IFRS FOR SMES – THE KEY TO CONVERGENCE

The IFRS for small and medium-sized entities (IFRS for SMEs) simplified framework is intended for use by entities which do not have public accountability. One of the main drivers for the standard is to facilitate the convergence of local standards with IFRS around the world. The decision as to which entities are required or permitted to use the new standard rests with the legislative and regulatory authorities and standard-setters in individual jurisdictions. How it will fit into a proposed UK converged framework is considered on page 9, but at present the standard cannot be applied in the UK.

Structure of the IFRS for SMEs

To facilitate ease-of-use the sections of the IFRS for SMEs are laid out by topic and there are also example accounts and a disclosure checklist. Accounting requirements of full IFRS have been simplified by:

- excluding topics which are less relevant to SMEs for example IAS 33 'Earnings per share', IAS 34 'Interim financial reporting' and IAS 14 'Segment reporting'

- omitting the more complex option from standards that provide a choice in accounting treatment

- simplifying recognition and measurement criteria, and

- reducing disclosure requirements.

Many of the principles are as contained in full IFRS and they are therefore different from UK GAAP, including the requirement to prepare a cash flow statement for each entity.

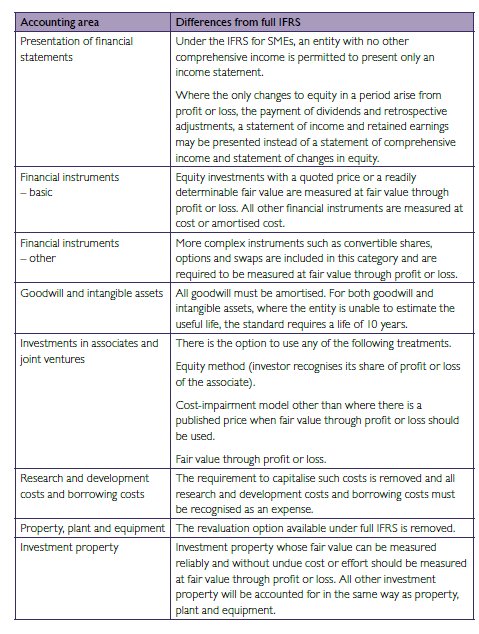

Main differences from full IFRS

Some of the most important differences from full IFRS are considered in the table opposite.

Transition

In the first year of adoption, an entity will be required to explain how the transition to IFRS for SMEs has affected its previously reported financial position, performance and cash flows. This will be achieved by presentation of reconciliations from previous GAAP in a similar way to the requirements of IFRS 1.

Smith & Williamson commentary

The IFRS for SMEs is probably one of the most important developments in financial reporting for a number of years insofar as it provides a catalyst for convergence. The IFRS for SMEs is not how

ever a simplified version of IFRS in the way the FRSSE is a simplified version of UK GAAP. There are a number of differences from full IFRS and, as a consequence, while underlying principles may be the same, detailed application and end result will be different.

For many UK preparers the removal of the revaluation option for fixed assets could be unpopular. For example where borrowings are linked to the valuation of a property, the entity will record all of the debt on its balance sheet without being able to reflect the value of the asset upon which it is secured.

FINANCIAL INSTRUMENTS AND THE BANKING CRISIS

Many commentators have suggested that the current approach to the fair value measurement of financial instruments has had a destabilising effect on some entities. Furthermore, a significant number of commentators have raised concerns that financial statements under the existing standards do not provide enough transparency, particularly when it comes to complex financial instruments and fair values. As a consequence the International Accounting Standards Board (IASB) is taking a number of steps to address the accounting requirements for financial instruments.

Improving financial instrument disclosures

'Improving disclosures about financial instruments – amendments to IFRS 7 Financial Instruments: Disclosures' has been issued in response to the concerns about transparency of financial instrument disclosures. The main aim of the amendments is to enable the user of financial statements to have a better understanding of the measurements and judgements that underpin the fair values of financial instruments in the accounts.

The revised version of IFRS 7 will require entities to analyse their financial instruments held at fair value across a three level hierarchy.

- Level 1 – fair values are measured using quoted prices.

- Level 2 – fair values are measured using inputs that are derived from observable market data.

- Level 3 – fair values are measured using inputs that are not based on observable market data.

Instruments will be categorised based on the lowest level of input that is significant to their fair value.

The entity will also have to disclose how the financial instruments in the statement of financial position (the new term for balance sheet) are spread across the three levels and give information about the fair value gains and losses that relate to each of those levels.

