Unlike in the past few years, there have certainly been some surprises sprung on taxpayers by the Minister in his Budget Speech. Although there is some relief for individuals in the form of adjustments of taxes on "earned" income and upward adjustments of the exemptions and rebates, the increased tax rates on local and foreign dividends and capital gains certainly came as a bolt out of the blue. Clearly the emphasis is on "soaking the rich".

A significant number of tax amendments were announced, many of them of a highly technical nature, but we have attempted to limit ourselves to matters which are likely to be of more general and widespread interest.

BIG SURPRISES

Capital gains tax

Capital gains are taxed at normal income tax rates, but only 25% of gains, in the case of individuals, and 50%, in the case of companies and trusts, were so taxed, giving effective rates of 10% (maximum), 14% and 20% respectively. The inclusion rate is now increased to 33.3% for individuals and 66.6% for companies and trusts. This results in the effective capital gains tax (CGT) rate for individuals, companies and trusts increasing to 13.3% (maximum), 18.6% and 26.7% respectively.

These changes will apply to disposals of assets from 1 March 2012.

Certain exemptions are increased, such as:

- The annual exemption from R20 000 to R30 000, and

- The primary residence exemption from R1,5 million to R2 million.

Further details are contained in the tables below.

Dividends tax (and other withholding taxes)

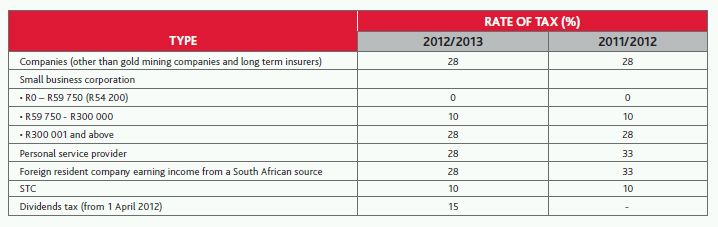

Dividends tax, which becomes effective on 1 April 2012, was enacted with a rate of 10%, which was the same rate applicable to secondary tax on companies (STC). Similarly, the withholding tax on interest payable to non-residents, which commences on 1 January 2013, has been set at 10%.

The dividends tax rate now increases, with effect from 1 April 2012, to 15% (though it is capable of being reduced under a double tax agreement). It has also been announced that the withholding tax on interest will be at the rate of 15%. Moreover, the withholding tax on royalties payable to non-residents, which is currently at the rate of 12%, will also increase to 15% (again, subject to reduction under a relevant double tax agreement).

Passive holding company regime to be removed

As a result of the 15% withholding tax rate on dividends, to be introduced from 1 April 2012, the need for the introduction of a passive holding company regime, to prevent potential arbitrage between tax rates, is deemed no longer required. As a result, this proposed regime will be removed. This however, does provide taxpayers with the opportunity of using companies to hold their investment portfolios in order to postpone the payment of the dividends tax.

STC credits

Originally, the STC credits existing at 31 March 2012, would have been able to be offset against the dividends tax for a period of five years, or until they were exhausted, whichever occurred first. The five-year period is reduced to three years. The rationale given is that the higher rate of dividends tax will utilise the credits quicker (which is logical). The other rationalisation is that the implementation of dividends tax was delayed (which is illogical, because STC credits continued to build up during that period).

Foreign dividends

Last year the method of taxing foreign dividends was amended so that, with effect from 1 March 2012 (for natural persons) and 1 April 2012 (for others), taxable foreign dividends were to be taxed at the effective rate of 10%, which corresponded to the rate applicable to South African dividends.

Not surprisingly, the effective rate will now increase to 15%.

Non-resident companies

Whereas resident companies are subject to tax at 28%, plus STC of 10% when the profits are distributed, giving rise to a combined effective rate of 34.5%, non-resident companies are exempt from STC. As a form of compensation, the latters' profits are taxed at 33% rather than 28%.

With the demise of STC, this differential is being removed, so that non-resident companies will now also be taxed at 28%.

This is somewhat strange given that, unlike in some other countries, there is no further tax payable when branch profits are remitted abroad. Absent any relief under a double tax agreement, a foreign investor holding shares in a South African company will, between the corporate tax of 28% and the dividends tax of 15%, suffer a combined effective rate of 38.8%. A branch of a foreign company will pay only 28%. The reduction is therefore somewhat surprising (and one can expect foreign investors to prefer operating through branches in the future).

