1. Introduction

Following the release earlier this year of the Insurance Growth Report 2020, which offered an overview and analysis of global mergers and acquisitions (M&A) activity across 2019, this mid-year update takes a look at transaction trends in the first six months of 2020.

The unprecedented events of the first six months of 2020 have thrown up unique challenges for all businesses. Those in the insurance industry are no exception. For many, responding to Covid-19 has meant putting growth ambitions to one side, in order to take stake stock of the impact of the pandemic on operations, claims and investment returns.

But as the economy moves towards a state of stability that could be defined as 'the new normal', opportunities will arise and re/insurance businesses around the world will look at every avenue to generate a positive return for their shareholders.

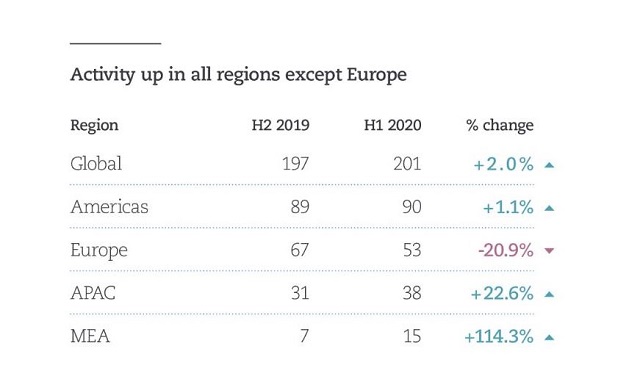

Mergers and acquisitions will remain an attractive strategy to deliver growth. In the first half of 2020, completed M&A in the global insurance industry held steady with 201 completed deals worldwide, up from 197 in the second half of 2019. While the outlook for the second half of the year is for a drop off in M&A activity as the effect of the pandemic is seen in the level of completed deals, the stage is set for re/insurance transactions to make a comeback in 2021.

Key stats at a glance

H1 2020 saw a slowdown in mega deals, evidence of a more measured approach to deal-making that we expect to continue.

Key stats at a glance

Slowdown in mega deals

- There were 6 deals in H1 2020 valued at over USD 1.0 billion

- There were 20 in the whole of 2019

Mix of big spenders

- 12 acquiror nationalities among the top 20 largest deals by value

- US has six of the top 20 deals, UK, Italy and Canada two each

France leads the way

- La Banque Postale's takeover of CNP Assurances for USD 6.3 billion was the largest deal of H1 2020.

Cross-border activity continues

- There were 50 completed cross-border deals in H1 2020, 24.9% of the global total

- 33 of 50 cross-border deals were intra-region – 66.0%

The growth agenda – key takeaways from H1 2020

M&A in the global insurance industry rose in the first half of 2020 with 201 completed deals worldwide, up from 197 in the second half of 2019.

The growth agenda – key takeaways from H1 2020

Brace for a deal dip

The deals completed in the first half of 2020 would have been negotiated and agreed back in 2019, pre-pandemic. The impact of Covid-19 on insurance M&A will only become clear in the coming months and we expect it to be stark. There are practical reasons for this, not least that lockdown has made it very challenging to progress deals as it has been impossible to meet face-to-face to negotiate.

Meanwhile, uncertainty – the enemy of deal-making – has rarely been as prevalent in the market. What might targets look like in the next six months, one year or five years? How will Covid-19 impact the availability of financing? And how confident can buyers be in their own businesses before they turn their sights to M&A? The market is not at a standstill, but strategic and financial buyers are putting heightened focus on deals that make sense to them.

Legacy to be a key deal driver

As the dust settles on Covid-19 we will see a range of distressed businesses, with re/insurers pulling out of certain lines, industries or geographies. Those looking to rationalise their operations will move to divest teams and books of businesses that do not fit with their core strategy.

In 2021, we expect an increase in the number of targets being offered for a sale and a greater interest in legacy business. In one example of an early mover, portfolio refinement specialist Gossmann & Cie obtained a licence to operate from the Maltese authorities in July 2020. Elsewhere, the US has not historically had the mechanisms in place to enable legacy activity. However, two recently enacted restructuring tools known as Insurance Business Transfers and Corporate Divisions, although still largely untested, could lead to a burst of deal activity.

Geographic axis tilting

The US is the perennial powerhouse of global insurance M&A but was poised for a slowdown even before the pandemic. There were 64 completed deals involving US acquirors in h3 2020, down from 73 in the previous six months, marking the third consecutive period of declining activity. In part this is due to the cyclical nature of transactions – after a sustained period of deal-making, valuations had risen and some investors have been pausing to take stock.

Others have been wary of geo-political tensions, particularly with China, and the upcoming US Presidential election adds another layer of uncertainty. In Europe the picture could not be more stark with the shadow of Brexit combined with difficulties in reaching valuations pushing transactions to a three-year low.

Meanwhile, M&A elsewhere in the Americas has been trending slowly upwards while markets in Asia Pacific, the Middle East and Africa have made steady gains, albeit from a relatively low base, that are helping to bolster the total number of deals worldwide.

A tech led recovery

Technology continues to be a primary growth driver worldwide. Deals completed in H1 2020 included investments into US-based start-up Openly, Belgium's Keypoint and yallacompare in the United Arab Emirates. While insurtech investment dived in Q1 due to Covid-19, it rebounded in the second quarter.

Although investors have already become more selective since last year, a trend that the pandemic will strengthen, high-quality tech offerings are still attractive, provided they can prove their worth. Start-ups now reaching maturity with a proven track record are ripe for acquisition and we expect this to be a key deal driver in H1 2021.

Capital raising could weigh on M&A

The impact of Covid-19 has accelerated the market hardening that was already underway, presenting opportunities for organic growth that could depress appetite for M&A. Capital-raising has been a feature of the post-pandemic market – reaching USD 16 billion in H1 2020 according to Willis – with re/insurers keen to write more risk at a higher price but needing to offset losses from Covid-19 in order to do so.

As rates rise there is also the potential for a wave of new start-ups and scale-ups, as we have seen in the aftermath of other major loss events in the past, albeit the situation now is more nuanced than post Hurricane Katrina, for example. That has not deterred a range of market figures from exploring options and there has been a succession of headlines around early-stage start-up plans. For that do make it to fruition, choice of location will be interesting. Although Bermuda's tax advantages have gone, the absence of red tape is appealing, while Lloyd's will be keen to attract its share, provided businesses can deliver on profitability and performance targets.

Originally published 17 August, 2020

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.