Overview

ENS, Taxand South Africa

In line with the trend in most developing countries, transfer pricing has in the last years become a key focus area for the South African Revenue Service ("SARS"). ENS' transfer pricing team has, however, been involved in the area of transfer pricing since the initial introduction of the transfer pricing rules in South Africa in 1995.

ENS' transfer pricing team has extensive experience in all areas of transfer pricing, inlcuding transfer pricing advisory (i.e., detailed value chain analyses, characterisation of entities, economic analyses and drafting of transfer pricing policies, also taking into account areas such as corporate tax, indirect taxes and customs, intellectual property law and exchange controls), transfer pricing documentation, and transfer pricing dispute resolution (i.e., assisting clients in respect of their interactions with SARS and other tax authorities, from the initial risk assessment process to potential litigation).

General : Transfer Pricing Framework

Section 31 of the Income Tax Act No.58 of 1962 ("ITA") contains the main legislative provisions relating to the South African transfer pricing rules.

The South African transfer pricing rules will apply, broadly speaking, to any transaction, operation, scheme, agreement or understanding where:

- that transaction constitutes an "affected transaction" as defined; and

- results or will result in any tax benefit being derived by a person that is a party to the affected transaction.

The term "affected transaction" is defined in section 31(1) of the ITA and includes, inter alia, any transaction, operation, scheme, agreement or understanding which has been directly or indirectly entered into or effected between or for the benefit of either or both, inter alia, a resident and a non-resident which are connected persons or associated enterprises in respect to each other and where any of the terms or conditions agreed upon are not of an arm's length nature.

Section 31 of the ITA does not apply to transactions between a South African permanent establishment and its nonresident head office or vice versa. Instead, the transfer pricing principles find application through the applicable double taxation agreement in that the SARS follows the OECD's guidance on the attribution of profits to a permanent establishment. On this basis, SARS will apply the arm's length principles to determine the arm's length attribution of profits between the permanent establishment and its head-office.

Where any non-arm's length term or condition of an affected transaction results or will result in any tax benefit being derived by a person that is party to that affected transaction, section 31(2) of the ITA places an obligation on each party to the affected transaction which derives a tax benefit, to calculate its taxable income or tax payable as if that transaction, operation, scheme, agreement or understanding had been entered into on the terms and conditions that would have existed, had those persons been independent persons dealing at arm's length.

Provision is also made for a secondary adjustment on the basis that any "adjustment amount" (i.e. the difference between the tax payable calculated in accordance with the arm's length principle and otherwise) will, in the case of an affected transaction between a resident company and inter alia, any other person that is not a resident, be deemed to be a dividend in specie paid by the resident company to that other person. In the case of an affected transaction between a resident individual and inter alia, any other person that is not a resident, the adjustment amount is deemed to be a donation made by that resident to that other person.

Accepted Transfer Pricing Methodologies

Although South Africa is not a member country of the OECD, it became one of five Key Partners (along with Brazil, China, India and Indonesia) to the OECD in 2007. South Africa is also a member of the OECD Base Erosion and Profit Shifting "BEPS" Committee.

South Africa closely follows the guidance contained in the OECD Transfer Pricing Guidelines for Multinational Enterprises and Tax Administrations "OECD Guidelines" in respect of transfer pricing matters in the absence of specific South African guidance and SARS also endorses the standard OECD transfer pricing methods.

As a general rule, the most reliable method will be the one that requires fewer and more reliable adjustments to be made. Taxpayers will not be required to undertake an intricate analysis of all the methodologies, but should have a sound basis for using the selected methodology.

