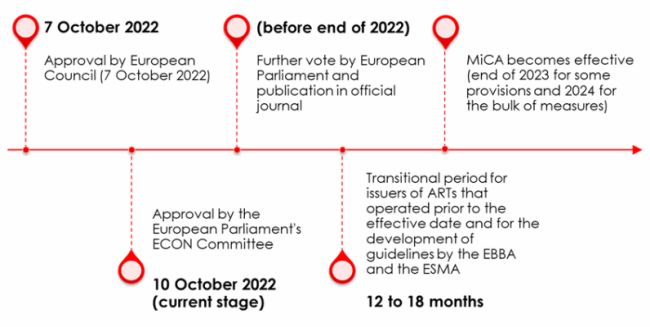

In a previous post we reported on the European Union's provisional agreements on (1) the Transfer of Funds Regulation extending anti-money laundering (AML) regulations to the transfer of crypto-assets; and (2) a new proposed regulatory framework for crypto-assets, the Regulation on Markets in Crypto Assets ("MiCA"). The draft texts (numbering some 450 pages) have now garnered the approval of the European Council and European Parliament's ECON1 and will shortly be put to a final vote by European Parliament.

These regulations introduce sweeping changes in an area that has so far seen little by way of regulation and will establish a comprehensive, EU-wide approach to crypto-assets aimed at ensuring stability in the financial markets and enhancing investor protection. We examine key aspects of these regulations which those operating in the crypto space should be aware of now, given that both MiCA and the Transfer of Funds Regulation will likely be implemented between 2023 and 2024.

MiCA2

MiCA brings crypto-assets, crypto-assets issuers and crypto-asset service providers under a new regulatory framework and sees the introduction of three sub-categories of crypto-assets (the first two more widely recognised as "stablecoins"):

- E-money tokens, defined as crypto-assets aimed at stabilising their value by referencing only one official currency.

- Asset-referenced tokens ("ARTs"), defined as crypto-assets aimed at maintaining a stable value by referencing to any other value or right, or combination thereof, including one or several official currencies.

- All other crypto-assets, including utility tokens (i.e., those intended only to provide access to a good or a service supplied by the issuer of that token).

Non-Fungible Tokens ("NFTs") are not generally captured by MiCA3, however, rather confusingly the recitals to MiCA state that "fractional parts of a unique and non-fungible crypto-asset should not be considered unique and not fungible" and "the issuance of crypto-assets as non-fungible tokens in a large series or collection should be considered as an indicator of their fungibility." What does this mean in reality? Peter Kerstens, advisor to the European Commission, explained, "If a token is issued as a collection or as a series — even though the issuer may call it an NFT and even though each individual token in that series may be unique — it's not considered to be an NFT, so the requirements will apply."4 Therefore, it seems that MiCA may extend to many digital art collectibles that are often issued as a series or collection of NFTs (e.g. the Bored Ape Yacht Club, a series of 10,000 unique tokens representing ape characters). In determining whether an asset is unique and not fungible, competent authorities should consider substance over form. Further, NFTs that qualify as financial instruments may also be caught by MiCA.

MiCA is comprehensive, but in this alert we focus on key aspects of the provisions concerning the issuance or offering of crypto-assets and ARTs and provisions applicable to CASPs.

- Issuing Crypto-Assets

In order to protect retail investors and consumers, MiCA , requires that offerings to the public in the European Union (including the admission to trading platforms) of crypto-assets may only be made by a "legal person" (which is likely to exclude decentralised autonomous organisations of "DAOs" which are not generally bestowed with any legal personality under EU rules) and issuers will need to comply with requirements including:

- the publication of an information document or "a crypto-asset white paper" ("White Paper");

- particular requirements for any related marketing communications; and

- certain duties on issuers, which are fiduciary in nature.

Failure to comply with relevant requirements will give rise to civil liability for damages though the onus is on the crypto-asset holder to show that the infringement had an impact on his or her decision to buy, sell or exchange the said crypto-assets. Additionally, any remedies under the relevant national law may also be available. As explained below, one aspect of the information that must be provided in the White Paper is the environmental impact of the crypto-asset issuance and issuers should therefore be cautious not to overstate the position which may give rise to claims for greenwashing.

(a) The White Paper and Marketing Communications

The White Paper must include information, which is fair, clear, and not misleading relating to: the issuer, underlying technology, the crypto-assets and related risks, the rights and obligations attached to the assets, and the environmental impact of the consensus mechanism used to issue the crypto-asset (i.e., the mining process).