MATTERS AFFECTING COMPANIES

Interest deductibility

A major modernisation step has been taken by the announcement that interest will be allowed as a deduction on debt used to acquire shares in another company where at least 70% of the target company is acquired. While the general principle is that interest is not allowable on debt to acquire shares, because the shares produce tax-free income, acquiring a subsidiary ought to have been viewed in a different light, because, economically, one was merely acquiring a business in a different form. In the past it was necessary to enter into complex re-structuring and debt push-down structures so that, effectively, the interest could be allowed.

This announcement is most welcome. It is a pity, however, that the threshold of 70% (being the threshold where a company forms part of a group for tax purposes) has been adopted, whereas other areas of the Income Tax Act (the Act) generally recognise 10% as a business-related threshold. Given that often a new company acquires the shares, as opposed to an existing operating company, it is not clear whether it will be possible for that new company to surrender its deduction to the target company, to enable the latter to claim it. Nothing was stated in this regard.

Last year certain restrictions were enacted in relation to arrangements where debt was used to fund businesses, particularly in relation to the intra-group transaction under section 45 of the Act and liquidation distributions under section 47 of the Act. These restrictions were to prevent interest being claimed on excessive amounts of debt. These restrictions will be extended to debt used to acquire shares as described above.

Limitation of excessive debt

In addition to the above, to prevent excessive gearing arising from acquisitions, including in private equity transactions, it is intended to enact a revised set of reclassification rules of instruments to deem certain debt to be equivalent to shares, thereby preventing deductibility of the interest. Consideration will also be given to introducing caps on interest deductions, whereby the amount of interest will be limited to a percentage of EBITDA (similar rules exist in certain European countries).

Debt cancellations and restructurings

The general rule is that a discharge of a liability at less than face value, including by way of waiver or forgiveness, triggers a capital gain in the debtor's hands, though exemptions generally apply for such reductions where both the debtor and creditor are members of a group.

This rule can result in difficulties where taxpayers in financial distress seek to reduce or restructure their debt. It has been announced that the goal is to create a simplified regime to determine the tax impact on the debtor, and to eliminate adverse tax consequences when the debt relief merely restores the debtor to solvency. Specific rules will also be required where creditors agree to accept shares in discharge of the debt.

Share issue mismatches

There appears to be a perception that share issues are being used to shift value to new shareholders without the existing shareholders paying full tax. It is proposed that if the consideration received by a company for the issue of shares exceeds the value of the shares issued, the excess will be subject to tax.

MATTERS AFFECTING INDIVIDUALS

Medical aid

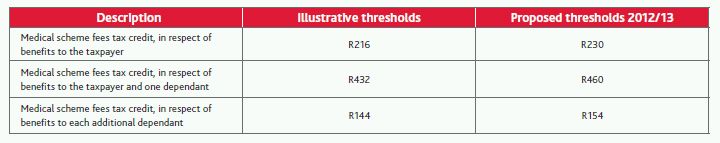

In line with the announcement made in 2011, the current system of income tax deductions for medical scheme contributions by persons under 65 years will be converted into a system of medical tax credits from 1 March 2012. The tax credits will be fixed amounts which are to be offset against the tax payable by an individual.

The revised rates for medical scheme contributions are set out in the table below.

In addition, medical scheme contributions plus out-of-pocket expenses in excess of four times the allowable tax credits may also be claimed as a deduction against taxable income. However, only the calculated amount in excess of 7.5% of taxable income will be allowed. As from 1 March 2014, these additional medical deductions will also be converted into tax credits at a rate of 25%.

For taxpayers with disabilities, disabled dependants or those older than 65 years, the current system of a 100% deduction of medical scheme contributions, including out-of-pocket expenses, will remain until 1 March 2014, whereafter the tax credits system will apply to all taxpayers. Additional medical scheme contributions may be converted into a tax credit of 33.3%. However, only the amounts in excess of three times the total allowable tax credits plus out-of-pocket expenses will be allowed.

Retirement reforms

It is proposed that from 1 March 2014, contributions by employees to pension, provident and retirement funds will be tax deductible by individual employees (currently contributions to provident funds are not deductible). The rate of deduction, as well as the annual limit, will depend on whether the individual is below or above 45 years of age. For persons younger than 45 years, a deduction rate of 22.5% of the higher of employment or taxable income, with an annual deduction limit of R250 000, is proposed. Persons 45 years and older will be able to deduct their contributions at the rate of 27.5% of employment income or taxable income, whichever is the higher. The annual limit for these individuals will be set at R300 000.