The amendments also affect the disclosure of liquidity risk. There are new rules clarifying how, and if, derivatives should be disclosed as part of the contractual maturity analysis already required by the standard. In addition, there are required disclosures about any uncertainties in the timing or amount of cash flows shown in the contractual maturity analysis. Also, under the revised standard, entities should provide, where appropriate, a maturity analysis for financial assets that are used to manage liquidity risk.

The effective date of these amendments is for annual periods beginning on or after 1 January 2009. In the first year of application, comparative disclosures will not be required.

Smith & Williamson commentary

For many IFRS preparers, the amendments to IFRS 7 will not result in a significant increase in disclosure. However, for those IFRS preparers who hold a number of different financial instruments at fair value, implementation of the revised standard will not be straightforward. Entities will need to group their financial instruments in a new way and then provide disclosures on this basis. Despite the initial exemption for comparative figures, preparers who have a large number of financial instruments may find that their accounting systems do not readily provide the new information.

A new standard for financial instruments – IFRS 9

In the summer the IASB launched a major new project that will result in the eventual replacement of IAS 39. The project represents a complete overhaul of the existing standard, and the IASB is aiming to develop a simpler and more transparent approach to financial instrument accounting.

The IASB has confirmed that the changes resulting from this project will not be mandatorily effective before January 2013. However, at the time of going to print the first phase of the project had just completed. IFRS 9 'Financial instruments' deals with classification and measurement. The new standard is available for early adoption for December 2009 year-end financial statements, leaving a very limited period of preparation for any entities that wish to do so. We will return to this new standard in our next edition of Financial reporting

Smith & Williamson commentary

Any simplification of financial instrument accounting is more than welcome. However, due process and consideration is vital to successful standard setting particularly in such a complex area. Whether a standard that is produced under such a short timetable addresses all of the issues preparers face can only be judged with time. There exists however a real possibility of subsequent revisions and additional guidance as the principles begin to be applied in practice. In the circumstances, any entity considering early adoption of the classification and measurement standard should think carefully before proceeding.

IMPROVING IFRS

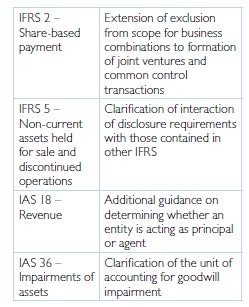

In April, 15 amendments to 12 standards (10 IFRSs and 2 IFRICs) were published. Below we consider four of the changes and, while the application dates of the amendments arising from the entire project vary, all of these are effective for periods beginning 1 January 2010 with early adoption being permitted.

IAS 17 'Leases'

Under the amendment, a lease of land with an indefinite economic life is no longer required to be classified as an operating lease. It can now be classified as a finance lease even if at the end of the lease term the title will not pass to the lessee. The reason for this change is that the IASB considers that substantially all the risks and rewards of ownership are transferred to the lessee and the present value of the residual value of the leased asset is negligible. Where the amendment results in a lease being reclassified as a finance lease, it should be applied retrospectively. This will most probably be for those leases of both land and buildings where the building is already treated as a finance lease.

IFRS 8 'Operating segments'

IFRS 8 has been amended to state that segment information in relation to total assets is only required if such information is regularly reported to the chief operating decision maker.

IAS 1 'Presentation of financial statements'

IAS 1 is clarified by confirming that the potential settlement of a liability by the issue of equity is not relevant when considering whether it is classified as current or non-current. The standard now permits a liability to be classified as noncurrent notwithstanding the fact that the entity could be required to settle in shares at any time, provided that the entity has the right to defer settlement for at least 12 months after the end of the accounting period.

IAS 7 'Statement of cash flows'

IAS 7 now requires that only expenditure that results in the recognition of an asset can be classified as a cash flow from investing activities.

Other amendments

The other standards subject to amendment are as follows.

Smith & Williamson commentary

Most of the amendments not discussed in detail relate to inconsistencies or clarification of scope exclusions which are unlikely to affect most preparers. However, any entity currently applying one of these standards should make themselves familiar with the relevant changes.

FINANCIAL REPORTING REVIEW PANEL

This key objective is primarily achieved through the Financial Reporting Review Panel's (FRRP) examination of directors' reports and financial statements of public and large private companies to see whether they comply with company law and relevant accounting standards (whether UK GAAP or IFRS).

As financial markets remain in distress, the Panel's work is becoming more relevant and of greater interest to both preparers and users of financial statements and the frequency of information published by the Panel has also increased over the last year.

In the words of the FRRP chairman, Bill Knight, in order to meet the needs of users financial statement disclosures need to be "full, frank and company-specific and should avoid generic descriptions of the economy which do not help users to understand how the board is responding to the challenges faced by their particular company."

