In Turkey, the fast-moving consumer goods ("FMCG") retail sector frequently finds itself at the focus of political and economic debates shaped by price increases. Thus, the Turkish Competition Authority ("TCA") frequently monitors the market dynamics and competitive framework of the FMCG sector.

The FMCG sector has been under the spotlight of the TCA since the Covid19 pandemic with hub-and-spoke cartel investigations1. Indeed, in 2021, the TCA found five grocery retailers, namely BIM, CarrefourSA, Migros, Sok, and A101, and their common cooking oil supplier Savola liable for the hub-and-spoke cartel and imposed a record-breaking administrative fine2. Afterward, at the end of 2022, the TCA made its second hub-and-spoke cartel decision concerning the same grocery retailers and their common suppliers, namely Coca-Cola, Doğanay, Düzey, Eti, Frito-Lay, GlaxoSmithKline, Haribo, Pasifik, Pepsi, Red Bull, Şölen Çikolata, and Uno, and found that these undertakings engaged in hub-and-spoke cartel arrangements3. However, the reasoned decision has not been published yet.

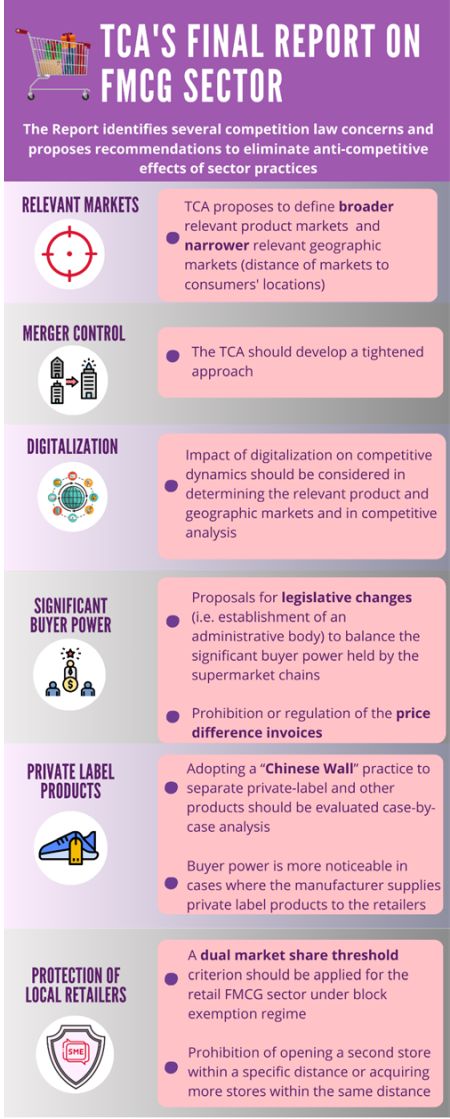

In this vein, the TCA has been conducting a new sector inquiry concerning FMCG retail sector, further to the former inquiry completed in 2012. After almost a 4-year intensive work, on February 5th, 2021, the TCA first published its preliminary FMCG sector inquiry report (the "Preliminary Report") on its official website. After that, while the Final Report was expected in the competition law and FMCG circles, the TCA published its final FMCG sector inquiry report ("Final Report") on 30th March.

Before delving into the details, we should stress that the Final Report adopts an approach that concentrates on the evolving structure of the FMCG sector. And it doesn't provide any clue on how grocery retailers compete, which has been a hot topic in the resounding hub-and-spoke decisions.

What does the Final Report Whisper?

Organized Channel Surpassed the Traditional Channel: The Preliminary Report provided that although the traditional channel, which consists of local groceries and small/local markets, continues to be relatively popular in Turkey, there has been a rapid shift towards organized retail channel (supermarkets, hypermarkets, discount markets, etc.). However, Final Report explicitly underlines that the organized channel surpassed the traditional channel in the intervening period. That said, the TCA notes that the contribution of local/regional retail chains in the shift from traditional channel toward organized retail is substantial.

High concentration ratios: In parallel with the Preliminary Report, the Final Report once again underlines that the FMCG retail market is a "highly concentrated market" with a concentration rate of 70% for the ten largest players in the market. In which the most significant part of the market is shared among the four major retailers (i.e., BIM, A101, Migros, and SOK). As a result of the highly concentrated market structure, it appears that the profitability of big/national retailers has been continuously increasing where there is no significant entry into the market. Accordingly, the Final Report claims that there has been a de facto high entry barrier into Turkey's FMCG retail market.