A minimum monetary threshold of R20 000 will also apply in order to allow low-income earners to contribute in excess of the prescribed percentages.

Provided the (non-deductible) amounts in excess of the thresholds are taken either as part of the lump sum or as annuity income on retirement, they will be exempt from income tax.

Savings

In an attempt to get South Africans to save more, an alternative to the current tax-free interest-income caps will be investigated. The alternative proposal entails the introduction of tax-preferred savings and investment vehicles, of which the returns, such as interest, capital gains and dividends, as well as withdrawals, will be exempt. High net-worth individuals will be precluded from benefiting disproportionately as the aggregate annual contributions per taxpayer could be limited to R30 000, with a lifetime limit of R500 000. It is stated that a discussion document will be published in May 2012 with Government planning to introducethese savings and investment vehicles by April 2014. It is however, not clear at this point in time whether the vehicles will only be Government run.

Employee share schemes

In an ongoing effort to eliminate perceived loopholes and possible double taxation, a review of the various types of employee share schemes is proposed over a two year period. This review will consider the interrelationship between employer deductions and employee income from these schemes, as well as the possibility of merging the regime for low income earners into a single employee share scheme regime.

Fringe benefit valuation

Employers are often obliged to use a prescribed formula to determine the taxable fringe benefit value in the hands of an employee. This would apply even if the employer could ascertain the actual cost of providing the benefit to that employee, such as where rented vehicles are provided to employees as "company vehicles". It is proposed that employers be allowed to use such actual costs to determine the value of the fringe benefits provided in these circumstances.

INTERNATIONAL ASPECTS

Dual resident companies

South Africa taxes the profits of foreign subsidiaries in the South African shareholder's hands under the controlled foreign company rules, unless the subsidiary (as a general rule) has a foreign business establishment outside South Africa. On the other hand, if the South African holding company exercises significant management control over the subsidiary's affairs – which is often the case with subsidiaries in Africa, where local skills are in short supply – the risk is run that the foreign subsidiary will be treated as being resident in South Africa and liable to pay tax here.

It is proposed that the dual-residence status be removed if the tax in the foreign country is similar to the tax otherwise payable in South Africa.

It is noteworthy that, having abandoned the source or territorial principle in favour of a residence or worldwide basis of taxation in 2001, more and more our system is effectively again becoming a source-based system, with only trading profits from a South African source effectively being taxed here.

Loans to foreign subsidiaries

Loans are often made in lieu of share capital, but effectively are fixed capital. If interest is not charged, interest could be imputed to the holding company/lender in South Africa under the transfer pricing rules. It is proposed that these loans be treated as shares, which will avoid this problem.

Fund management

The activities of South African-based fund managers of foreign investment funds could render those funds liable to tax here, on the basis that they become resident here because effective management is in South Africa. This discourages fund managers from continuing to operate here and has, in some instances, resulted in their relocation to other jurisdictions. In line with exemptions granted in certain other countries (for example, the UK) it is proposed that a carve-out be created under the residence rules for foreign investment funds.

Foreign group reorganisations

Following upon the extension of certain of the group reorganisation rules to foreign groups last year, it is proposed that section 45 of the Act, dealing with intra-group transactions, will also become available.

OTHER NOTEWORTHY PROPOSALS

Without going into detail, the following are some proposed changes, which will not necessarily be implemented in the current year:

- The treatment of property loan stock companies will be placed on a par with property unit trusts, with rental income effectively being passed through to the unitholders. Presumably formal REIT legislation will be passed.

- As part of the incentives in relation to special economic zones, a reduction in the company income tax rate for businesses within selective zones will be considered, as well as an additional deduction for the employment of workers earning below a pre-determined threshold.

- Following the unsuccessful attempt to amend the Act last year to deal with the tax effect of contingent liabilities (such as provisions for leave pay) on the sale of a business, it is intended that interpretative guidance will instead be given later this year.

- Further amendments to the Act are required in light of the introduction of the new Companies Act, especially in the case of reorganisations (for example, the Companies Act allows for mergers of companies but there are no corresponding tax rules). Generally, a complete review of the corporate reorganisation rules in the Act will be undertaken.

- Consideration is being given to expand the range of instruments that will be taxed on a mark-to-market basis, so as to align tax treatment with GAAP. The revised system will be subject to explicit approval from SARS.

