1. SUMMARY

This article provides a regulatory overview of carbon pricing and trading in Indonesia following the issuance over the past year of 2 initial framework regulations: Presidential Regulation No. 98 of 2021 on Implementation of Carbon Pricing for the Purpose of Achieving Indonesia's Nationally Determined Contribution and the Control of Greenhouse Gas Emissions in National Development (PR 98/2021) and Ministry of Environment and Forestry Regulation No 21 of 2022 on the Guidelines for the Implementation of Carbon Pricing (MOEF 21/2022) which was issued as an implementing regulation of PR 98/2021.

MOEF 21/2022 is an extensive regulation structured around 12 chapters. The main measures are presented below and include:

- the requirements for domestic and international carbon trading;

- result-based payments;

- carbon tax and levies; and

- greenhouse gas Carbon Credits.

The two new regulations follow similar trends in other jurisdictions which are attempting to regulate their carbon markets and are integral to the Indonesian Government's efforts to transition its energy needs and achieving its Nationally Determined Contribution (NDC) of greenhouse gas emissions reduction target ahead of the first global NDC stocktake in 2023.

2. A YEAR OF REGULATORY DEVELOPMENTS

Through the issuance of PR 98/2021 and MOEF 21/2022, Indonesia is proposing to implement both the "cap and trade" and "cap and tax" mechanisms, whereby the Government will progressively introduce mandatory "emission caps" and a carbon tax for certain sectors/businesses to govern emission levels and enable carbon pricing.

MOEF 21/2022 also regulates other related measures such as (i) the stipulation of a greenhouse gas emissions cap (Emissions Cap) which will be applied across key sectors such as energy, transportation and industrial processes; and (ii) the certification of efforts in reducing greenhouse gas emissions. The Emission Cap is a key feature of the new regulatory regime which imposes a strict obligation for businesses to reduce their greenhouse gas emissions below a stipulated threshold. Businesses will be expected to come up with mitigants and solutions to comply with the Emission Cap, including participating in carbon trading.

Pursuant to MOEF 21/2022, the following sectors and sub-sectors will be subject to an emissions threshold:

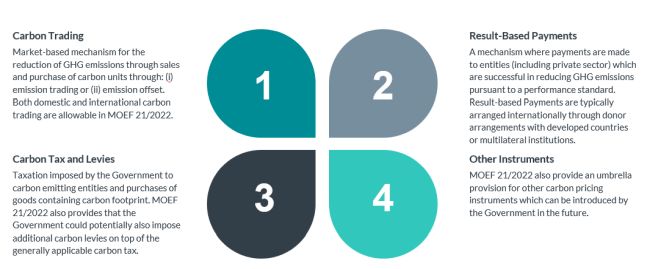

Carbon pricing instruments come in various forms, but in general, they require greenhouse gas emitters to pay for their emissions. MOEF 21/2022 regulates four possible carbon pricing instruments as follows:1

3. CARBON TRADING

Article 4 of MOEF 21/2022 provides that carbon trading can be conducted both onshore (in the domestic market of Indonesia) and offshore (in the international market) and may take place either through:

- the Indonesian carbon market; and/or

- direct trading between business entities.

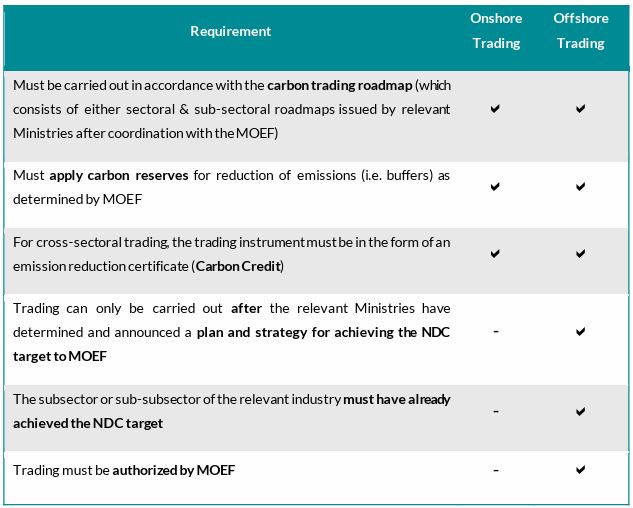

The following requirements apply for business entities participating in carbon trading:2

The key difference between domestic and international carbon trading lies with how credits are allocated to fulfilling Indonesia's NDC. International trading can, in certain circumstances, allow Carbon Credits to be transferred to another country and Indonesia to then be able to register a "corresponding adjustment" pursuant to art. 6 of the 2016 Paris Agreement Under the United Nations Framework Convention on Climate Change (Paris Agreement).

Effective carbon trading relies heavily on having a transparent and authenticated form of carbon credits. For onshore trading, MOEF 21/2022 provides that Carbon Credits (i.e. Emission Reduction Certificates) are the main type of carbon credit trading instrument to be recorded in the Indonesian carbon market. Carbon Credits are issued by the MOEF to business entities which have succeeded in reducing their emissions level below the stipulated threshold (for sectors with a determined maximum amount of emission) and/or baseline (for sectors without a determined maximum amount of emission).

Click here to read the PDF article.

Footnotes

1. Article 3(2) of MOEF 21/2022.

2. Article 4(2) of MOEF 21/2022.

Originally published 23 December 2022

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.