1. Introduction

On May 7, 2021, the Turkish Competition Authority ("TCA") released an interim report on its sector inquiry on e-commerce platforms. Setting out as its objectives the need to safeguard the high value generated for consumers by e-commerce platforms, the report endeavours to detect potential anticompetitive threats and envisage tools and mechanisms to combat undesirable behaviour in this relatively nascent market. The results of the inquiry yield valuable insights into the state of the Turkish e-commerce market through a law and economics perspective, along with the identification of key players, competitively dubious business practices, and a three-pronged approach to strengthen the Turkish legal landscape against the challenges brought about by the digitalisation of shopping.

2. Market characteristics

The available statistics and findings make it possible to deduce the overall structure of the market. Accordingly, one can identify Trendyol as a rising star, with the latter capturing around 40% of the overall market; followed by Hepsiburada as the runner-up, with N11 and GittiGidiyor as adamant followers. The TCA also notes the case of Amazon. An e-commerce giant, Amazon nevertheless has struggled to penetrate Turkish markets since its entry in 2018, which leads the Authority to concede that global might may not always guarantee local power.

The report also entails interesting insights into Turkish consumers' behaviour. For instance, consumers overwhelmingly use mobile devices to shop online (83,6%). Furthermore, 79,6% of those opting for mobile devices choose applications instead of websites. Moreover, almost half of the consumers surveyed indicated that they only have a single online shopping app installed on their phones. This group of statistics highlights the importance of the app economy, where the installation of an app is an important threshold to obtain a competitive advantage. Lastly, a point of interest pertains to multi-homing (or lack thereof). Whereas 50% of consumers surveyed utilise only one e-commerce app, the figure is drastically lower for business users, hovering around 17%. The survey results indicate that business users utilise multiple platforms for their selling activities to reduce dependency and maximise visibility. Nevertheless, the stickiness of platforms for consumers and the latter's 'inertia' is liable to facilitate tipping on the consumer-side, with consumers eventually dragging business users with them.

3. Competitive concerns

TCA groups practices liable to contravene competition laws into three categories: inter-platform, intra-platform, and problems directly related to consumers. Concerns surrounding inter-platform competition are dominated by Most-Favoured-Customer ("MFC") provisions, which are further grouped into wide and narrow clauses. TCA asserts that wide MFCs are particularly pernicious as they can lead to multiple theories of harm, such as limiting the (already constrained) entries into the market and facilitating the exits from the market. These clauses can also create a conducive environment for collusion and directly lower consumer welfare in the form of higher prices. They also discourage platforms from competing on commission fees per sale. Therefore, TCA makes a strong case for banning wide-MFCs and attests that efficiency defences will probably fail to compensate the damages inflicted on competition. For narrow MFCs, an effects-based analysis will be necessary.

Intra-platform competition is plagued by discrimination and unfair commercial practices. Since online marketplaces effectively dictate the conditions of competition in their platforms, conflicts of interest are rampant. They can incentivise platform owners to engage in discriminatory behaviour towards their customers, especially if they also act as sellers in their own market. The report draws particular attention to "Buy Boxes", a practice first employed by Amazon and which was subsequently propagated to other platforms. The programming of the algorithm deciding which products will be placed into such boxes can contain self-preferencing tools, which can give rise to competition concerns. Another highlight is with regard to data, as TCA explains that the amount of data gathered from the activities of business users can yield competitively sensitive information which can be used in favour of the platform, for example to locate potentially lucrative business areas to which the platform can then enter. Data is also analysed regarding its role in potentially exploitative behaviour employed directly against consumers, such as through excessive data collection and targeted advertising.

4. Proposed remedies

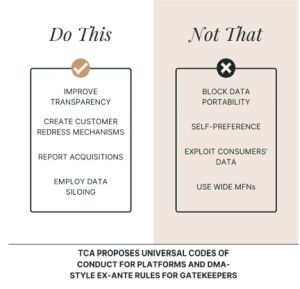

TCA offers a three-pronged approach to augment the law applicable to online marketplaces. All three reflect a considerable degree of inspiration derived from the recent initiatives in the EU and the UK. The first mechanism proposes to amend the secondary legislation through the introduction of new guidance documents. For instance, TCA looks into the feasibility, in the short term, of drafting guidelines for excessive data collection and the latter's relationship with the law on abuses of dominance. Secondly, TCA will scrutinise the possibility to develop codes of conduct applicable symmetrically, which will place transparency and clarity obligations on players across the market. Such a measure is reminiscent of both the Platform-to-Business Regulation in the EU and the recent initiatives undertaken in the UK as regards the Digital Markets Unit. Lastly, TCA will investigate avenues through which an ex-ante regulation built to tame the power of the largest platforms ("gatekeepers") can be built. The proposal in the report, albeit preliminary, is very similar to what the European Commission published last December. In particular, TCA adopts a number of obligations ("do's and don'ts") from Article 6 of the Digital Markets Act, such as the necessity to create "data silos". However, the details behind the procedure to designate undertakings as gatekeepers are unclear at this stage.

5. Conclusion

TCA's long-awaited report on Turkish e-commerce markets forms a significant document with valuable insights into the latter's current state-of-play, and yields important insights as to how the market and its players can be expected to grow, behave, and compete in the upcoming years. The report also doubles as the sketch of the competitive pressures surrounding an emerging sector in an emerging economy. It is reasonable to argue that the Turkish e-commerce market will be a particularly interesting arena for competition enforcement. As the legal landscape is poised to be largely aligned with its European counterparts, the younger and relatively underdeveloped nature of the market is sure to provide practitioners, academics, and competition enthusiasts with plenty of food for thought.

TCA will be accepting inputs from industry stakeholders who wish to comment on the report until July 9, 2021.

The authors thank Selçukhan Ünekbaş for his contributions to the writing of this article.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.