Introduction

On October 25, 2023, the American Shrimp Processors Association (ASPA) filed petitions with the United States Department of Commerce (DOC) and the U.S. International Trade Commission (ITC), seeking antidumping (AD) duties on imports of frozen warmwater shrimp from Ecuador and Indonesia, and countervailing (CVD) duties on such imports from Ecuador, India, Indonesia and Vietnam.

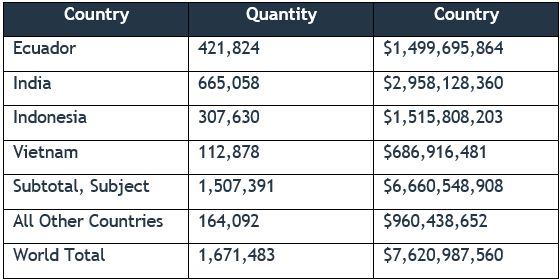

The petitions implicate a substantial volume of trade, with imports of subject frozen warmwater shrimp from the four countries amounting to $6.66 billion in 2022. In 2005, the DOC published AD orders on Frozen and Canned Warmwater Shrimp from China, India, Thailand and Vietnam, which remain in place today. Accordingly, if successful, the new petitions would add CVD liability for importers of frozen warmwater shrimp from India and Vietnam that are already subject to AD duty requirements, and would impose new AD and CVD liability for importers of frozen warmwater shrimp from Ecuador and Indonesia.

The Coalition of Gulf Shrimp Industries, an association with nearly identical membership to ASPA, filed a similar case in 2012, requesting CVD duty investigations into frozen warmwater shrimp from China, Ecuador, India, Indonesia Malaysia, Thailand and Vietnam. However, the case did not result in imposition of CVD orders, as the DOC reached negative CVD determinations for Indonesia and Thailand, and the ITC reached a negative injury determination for the remaining five countries (China, Ecuador, India, Malaysia and Vietnam). The ITC reached its final negative injury determination after determining that subject imports did not have adverse effects on prices of domestically produced shrimp, and because any declines in domestic producers' financial performance was not caused by imports. Accordingly, while the U.S. market landscape may have changed in the last decade, the ITC's prior findings could complicate ASPA's affirmative injury arguments.

Under U.S. law, a domestic industry may petition the government to initiate an AD investigation into the pricing of an imported product to determine whether it is sold in the U.S. at less than fair value (i.e., "dumped"). A domestic industry may also petition for the initiation of a CVD investigation, which examines alleged subsidization of foreign producers by a foreign government. The DOC will impose AD and/or CVD duties if (1) it determines that imported goods are dumped and/or subsidized, and (2) the ITC also determines that the domestic industry is materially injured or threatened with such injury by reason of subject imports.

If the ITC and DOC make preliminary affirmative determinations, U.S. importers will be required to post cash deposits in the amounts of the estimated AD and/or CVD duties for all entries on or after the dates of publication of the DOC's preliminary determinations in the Federal Register. The DOC will publish country-specific AD and CVD rates, likely based on the average of individual rates calculated for the largest producers in each country. The preliminary AD/CVD rates can and often do change in the final DOC determinations.

Scope

The products subject to these investigations are certain frozen warmwater shrimp and prawns whether wild-caught (ocean harvested) or farm-raised (produced by aquaculture), head-on or head-off, shell-on or peeled, tail-on or tail-off, deveined or not deveined, cooked or raw, or otherwise processed in frozen form.

Frozen shrimp and prawns that are packed with marinade, spices or sauce are included in the scope. In addition, food preparations, which are not "prepared meals," that contain more than 20% by weight of shrimp or prawn are also included in the scope.

Imports of the subject merchandise are primarily provided for under the following categories of the Harmonized Tariff Schedule of the United States (HTSUS): 0306.17.0004, 0306.17.0005, 0306.17.0007, 0306.17.0008, 0306.17.0010, 0306.17.0011, 0306.17.0013, 0306.17.0014, 0306.17.0016, 0306.17.0017, 0306.17.0019, 0306.17.0020, 0306.17.0022, 0306.17.0023, 0306.17.0025, 0306.17.0026, 0306.17.0028, 0306.17.0029, 0306.17.0041, 0306.17.0042, 1605.21.1030 and 1605.29.1010.

A full description of the proposed scope, including the non-exhaustive list of covered further processed merchandise and descriptions of the merchandise that is specifically excluded from the proposed scope, is provided in Attachment 1.

Foreign Producers and Exporters of Subject Merchandise

A list of foreign producers and exporters of frozen warmwater shrimp, as identified in the petitions, is provided in Attachment 2.

U.S. Importers of Subject Merchandise

A list of U.S. importers of frozen warmwater shrimp, as identified in the petitions, is provided in Attachment 3.

Alleged Margins of Dumping/Subsidization

Petitioners allege the following dumping margins for Ecuador and Indonesia:

- Ecuador: 4.8% to 111.4%

- Indonesia: 4.85% to 37.36%

The DOC generally assigns duties at the highest of these alleged dumping rates to foreign producers and exporters that fail to cooperate with its investigative process.

The petitions include no allegations of country-specific subsidy rates.

Potential Trade Impact

According to official U.S. import statistics, a total of 1.5 billion tons and $6.66 billion of the subject merchandise was imported into the U.S. in 2022. The quantity and value of total subject merchandise covered by these petitions makes their trade impact one of the largest of any AD/CVD petition filed in the last several decades. The table below shows the 2022 quantity and value of frozen warmwater shrimp exported to the United States from each of the subject countries.

The full quantity and value breakdown for frozen warmwater shrimp exported from the subject countries is available at Attachment 4.

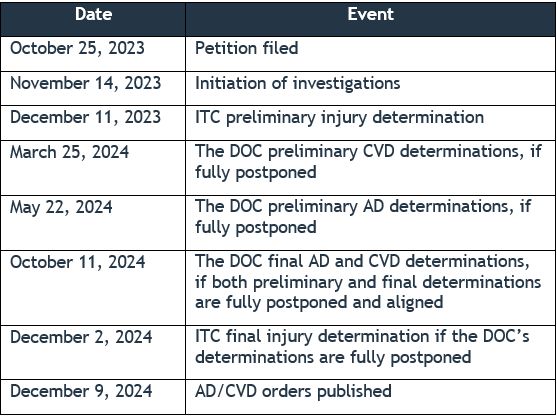

Estimated Schedule of Investigations

The below table provides the estimated schedule for the investigations before the ITC and DOC. The schedule assumes that the DOC will extend its statutory deadlines to the extent possible under the statute, which is its usual practice in investigations, particularly those involving large volumes of trade.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.