sustainable finance legislation

- Potential changes to the disclosure requirements for FMPs 4. Potential establishment of a categorisation system for financial products

The consultations include a series of statements about the SFDR or about potential future changes, inviting stakeholders to indicate whether they agree with the statements on a scale of 1 (not at all) to 5 (to a very large extent), as well as a small number of questions providing an opportunity to insert a narrative answer. The questions indicate that the Commission recognises that there are a number of issues with the current regime, which have been highlighted by industry to date, including a lack of clarity relating to the definition of key concepts, a lack of availability of reliable data to support the proper function of the principal adverse impacts ("PAI") regime, inconsistencies with related sustainable finance legislation and high implementation costs.

Uniform Sustainability Disclosures for All Funds

The Commission is considering requiring that all products (or, alternatively, products above a certain threshold based on AUM, or equivalent, or products intended solely for retail investors) be subject to uniform disclosure requirements, regardless of their sustainability-related claims. In the Commission's view, this would improve the comparability of products and address the fact that, currently, the regime places an additional burden on products that factor in sustainability considerations.

These uniform disclosures might include:

- taxonomy-related disclosures;

- engagement strategies;

- exclusions; and

- information about how ESG-related information is used in the investment process.

A New Product-Labelling Regime The Commission and the ESAs have taken every opportunity to reiterate that the SFDR is intended as a disclosure regime and not a product-labelling regime, despite market practice evolving to treat Article 8 and Article 9 funds as de facto product categories. The original intention behind the disclosure regime was to encompass as broad a range of products as possible, so that any sustainability claims had to be substantiated. However, the current market use of the SFDR as a labelling scheme potentially leads to risks of greenwashing.

The two options put forward by the Commission for a new voluntary product-labelling regime are set out in the table below.

The product labels at A, B and D above would appear to be closely aligned with the categories of Impact, Focus and Improvers under the UK SDR.

The Commission has sought feedback on whether products opting into the labelling regime should be subject to additional disclosure requirements, which could include taxonomy-related disclosures, engagement strategies, exclusions and information about how the criteria required to fall within a specific sustainability product category have been met. The Commission also asks whether third-party verification of satisfaction of the label's minimum criteria should be required.

Next Steps

In addition to the key potential reforms highlighted above, it seems likely that the PAI disclosure regime will be streamlined and there will be a stronger focus on product-level disclosures rather than entity-level disclosures, as the general usefulness of entity-level disclosures is questioned in the consultation. Views are also sought on whether transitional arrangements will need to be put in place.

The consultation closes on 15 December 2023. The Commission's review will continue into 2024 and it expects to issue proposals in Q2 2024

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.