The Federal Trade Commission ("FTC") has announced that the Hart-Scott-Rodino ("HSR") Act filing thresholds will increase again in 2023. These thresholds determine which mergers and acquisitions must be reported to the federal government before consummation. The higher thresholds are expected to take effect on February 27 and will remain in effect through early 2024.

The FTC also confirmed that new HSR filing fee thresholds will take effect the same day. Parties to any transaction that will close on or after February 27 may wish to confirm their HSR filing analysis using the adjusted thresholds.

Adjusted HSR Jurisdictional Thresholds

Size-of-Transaction Threshold. An HSR filing may be required if an acquirer will hold, as a result of a transaction, voting securities, noncorporate interests, and/or assets of an acquired person valued in excess of $111.4 million (the 2022 threshold was $101 million). If the Size-of-Transaction is between $111.4 million and $445.5 million, the transaction also must satisfy the Size-of-Person threshold, described below. Transactions valued in excess of $445.5 million need not satisfy the Size-of-Person threshold.

Size-of-Person Threshold. A transaction meets the Size-of-Person threshold if either the acquired or acquiring person has annual net sales or total assets of at least $222.7 million and the other party to the transaction has at least $22.3 million in annual net sales or total assets. (The 2022 thresholds were $202 million and $20.2 million, respectively.) If the acquired person is not "engaged in manufacturing," the threshold is not met unless that person has at least $22.3 million in total assets or $222.7 million in annual net sales.

The tables below summarize these threshold changes.

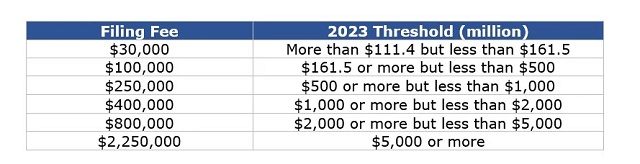

As detailed in our prior Alert, and shown below, a law passed in late 2022 introduced additional HSR filing fee thresholds, increased filing fees for large transactions, and decreased fees for small transactions. The FTC clarified that those new thresholds also will take effect on February 27.

There are exceptions to the reporting requirements under the HSR Act. Qualified counsel should be consulted whenever a transaction may implicate this statute.

Interlocking Directorates Thresholds and Civil Penalties Amounts Also Increase

The FTC also increased the jurisdictional thresholds for the prohibition on interlocking directorates under Section 8 of the Clayton Act. Section 8 prohibits a person from serving as an officer or director of competing corporations if each company has a net worth of more than $45,257,000. However, there is no violation if the competitive sales of either are less than $4,525,700.

Earlier in January, the FTC announced an increase in the maximum civil penalty for violations of the HSR Act (among other statutes) from $46,517 per day to $50,120 per day.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.