The potential competitive advantage of vertically integrated entities: The finding of the Preliminary Report concerning the competitive advantage created by vertically integrated undertakings through acquisitions remains in the Final Report. The Final Report points out that the economies of scale and decreasing information asymmetry on the supply side allow vertically integrated companies to develop well-directed commercial strategies and theoretically provide a competitive advantage at the retail level.

Increasing market power of discounters: The Final Report provides that "discount markets" drastically increased their market power over the last ten years by using their competitive advantage deriving from (i) private label products, which are mainly produced by small/medium size or local producers with significantly lower costs, (ii) small store sizes and flexible decision-making mechanisms tailored to the needs of local consumers and market dynamics. In fact, while the market share of BİM, A101, Migros, and ŞOK was 26% in 2010, this ratio reached 77% by the end of 2021. Looking specifically at the way of concentration, the Final Report states that new store openings (organic expansion) have led to a rapid increase in the concentration level of the market. The TCA further states that most sector players anticipate this ongoing concentration trend will last.

Abuse of "buyer power" by retailers against suppliers: The Final Report argues that the increasing concentration levels in the sector contribute to the buyer power of the retailers. As private label products sold at lower prices have gained more popularity in terms of consumer preferences, retailers (particularly discounters) increased their market power and buyer power against suppliers. Abusive conduct by retailers through the use of buyer power against suppliers has created a negative impact on small and local suppliers' position in the market, although the global suppliers have not been vitally affected.

The Final Report concentrates on potential unfair commercial practices through abuse of buyer power. To illustrate these actions, the report provides some examples:

- Charging additional fees such as listing or shelf fees by retailers against suppliers,

- Reserving the right to make unilateral changes in contracts with suppliers and threatening to stop trading if suppliers insist on enforcing the deal without making concessions against retailers,

- Long maturity periods creating financial uncertainty on the supplier side,

- Additional and unforeseeable costs imposed by the retailers on suppliers (e.g., passing on the damage risk for a product to the supplier before placement on the shelf).

Digitalization in the sector: Unlike the Preliminary Report, in the Final Report the TCA scrutinizes the effects of digitalization in the FMCG retail sector. Accordingly, while the primary sales channel of the sector is still the physical retail channel, online sales channels having a limited share in turnover grow rapidly. In this sense, the TCA provides that online sales channels will account for almost 3% of total sales in the organized retail sector by 2021.

Further, the Final Report also found that digitalization in FMCG retail sector lessened the importance of store format or size. In the same vein, according to the Final Report, retailers consider specific digital platforms offering retail services as competitors even if they do not have any physical store. The Final Report also remarks that both the size and shape of competition in the sector would change due to the digitalization driven by Covid-19.

Need for a broader definition of the relevant product market: The TCA assesses the relevant product market under two main categories: (i) supply (up-stream market) and (ii) retail (down-stream market). Since the market is highly segmented and concerns with the trade of numerous products with similar commercial activities, in parallel with the Preliminary Report, the Final Report indicates that it is challenging to develop an absolute definition for a relevant product market. Hence, the Final Report recommends a case-by-case analysis rather than suggesting alternative definitions. Moreover, the Final Report presents significant findings that vary from those in the 2012 Report.

The Final Report states that as long as other market players' product range is similar to the products sold in their stores, such players are deemed as competitors regardless of store size or format. It further argues that consumers no longer attribute importance to store design or size to address their needs.

Need for a narrower definition of a relevant geographic market: The Final Report establishes that the distance of markets to consumers' locations determines the relevant geographic market. The Final Report argues that the increasing rate of urbanization and traffic density, along with car parking issues in big cities, may lead to the need for a narrower definition of the relevant geographic market. It contrasts with the TCA's recent precedents developed in its Phase II review for certain acquisitions, suggesting that the relevant geographic market should be defined based on towns or districts.