Similarly, associated marketing communications (which cannot be disseminated until a White Paper is published) must be fair, clear, and not misleading; be consistent with and refer to the White Paper.

While a White Paper does not need to be approved prior to publication, the offering must be prior notified to the competent authority of the relevant EU Member State. Competent authorities will be able to request amendments to a White Paper and suspend or prohibit an offering where the White Paper or marketing communications are not fair, or clear or are misleading.

The European Securities and Markets Authority is tasked with developing the technical standards for White Papers, will maintain a public register of White Papers and will consider the use of energy, renewable energy, and natural resources as well as emissions by the mining of the crypto-assets referenced in any White Paper.

Retail holders will have the right to withdraw from the agreement to purchase assets covered by the White Paper within 14 days without incurring fees or costs, and without giving reasons; this right, however, shall not apply where the crypto-assets have been admitted to trading on a trading platform for crypto-assets prior to the purchase by the retail holder.

(b) Duties on Issuers/Offerors

Article 13 of MiCA imports fiduciary-like duties on offerors and issuers, including to:

- act honestly, fairly, and professionally;

- communicate with the holders and potential holders of crypto-assets in a fair, clear and not misleading manner;

- identify, prevent, manage, and disclose any conflicts of interest that may arise;

- maintain all of their systems and security access protocols to appropriate Union standards; and

- act in the best interests of the holders of such crypto-assets and treat them equally (unless otherwise disclosed in the White Paper).

No doubt, offerors and issuers will need to consider appropriate insurance cover to risk manage.

- ART - Specific Provisions

In a measure designed to protect investors and manage risks to payments systems and financial stability, those offering ARTs to the public in the European Union (including seeking admission to trading on a trading platform) are subject to particular requirements depending on whether they are a legal person (or other undertaking) or a credit institution.

Legal persons issuing ARTs to the public must be established in the EU and have sought authorisation from the competent authority of their home Member State. ARTs may be issued by an undertaking that is not a legal person (which the recitals to MiCA suggest would include a commercial partnership, though query whether this may also extend to a DAO) provided it ensures relevant protection for third parties' interests and they are subject to appropriate prudential supervision. In seeking authorisation, issuers are required to provide a broad spectrum of information relating to their business model, governance arrangements, internal control mechanisms to prevent money laundering, contractual arrangements with third parties and information regarding its management and those with qualifying holdings (i.e. natural or legal persons with direct or indirect holdings representing at least 10 percent of the capital or the voting rights). A White Paper and a legal opinion that the ART is not a crypto-asset excluded from the scope of MiCA or an e-money token are also required.

For credit institutions, the authorisation component does not apply, so long as they offer a White Paper and provide specific information (e.g., on governance arrangements, and operation, as well as a legal opinion that the ART does not qualify as an e-money token or as an asset outside MiCA's scope) to their competent authority at least 90 days prior to offering the White Paper.

The requirements applicable to legal persons and credit institutions offering ARTS to the public outlined above do not apply where:

- the ARTs' value does not exceed EUR 5 million (or equivalent in) over a period of 12 months and the issuer is not linked to a network of issuers covered by this exemption; or

- offers are addressed solely to qualified investors.

Issuers of ARTs will also have to maintain appropriate reserves to back the value of the tokens, which should be maintained in a way that does not face market and currencies risk. Such reserve assets will be segregated from the issuer's own assets at all times. The management body of such issuers should be "fit and proper" including for AML and CTF purposes and all issuers of ARTs will be subject to duties to act honestly, fairly, and professionally, communicated in a fair, clear and not misleading manner, and act in the best interests of holders as a whole. ART issuers must also implement and maintain procedures to identify, prevent, manage, and disclose any conflicts of interests between themselves and shareholders, management, employees, any persons with qualifying holdings and certain third parties. Issuers should also provide a permanent redemption right to the holders of the ARTs (either through paying an amount of funds equivalent to the market value of the referenced assets or by delivering the referenced assets).

ARTs with a value issued of over EUR 100 million will be subject to additional quarterly reporting requirements. Where ARTs are widely used as a means of exchange within a single currency area, then MiCA seeks to reduce and control the level of activity. Wide use is calibrated as a quarterly average of higher than 1 million transactions and EUR 200 million in value per day respectively, within a single currency area. There are also provisions for the orderly wind-down of issuers of ARTs.