Knight's comments were made when the FRRP issued its most recent annual activity report in July this year. This article looks at the key findings from that report in more detail.

The business review

The business review section of the directors' report has been an area of focus for the FRRP since its introduction as a mandatory requirement back in 2005. In its report the Panel noted that these disclosures are likely to warrant greater attention from users of financial statements at the current time due to the speed of the deterioration of market conditions over the last two years.

Unfortunately the FRRP's most recent findings indicate that these disclosures are still lacking, in particular the disclosure of principal risks and uncertainties. The Panel criticised companies for their generic, boiler-plate descriptions of risks, listing of risks with no proper description of their precise nature and, in some cases, providing no clear information about risks and uncertainties at all.

The FRRP will continue to review directors' report disclosures and, in future, will also focus on the consistency of financial statements with the disclosures made in the business review.

Segmental information

Just as narrative reporting in the business review is of increased importance to shareholders and other users when times are tough, so too is segmental reporting.

The application of IFRS 8 'Operating segments' by the majority of IFRS adopters for the first time in 2009/10 will be of particular interest to the FRRP over the next 12 months. It will also be focusing on the interaction between the segmental information in the financial statements and the disclosure of key performance indicators (KPIs) in the business review.

Smith & Williamson commentary

The Panel has already conducted an investigation into the financial statements of a listed company that had adopted IFRS 8 early but excluded certain IFRS 8 disclosure on the grounds of commercial sensitivity. The outcome of this investigation is clear; the Panel will not accept commercial sensitivity as justification for an absence of the disclosures required by the standard.

Explaining and reporting revenue

Also high on the FRRP's agenda is revenue recognition, particularly the clear and transparent disclosure of revenue recognition policies for all key income streams. Its report highlights continued concerns over the adequacy of stated accounting policies to explain the bases on which revenue is recognised and the completeness of the policies to cover all significant sources of revenue.

In its report, the Panel warns companies to keep their revenue recognition policies and practices under review, particularly given the downturn in the economy and continued uncertainties in financial markets. Clearly it is concerned that as businesses change the way they operate (for example by amending contracts to bring forward the timing of cash receipts from customers) they do not also change the timing of the recognition of revenue unless the treatment is in line with accounting standards.

The FRRP has announced that one of their priorities for 2009/10 will be the financial statements of companies which derive significant revenue from the provision of services such as advertising, media, recruitment and technology.

Investigating qualified audit reports

Since June 2008 the Panel has had in place arrangements to receive notification when any set of UK company accounts is filed with a qualified audit report for noncompliance with an accounting standard. It does not investigate every such set of accounts and in the year to 31 March 2009 they wrote to 50 companies regarding their non-compliance.

The most common standards which gave rise to non-compliance were FRS 17 'Retirement benefits' and SSAP 19 'Accounting for investment properties'. This is perhaps not surprising as these standards are often viewed by companies, particularly private companies, as being unnecessarily onerous. The Panel has made clear, however, that it will not accept a cost and benefit argument as justification for a lack of compliance and are reminding directors of their obligation to prepare accounts that give a true and fair view in accordance with the law.

UK GAAP – CHANGE IS COMING

Convergence of UK GAAP and IFRS has for a number of years been the goal of the Accounting Standards Board (ASB). However, complex measurement models, lengthy disclosure requirements and the absence of concessions for smaller entities have been major barriers to the introduction of a general requirement to use IFRS. Publication of the IFRS for SMEs (see page 2) has now paved the way for what will be a significant change for the majority of entities currently applying UK GAAP.

The three-tier approach suggested by the ASB is as follows.

All entities will have the option to voluntarily adopt a higher tier (e.g. a small entity could choose to adopt the IFRS for SMEs instead of the FRSSE).

It is proposed that the changes would be effective for periods beginning on or after 1 January 2012.

Public accountability

The definition of public accountability is important for the majority of UK entities because it effectively defines those who will be required to use European Union (EU) adopted IFRS. The ASB is proposing that the following would be deemed publically accountable:

- an entity whose debt or equity instruments are traded in a public market or is in the process of issuing such instruments

- an entity that is deposit taking or holds assets in a fiduciary capacity for a broad group of outsiders as one of its primary businesses (e.g. banks, credit unions, insurance companies, securities broker/dealers, mutual funds and investment banks).

As currently drafted, the proposals would apply to all entities other than those in the public sector. This includes not only entities that are 'profit seeking' but also those in the not-for-profit sectors, referred to in the consultation paper as 'public benefit' entities.