Transfer Pricing Documentation Requirements

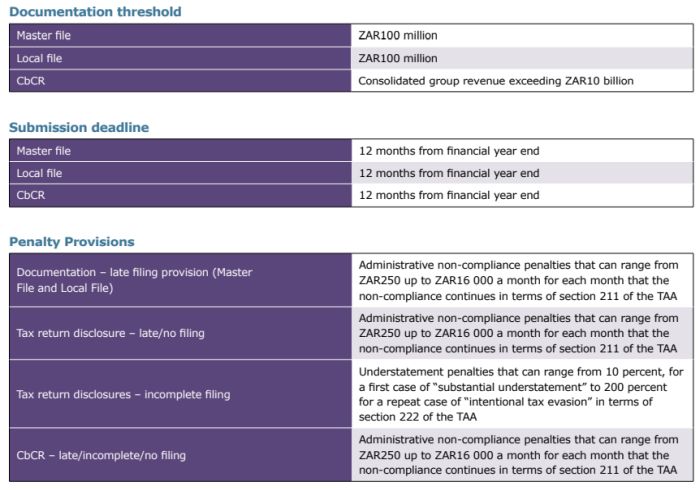

South Africa implemented the OECD's "three-tiered" approach to transfer pricing documentation, consisting of a country-bycountry report "CbCR", a master file and local file.

In terms of a public notice published by SARS, a Reporting Entity, as defined in the context of CbCR, that is a resident, will be required to submit information relating to all three tiers of documentation (i.e. CbCR , master file and local file).

In addition, a person, that is a resident, whose aggregate potentially affected transactions (essentially crossborder transactions with a connected person) for the year of assessment exceed or are reasonably expected to exceed ZAR100 million, will be required to submit the information relating to:

- the master file, where the ultimate holding company (the ultimate holding company is defined as a resident person which consolidates the taxpayer for accounting purposes, or would be required to do so if it were listed) in respect of the Group is a resident, or where a master file that substantially conforms with Annex I to Chapter V of the OECD Guidelines is prepared by any other entity within the Group; and

- the local file.

The necessary returns must be submitted within 12 months of the end of the taxpayer's financial year.

In addition to the submission of transfer pricing returns, South Africa has additional record keeping requirements specific to transfer pricing "South African Record Keeping Requirements"

The South African Record Keeping Requirements provide for two levels of record keeping:

- Records in respect of structure and operations – applicable to taxpayers whose potentially affected transactions for a year of assessment exceed, or are reasonably expected to exceed ZAR100 million in aggregate.

- Records in respect of transactions – applicable to a taxpayer who has entered into a potentially affected transaction where such transaction exceeds or is reasonably expected to exceed ZAR5 million in value.

Taxpayers which do not meet the ZAR100 million threshold are nevertheless required to keep such records as will allow them to ensure, and allow SARS to be satisfied, that their potentially affected transactions were concluded at arm's length.

These records are not intended to be submitted as a matter of course but are required to be retained in case of an audit.

Independent of whether a taxpayer has met the above mentioned ZAR100 million threshold, the corporate income tax return further requires the disclosure of certain transfer pricing-related information. In particular, taxpayers are required to disclose whether they have entered into any potentially affected transactions during the year of assessment. Taxpayers which have entered into such transactions are further required to answer whether they have prepared documentation which supports the arm's length nature of such transactions. According to the SARS Comprehensive Guide to the Income Tax Return for Companies, taxpayers answering this question in the affirmative must have such documentation available for immediate submission to SARS, if requested.

Local Jurisdiction Benchmarks

South Africa follows the guidance in the OECD Guidelines to determine an arm's length remuneration.

Where it is possible to locate comparable uncontrolled transactions, the CUP method is the most direct and reliable way to apply the arm's length principle and consequently, in such cases, the CUP method is preferable over all other methods. SARS accepts both internal and external comparables.

Information on South African companies is only readily available in the form of published financial accounts of public companies. More detailed information on public companies and information on private companies is generally not publicly available. South African comparables are consequently not easily available.

Accordingly, SARS has stated (in its Practice Note 7 which provides guidance on the application of the transfer pricing rules in South Africa), that it accepts the use of foreign financial databases but may require that adjustments to the data are carried through for use in the South African market. While in the past SARS was relying heavily on European companies for comparability, its approach has recently been widened to include other geographic areas, depending on the specific circumstances of the transaction and the industry in which the tested party operates.