The European Banking Authority ("EBA") will have supervisory powers in this area where an ART or e-money token has been classified as significant. These assets will be subject to higher capital requirements and more "stringent requirements," in a move designed to curb the issuance of tokens not denominated in EUR.

- Crypto Asset Service Provider ("CASPs") - Specific Provisions

CASPs are legal persons or other undertaking whose occupation or business is the provision of one or more crypto-asset services to third parties on a professional basis. Crypto-asset services are broadly defined and include custody and administration services, the operation of a trading platform or crypto-asset exchange, placing of crypto-assets, advising on crypto-assets and providing portfolio management on crypto-assets.

CASPs will now need to be authorised by competent authorities, should have their place of effective management in the EU, and at least one of the directors should be resident in the EU. With some exceptions (notably exchanges that are also EU payment services firms or e-money firms), CASPs will be subject to various obligations including:

- Prudential Requirements: Prudential safeguards will apply which may take the form of minimum capital requirements, set out in Annex IV and ranging from EUR 50,000 to EUR 150,000, depending on the specific services offered, or in proportion to their fixed overheads. These safeguards may take the form of own funds, insurance policy or comparable guarantee.

- Fiduciary-type duties: CASPs will be subject to a number of duties including to: identify and manage any conflicts of interests; act in the best interests of asset holders; warn clients of risks associated with transactions in crypto-assets; and provide transparent information regarding pricing.

- Governance:

- Management must possess knowledge, experience and skills to perform their duties, demonstrate that they are capable of committing sufficient time to effectively perform their duties. Both management and natural or legal persons with qualifying holdings must have sufficiently good repute (including no previous relevant convictions for money laundering or terrorist financing offences).

- CASPs must maintain effective procedures in place to monitor market abuse and insider dealing.

- Records of all crypto-asset services, activities, orders, and transactions undertaken by CASPs must also be kept.

- Custody and safeguarding: CASPs will be required to make adequate arrangements to safeguard the ownership rights of clients, especially in the event of insolvency, and to prevent the use of a client's crypto-assets for their own account. Specific additional requirements apply to CASPs offering custodial services, including the maintenance of a register of positions corresponding to each client's right to the underlying crypto-assets, updating obligations, and a requirement to segregate client assets from their own by ensuring that clients' assets are held on separate addresses.

Transfer of Funds Regulation5

Payment service providers ("PSPs") will have to collect and verify information about the source and the beneficiary of crypto-asset transfers. The new legislation enshrines the "travel-rule" by stating that transfers of funds shall be accompanied by at least the payment account number of both the payer and the payee. PSPs are also required implement effective procedures to detect missing information which must be taken into consideration when the PSP assesses whether a transfer needs to be reported to the Financial Investigation Unit.

Similar obligations apply to CASPs. The rules also apply to transfers exceeding EUR 1,000 in circumstances where a private unhosted wallet interacts with a wallet hosted by a CASP. This requirement accords with Financial Actions Task Force ("FATF") proposals.

The EBA will issue guidelines on the implementation of the regulation, including on the characteristics of a risk-based approach to supervision of CASPs.

The overall objective is for the EU to ensure cross-border adherence to FATF standards (and the EU's own framework) on combating illicit financing and terrorism financing by ensuring that transfers of crypto-assets are traceable. Where such transfers involve non-EU entities that are not regulated or unhosted wallets, then they will be conducted in accordance with guidelines that will be issued by the EBA on enhanced due diligence and appropriate use of DLT analytic tools.

Comment

There is a great deal of new law incoming in this area, yet not a great amount of time for CASPs and other market participants to ready themselves for anticipated implementation by the end of 2024 (subject to the final vote of the European Parliament). Industry reaction has been broadly positive, although qualms over the treatment of NFTs and certain other types of assets remain. Compliance with MiCA is likely to be challenging for crypto issuers and service providers operating in the EU who have so far enjoyed little scrutiny and supervision over their activities, and they will need to be cognisant of, and start work on, implementing compliance with these new requirements now to ensure that they can continue to operate in compliance with this comprehensive framework once enacted and to risk manage.

Footnotes

1. Committee on Economic and Monetary Affairs

2. https://data.consilium.europa.eu/doc/document/ST-13198-2022-INIT/en/pdf

3. See recital 6b of MiCA

5. https://data.consilium.europa.eu/doc/document/ST-13215-2022-INIT/en/pdf

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.