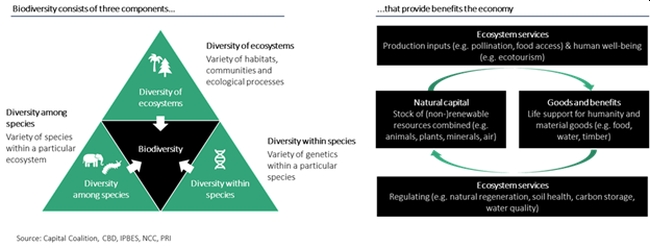

While climate change has dominated ESG thinking thus far, biodiversity is quickly emerging as the next key focus for companies, asset managers, and asset owners. There is even a COP devoted to the topic, that currently takes place in Montreal. It refers to the abundance and variation among all life on earth, at the genetic, species and ecosystem levels. Although images of lush tropical rainforests, birdlife-rich river deltas and wild African savannas may be what first comes to mind, biodiversity, the subject, and its impact are much broader than this. We all directly depend on rich eco-diversity, even in big cities and within the very human construct of the finance industry.

In fact, the World Economic Forum estimates that nearly half our global GDP is moderately or highly dependent on these so-called ecosystem services, i.e. the 'free' services nature provides to the human population. Sitting in skyscrapers boardrooms, it is easy to forget our dependence on nature and these ecosystem services. Without insect pollination our agricultural yields would collapse; without rainforest plant medicines, many would die; and without clean water sources none of us could survive.

Unfortunately, global biological diversity is declining at unprecedented rates, with many experts warning that Earth's next mass extinction event has begun1. The current state of play follows a negative trend over the last 50 years, with The Living Planet Index reporting a 69% fall in species populations since 1970 worldwide2. Reflecting on these same 50 years, humans have experienced a rich period of population growth, development, and innovation. This prosperity has been enabled, in part, by capitalising on the natural capital that living things and ecosystem services provide. However, society has largely forgotten to nurture and replenish the reservoirs that sustain such services, and we are beginning to see the first cracks in an otherwise resilient system. For example, insect pollination in the US is at a crossroads: there have been significant concerns that the level of pollinators is insufficient to sustain crop yields3. We saw a massive decline in olive oil production in Southern Italy due to a bacterium attacking the trees, travelling along the global supply chain routes from the Americas to Europe4. And global rainforest cover and quality are declining yearly, changing the forests from a carbon sink into a carbon emitter, accelerating rather than decelerating global warming5.

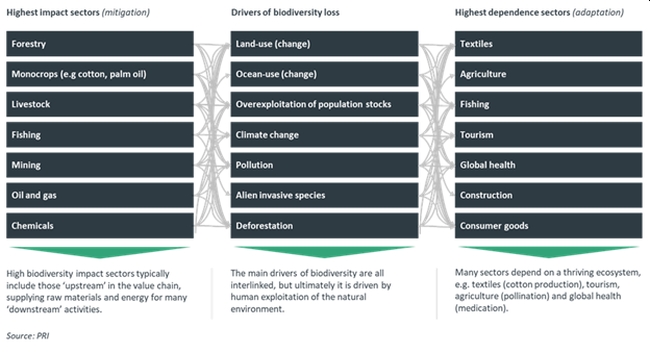

Many business activities (whether directly or indirectly, via supply chain effects) contribute to the reduction of biodiversity, including land-use change, ocean-use change, species overexploitation, pollution, and climate change. According to ASN, a Dutch bank that created the world's first biodiversity impact fund, only 0.01% of listed companies were classified as doing 'zero-harm' to nature. Isn't it time that we transition to an economy where humans continue to prosper, not at the expense of nature, but alongside?

From risk mitigation to value creation

Although the risks of not doing anything are severe (according to the World Economic Forum's Global Risks Perception Survey 2021-2022, loss of eco-diversity is the third most severe threat facing the world over the next ten years6), the commercial imperative to act is also extremely high. Stalling the loss of genetic, species, and ecological diversity and investing in nature-positive solutions could create new business opportunities to the scale of USD 10 trillion, annually, and create 395 million jobs, by 20307. Companies that take early action on tackling the loss of biological diversity can improve access to capital, capture new revenue streams, reduce costs, increase the security of supply, and benefit from a host of other value-creation opportunities. Investors and fund managers should consequently encourage their portfolio companies to measure biodiversity impact and invest in natural capital to create resilience and long-term value. Not convinced? Think about how the corporate world's view on climate change evolved between 2015 and today. In 2015, only a few companies measured carbon emissions: hardly any had net-zero pledges. With regards to biodiversity, we are just at the starting point and pace of change in sentiment is expected to be even faster than climate change: we simply have less time to take real-world action.

Investors and fund managers should consequently encourage their portfolio companies to measure biodiversity impact.

Standards and frameworks to support regulation and strengthen accountability

As a laggard, compared to climate change awareness, biodiversity is slowly starting to feature in financial market regulations and supporting frameworks. For example, it is registered as a Principal Adverse Indicator in the European Commission's Sustainable Finance Disclosure Regulation (SFDR). In January 2023, the EU will launch a Taxonomy objective focused on protecting and restoring nature. It is also directly covered by The United Nations Sustainable Development Goals in life below water (goal 14) and life on land (goal 15).

Two key challenges facing financial market participants that aim to measure biological diversity are fragmented data and a lack of harmonised standards. To measure climate change, one measures the amount of greenhouse gas emissions; biodiversity, however, is multidimensional and cannot be captured by a single metric. For example, risks are different for a tropical forest than for a wetland. In addition, since any loss of genetic, species and ecosystem diversity usually occur higher up in the value chain, it is challenging to obtain data and quantify the full impact.

One standard looking to overcome the challenges outlined above is the recently released Partnership for Biodiversity Accounting Financials (PBAF) Standard. PBAF presents a new standard for financial institutions to assess and disclose impact and dependency on the natural capital of loans and investments. This standard will likely inform the recommendations outlined in the highly anticipated Taskforce for Nature-related Financial Disclosures (TFND) framework. The TNFD, due in September 2023, will provide financial institutions and corporations with an integrated methodology for quantifying and disclosing nature-related risks and opportunities8.

Footnotes

1. The Sixth Mass Extinction: fact, fiction or speculation?

3. Pollinators at a Crossroads

4. Italy's Olive Trees Are Dying

5. The Brazilian Amazon has been a net carbon emitter since 2016

6. WEF – The global risks report 2022

7. Scaling Investments in Nature

8. The TNFD Nature-related Risk & Opportunity Management and Disclosure Framework

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.