The ongoing role of SORPs

There are no equivalents to UK industry specific statements of recommended practice (SORP) under IFRS. While the ASB does not issue SORPs it does issue a negative assurance report on each statement confirming there is no conflict with the principles of accounting standards. Consideration has therefore been given as to the ongoing role of SORPs under the new framework. A general policy of only maintaining a SORP where there is a clear and demonstrable need as a consequence of sector specific issues is contained in the consultation paper and the proposed approach to each extant SORP is considered.

Application to public benefit entities

IFRS are not drafted in contemplation of being applied by public benefit entities and the ASB recognise that this might create a risk of uncertainty and ambiguity in their application. The consultation paper is therefore seeking views as to whether converged UK GAAP would need to be supplemented in order to be adequate and practicable for public benefit entities.

Four options are being suggested.

- A public benefit entity framework containing only principles and no specific accounting requirements.

- A public benefit standard which would set out where different accounting is required. This is the ASB's preferred option and the consultation paper considers matters that might be included in such a standard.

- Separate standards on public benefit issues.

- Supplementary text in UK GAAP.

Smith & Williamson commentary

For the majority of UK GAAP preparers IFRS is now one step closer to reality. While the IFRS for SMEs may prove to be less complex than existing UK GAAP in the long term, it still contains a number of different principles and disclosure requirements and it may be advisable for preparers and users alike to start to become familiar with the new framework.

Taking into account the requirement for comparatives and the need for an opening balance sheet the proposals as they stand would mean an effective implementation date of 31 December 2010. With many entities struggling to cope with the implications of the current economic environment a change in the basis of accounting may prove to be particularly challenging.

FINANCIAL REPORTING ROUNDUP

Companies Act 2006 and the Registrar's Rules

The final tranche of changes resulting from the Companies Act 2006 (CA06) took effect on 1 October 2009, completing its lengthy implementation process.

The majority of these last changes are constitutional and include simplification of the memorandum of association, new model articles of association and removal of the restrictions on a company's objects. Other important changes relate to share capital including the abolition of the concept of authorised share capital and further restrictions on the use of the share premium account.

From 1 October 2009, new Registrar's Rules require financial statements filed at Companies House to use only black text on white paper – including the signatures of directors on the balance sheet. The rules also require the company name and number to be shown on at least one of the balance sheet, directors' report, directors' remuneration report or the auditor's report – inclusion on the front cover alone will no longer be sufficient.

Smith & Williamson commentary

The changes in the Registrar's Rules mean that directors and company secretaries need to take care that they use black ink, not blue, when signing accounts. In addition, it may be advisable for logos in any colour other than black to be removed before the accounts are filed. Without these precautions, a company could be deemed not to have complied with the filing requirements and it is possible that a late filing penalty may be incurred.

FRS 20 amendment

An amendment to FRS 20 was recently issued by the ASB. The amendment deals with cash settled arrangements within groups by extending the scope of the standard to include situations where goods or services are received from a supplier, but the obligation to settle the transaction lies with another company within the group. It covers both circumstances where the value of the cash payment to the supplier is linked to the price of equity instruments of the entity itself, or of another company within the group. The amendment specifies that such goods and services received should be measured in accordance with the requirements for cash-settled share-based payments.

The amended FRS 20 applies retrospectively for annual periods beginning on or after 1 January 2010 and mirrors an amendment made to IFRS 2 by the IASB. As a result of the amendment, UITF 41 (IFRIC 8) 'Scope of FRS 20 (IFRS 2)' and UITF 44 (IFRIC 11) 'FRS 20 (IFRS 2)' – Group and treasury share transactions' have been withdrawn.

Amendment to UITF Abstract 42 and FRS 26

The ASB has now issued 'Amendments to UITF Abstract 42 (IFRIC 9) Reassessment of Embedded Derivatives and FRS 26 (IAS 39) Financial Instruments: Recognition and Measurement – Embedded Derivatives'. The amendments require that when an entity reclassifies a hybrid financial asset out of the fair value through profit or loss category, an assessment should be made as to whether an embedded derivative is required to be separated from the host contract.

The amendments reflect the changes made by the IASB to IFRIC 9 and IAS 39 and apply for annual periods ending on or after 31 December 2009.

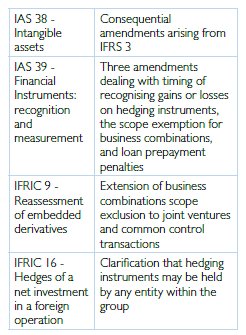

ON THE HORIZON

The table below summarises the effective dates for new and revised IFRS and IFRIC interpretations. Those that are shaded have not yet been endorsed by the EU and the effective date will be contingent on successful endorsement.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.