- The method of taxing insurance companies, both long-term and short-term, is to be revised, with amendments in respect of the latter to be passed this year.

- In a change to the 2011 proposal, gamblers will no longer be taxed on their winnings in excess of R25 000. However, casino and gambling operators will now bear the burden of a national gambling tax from 1 April 2013. This tax will be an additional 1% national levy on a uniform provincial gambling tax base, with a similar tax base to be used for the national lottery.

As mentioned above, there are a number of other announcements made, but we confine ourselves to those of more widespread interest.

CHANGES TO TAX RATES AND THRESHOLDS

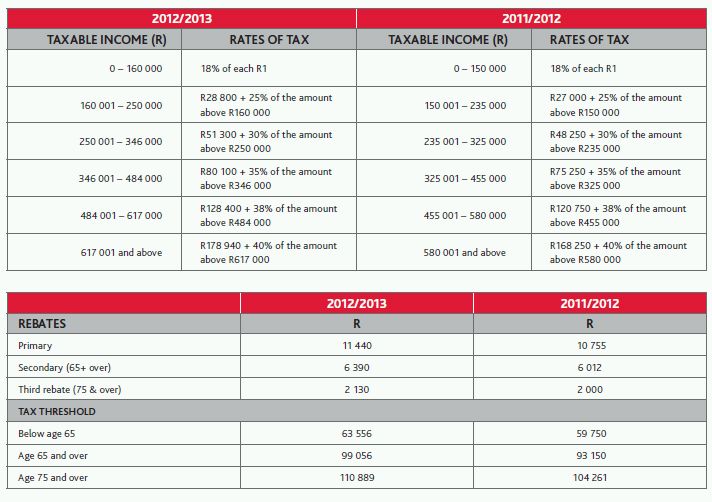

Individuals

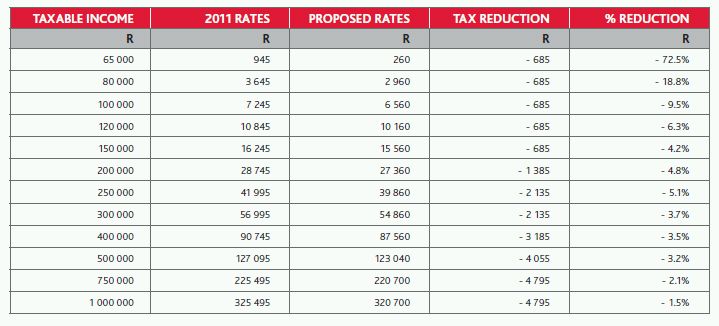

Relief will be granted by adjustments to the personal income tax table as follows:

The relief, insofar as it applies to individuals younger than 65 years, is illustrated in the following comparative table:

Capital gains tax

Capital gains tax inclusion rates for individuals and special trusts have been increased by 8.3 percentage points to 33.3%, and the rate for other persons has been increased by 16.6 percentage points to 66.6%. The changes to the effective tax rates are set out in the table below.

Proposed effective capital gains tax rates

Proposed capital gains exemptions

Corporate income tax rates

Income tax – Companies

For the financial years ending on any date between 1 April and the following 31 March, the following rates of tax will apply:

Tax regime for very small businesses

For the financial years ending on any date between 1 April 2012 and 31 March 2013, the following progressive tax scale will apply to registered micro businesses:

Tax free portion of interest and foreign dividends

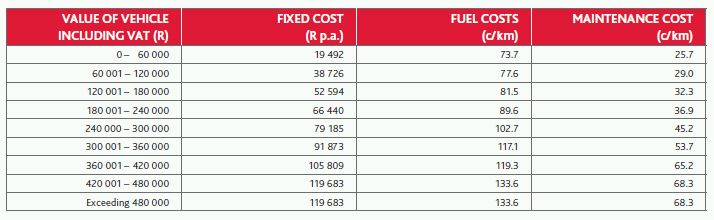

TRAVEL ALLOWANCE

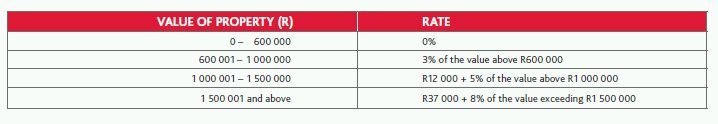

TRANSFER DUTY

The transfer duty table, which applies to all types of purchasers under purchase agreements concluded on or after 23 February 2011, is as follows:

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.