Ecuador has shown the world that it is open for investment by introducing a new legal entity, the Simplified Shares Company, or SAS (Sociedad de Acciones Simplificadas). Before diving into the details, let's take a deeper look at Ecuardor's economy.

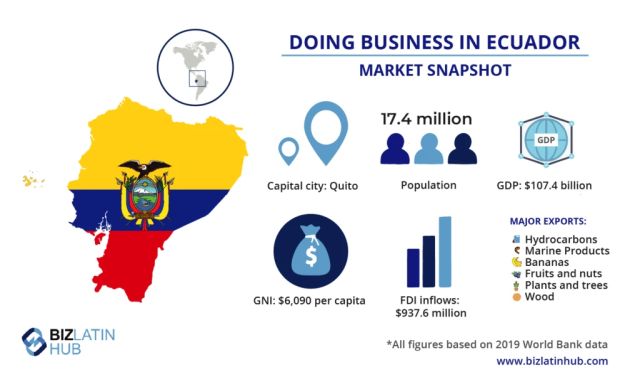

Ecuador is the eighth-largest economy in Latin America, with a gross domestic product (GDP) of $106 million in 2021 (all figures in USD). It's also one of the main recipients of foreign direct investment (FDI) in the region, with inflows of over $630 million that same year, a sharp decrease in 2020 which saw FDI numbers reach $1 billion!

Ecuador's capital Quito is seen as a startup hub in the region and offers skilled labor at competitive rates. Additionally, Ecuador is rich in hydrocarbon reserves, with oil drilling responsible for 40% of the nation's export income. The services sector has become a key source of employment for the economy.

Ecuador's capital Quito is seen as a startup hub in the region and offers skilled labor at competitive rates. Additionally, Ecuador is rich in hydrocarbon reserves, with oil drilling responsible for 40% of the nation's export income. The services sector has become a key source of employment for the economy.

The law also launched the National Council for Entrepreneurship and Innovation to support Ecuadorian commercial development, education, and culture.

The law also launched the National Council for Entrepreneurship and Innovation to support Ecuadorian commercial development, education, and culture.

The creation of SAS in Ecuador has important advantages

What are Simplified Stock Companies and how do you form a SAS in Ecuador?

A Simplified Stock Company (SAS) is a company where shareholders are only liable for the amount of money they invested in the company. Shareholders can choose to waive this limitation to insure with their own assets any operation of this type of entity.

It's important to mention that the SAS in Ecuador cannot be listed on the stock exchange. To form a SAS in Ecuador, you'll need to register private documents in a new Registry of Companies by the Superintendence of Companies. Additionally, SAS corporations in Ecuador don't have a minimum capital requirement.

This type of legal entity in Ecuador cannot carry out activities relating to the financial, stock market, insurance or any of the other industries that have special treatment under Ecuadorian law.

Market overview in Ecuador. SAS Ecuador.

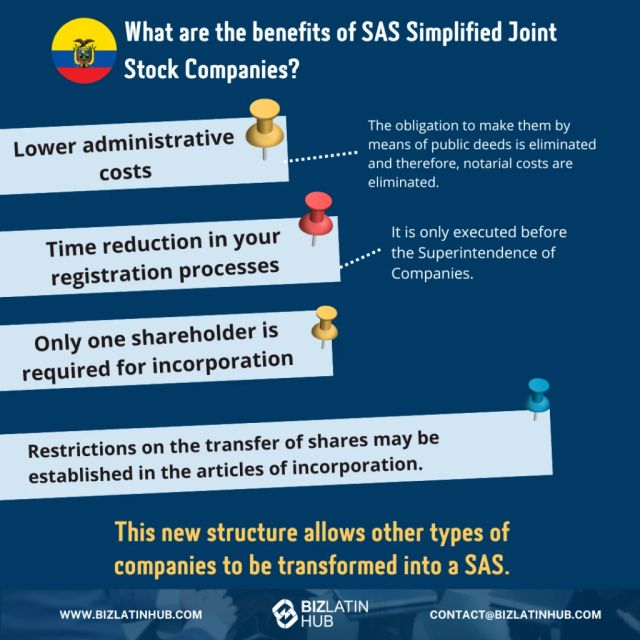

What are the benefits of a SAS Simplified Stock Companies?

The fist advantage of the SAS Simplified Stock Company is lower administrative costs. The SAS in Ecuador can be executed and implemented by means of private acts and documents. You don't need any public deeds and so, notarial costs are cut.

The second benefit is that the incorporation process and subsequent activities are much faster. You don't need to register this type of corporate act in the Commercial Registries and it is only executed with the Superintendency of Companies. This means business owners can form a SAS in Ecuador with reduced bureaucratic requirements and wait time.

Furthermore, unlike other corporate structures, when you incorporate a SAS in Ecuador, you only require a single shareholder. This adds simplicity and flexibility to management processes.

A fourth benefit of the SAS in Ecuador is that restrictions on the transfer of shares can be established in the incorporation statutes. Additionally, it can be established that the shares can give multiple votes. This helps to streamline the management of corporate governance for this type of entity.

A fourth benefit of the SAS in Ecuador is that restrictions on the transfer of shares can be established in the incorporation statutes. Additionally, it can be established that the shares can give multiple votes. This helps to streamline the management of corporate governance for this type of entity.

Dollarized countries in Latin America. SAS in Ecuador

Finally, this new structure allows other types of companies to turn into a SAS structure, unless they have a particular or special legal treatment. Consulting a local legal expert can help you understand how to make this transition for your company.

Originally published 28 March 2020 | Updated on: 27 July 2023

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.