Although SARS accepts both gross margin and net margin based benchmarks, SARS has become increasingly critical of taxpayers benchmarks and will critically review the search strategy as well as the final set of comparative companies.

Advance Pricing Agreement "APA"/Bilateral Advance Pricing Agreement "BAPA" Overview

It is not currently possible to obtain an advance pricing agreement ("APA") in South Africa.

SARS has, however, published draft legislation and a proposed model ("APA Framework") for establishing an APA programme in South Africa in the Draft Tax Administration Laws Amendment Bill, 2023 released on 31 July 2023.

Key features of the APA Framework in its current format include, inter alia:

- the scope of APAs is limited to affected transactions as defined in section 31 of the ITA and does not include, for example, transactions between a South African permanent establishment and its non-resident head office or vice versa;

- It is intended that the APA programme will only apply to affected transactions of a complex nature and above a minimum value, still to be determined;

- The APA programme covers both the determination of the most appropriate transfer pricing method and the arm's length price and all OECD accepted methods of determining the price may be used;

- Only bilateral APAs are currently provided for and there is no indication whether unilateral or multilateral APAs will be considered in the South African context;

- The maximum period of time for the application of an APA is five (5) years with an option to extend for a further three (3) years provided that the facts and circumstances have not changed materially from the original application for an APA;

- The APA holder will have to prepare and submit and annual compliance report to SARS.

Fees are envisaged for all the steps in the process but are still to be determined by SARS by way of public notice.

Transfer Pricing Audits

A small specialist unit within SARS conducts transfer pricing audits. Although SARS is committed to building the capacity of this unit, transfer pricing audits typically take a long time to finalise.

Transfer pricing audits are often triggered by taxpayers' responses to the transfer pricing specific questions included in the Income Tax Return for Companies.

SARS's approach typically starts with a detailed functional analysis, including functional analysis interviews.

Key focus areas for transfer pricing audits include, inter alia, both inbound and outbound distribution arrangements, as well as transfer pricing models that include a limited risk entity, such as contract manufacturing and limited risk distributor arrangements.

SARS selects taxpayers for audit from all industries in South Africa, but appears to focus on the commodities, financial services, retail and automotive sectors.

Transfer Pricing Penalties

In addition to the primary and secondary adjustment, where the application of non-arm's length terms has resulted in any prejudice to SARS or the fiscus, the taxpayer may be liable for understatement penalties in terms of section 222 of the TAA.

Understatement penalties are determined as a percentage of the difference between the understated amount of tax and the amount that should properly have been chargeable to tax. The percentage depends on the "behaviour" involved in the understatement and ranges between 10 percent, for a first case of "substantial understatement" to 200 percent for a repeat case of "intentional tax evasion".

In terms of sections 89bis and 89quat of the ITA, interest is payable on underpaid amounts of tax at a rate which is prescribed from time to time.

South African taxpayers with an obligation to file the CbC report and/or a master and/or local file to SARS, that fail to comply, could also be subject to so-called "administrative noncompliance penalties".

Administrative non-compliance penalties comprise fixed amount penalties as well as percentage-based penalties as per sections 210(1) and 211 of the TAA. The penalty amount that will be charged depends on a taxpayer's taxable income and can range from ZAR250 up to ZAR16 000 a month for each month that the non-compliance continues.

Local Hot Topics and Recent Updates

The recent publication by SARS of the proposed APA Framework has been welcomed by taxpayers and tax professionals alike as a big step towards enhanced tax certainty in South Africa. However, the actual implementation date is still uncertain, and success of such a regime will to a large degree depend on question whether SARS will be able to build up sufficient capacity in the APA unit.

In January 2023, SARS published a final version of an interpretation note to provide guidance on the transfer pricing aspects of intra-group financing arrangements ("IN127"). IN127 is largely based on the latest guidance of the OECD included in Chapter X of the OECD Guidelines.

As a result, we expect an increased focus from SARS on intragroup finance arrangements and, in particular, inbound loans.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.