Need for Chinese Walls: Another issue not covered in the preliminary report but addressed in the Final Report is the need for Chinese Walls. The final Report indicates that private-label products could be quite effective in creating a sounder and stronger competitive environment for the sector. That said, the TCA estimates that a possible exchange of competitively sensitive information regarding private-label products may have significant consequences for the market due to the increasing share of private-label products in the FMCG retail market. Accordingly, the Final Report evaluates whether there is a need for the separation of the communication channels between the relevant purchasing units of the undertakings, which is referred to as the Chinese Wall, to restrict or eliminate the possible exchange of competitively sensitive information between the manufacturers of private label products and retailers. The TCA argues that relevant concerns would be better addressed through case-by-case analysis rather than initially separating the communication channels between the purchasing units of the undertakings.

What does the TCA Recommend?

To address the structural issues, the Final Report proposes a set of recommendations that can be summarized as follows:

- In terms of merger control analysis in the FMCG retail sector, the TCA should develop a tightened approach and consider defining the relevant geographic market, narrowing it down to the neighborhood or smaller districts,

The Final Report deviates from its recommendation from the Preliminary Report and claims that decreasing the thresholds for merger control filings in the FMCG retailing sector is unnecessary.

- In terms of potential anti-competitive impacts of abuse of buyer power by retailers;

-

- A dual market share threshold criterion should be applied for the retail FMCG sector, where both the suppliers' and the retailers' market shares are taken into account within Communiqué No. 2002/2 on Block Exemption for Vertical Agreements ("Vertical BER")

- In terms of abuse of buyer power through unfair commercial practices;

-

- An independent administrative authority should be established and authorized to effectively implement relevant legislation prohibiting retailers' abuse of buyer power. This authority should also be authorized to conduct investigations upon complaint or ex officio, execute dawn raids, and impose sanctions against the retailers infringing the applicable legislation. Accordingly, relevant legislation or regulation should be enacted.

- In this respect, the following practices should be prohibited;

-

- Maturity dates exceeding 30 days for perishable agricultural and food products,

- Maturity dates exceeding 60 days for other agricultural food products,

- Cancellation notifications made in a short period for perishable foods,

- Unilateral contract amendments of the buyer,

- Payment requests which are not related to the transaction,

- Transfer of risk for lost and perished goods to suppliers,

- Avoiding providing written approval to supply agreement further to the request by the supplier,

- Abuse of trade secrets by buyers,

- Trade retaliation by the buyer,

- Transfer of costs for examination of consumer complaints to suppliers.

- The following practices should be regulated;

-

- Return of unsold products,

- Paying for listing, shelving, and stocking fees by suppliers,

- Payment by a supplier for promotion,

- Payment by a supplier for marketing,

- Payment by a supplier for advertisement,

- Charging suppliers for personnel working to place supplier's products on buyers' shelves.

- To avoid circumvention of the rules, the concept of economic unity should be implemented to encompass affiliated companies.

- Prohibition or regulation of the supplementary invoices (i.e., price difference invoices) to the suppliers for price differences and for deviating from commonly agreed prices.

- To protect small or local retailers' competitive position against big market chains, a regulation that prohibits opening a second store within a specific distance or acquiring more stores within the same distance should be introduced.

- To ensure that the products are available at the price promoted through the advertisement for the period specified in the advertisement, a regulation should be implemented.

- The impact of digitalization on competitive dynamics should be considered in determining the relevant product and geographic markets and in competitive analysis.

- Agreements between retail chains and suppliers on the production of specific product weights should be prohibited.

- Since it may give rise to an exclusive supply of a particular type of product, agreements for suppliers to produce special-weight products for a particular retail chain should be prevented.

Footnotes

1. Emin Köksal, Şahin Ardıyok, Turkish Competition Authority's First Hub-and-Spoke Cartel Decision, Journal of European Competition Law & Practice, Volume 13, Issue 8, December 2022, Pages 566–570, https://academic.oup.com/jeclap/article-abstract/13/8/566/6761964?redirectedFrom=fulltext

2. The TCA decision dated 28 October 2021

numbered 21-53/747-360.

You may find our article, criticizing the decision, titled

"What did the Turkish Competition Authority Ignore in its

First Hub-and-Spoke Cartel Decision?" here: https://dergipark.org.tr/en/pub/ekonomitek/issue/75574/1232141

3. Please find short decision of the TCA here: https://www.rekabet.gov.tr/Dosya/hizli-tuketim-nihai-karar-duyurusu.pdf

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.