Introduction

The past 12 months have been some of the trickiest to navigate for oil & gas companies in recent memory. Despite high energy prices and record cashflows, there is still uncertainty about what future paths to growth might look like.

With volumes of activity for both M&A transactions and debt & equity capital markets deals at historically low levels, many are sitting on their cash (or distributing out their cash through dividends or stock buybacks) while those companies without large cash piles have turned to alternative lenders to fund growth.

Decarbonization remains a key driver of both deal activity and policymaking, creating challenges and opportunities in equal measure. As we go into a U.S. presidential election year, the polarized split between Democrats and Republicans on energy policy has the potential to either turbocharge energy transition efforts or pivot back to or in favor of traditional fossil fuels, scaling back much of the focus in recent years.

At the same time, certain individual investors and other funding sources remain guarded on the extent to which they want to continue supporting oil & gas, creating new dynamics for the pursuit of both public and private capital.

Still, there are signs of a turning tide. In the latter part of 2023, we saw several definitive megadeals and hints of an IPO window opening, suggesting we may be in for a wave of consolidation in 2024 and that investor appetite for oil & gas may be reviving.

But as we explore in the following commentary, the evolving macro and political backdrop cannot be ignored— how hydrocarbon prices will fare, how the U.S. electorate will vote, how markets will react and how legislators will respond all remain to be seen.

Our view is that the next 12 months are set to be more active than the prior year on many fronts as the oil & gas industry's longer-term trajectory continues to take shape. We hope the insights we share here will prove useful to those exploring new opportunities and addressing challenges.

Pursuing Capital for Growth

The past year has been broadly characterized as one of limited public market activity and rising interest rates putting a dampener on access to capital. For the oil & gas industry, higher and relatively steady commodity prices going into 2023 led commentators to predict a busy year for U.S. energy IPOs, but the volume of debt & equity offerings remained at historically low levels, at least for the first half of the year. With bank lenders and some institutional investors also continuing to retreat from the market, it has been a year in which alternative sources of capital have come to the fore.

Capital Markets

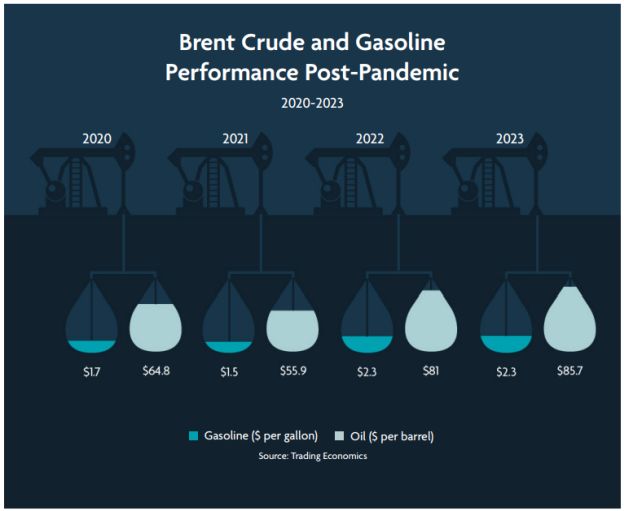

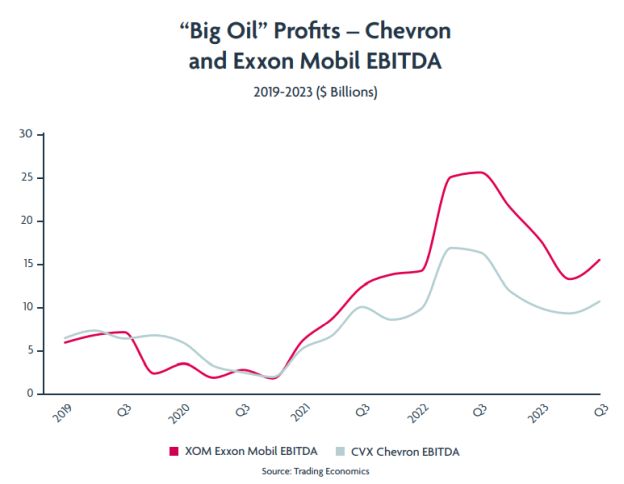

Oil & gas companies have traditionally raised equity & debt in the capital markets during times of strong oil & gas prices and the capital markets have typically been closed during periods of price weakness. That cycle began to change in 2019 as investors started to leave the traditional hydrocarbon space—often in favor of tax favored energy transition investments. When hydrocarbon prices strengthened post pandemic, the demands of existing investors led now-profitable oil & gas companies to focus on cash flow instead of growth.

The energy transition will not mean the end of traditional oil & gas, but rather a move to a much more diverse range of new and existing energy sources.

As a result of both investors cycling out of traditional hydrocarbons and the focus on cash flows, many of those companies generally chose not to attempt to access the capital markets outside of garden-variety refinancing of maturing paper, leading to a sustained period of depressed capital markets activity in the sector.

As we move into 2024, that impasse has begun to unlock across the space. We have seen a significant increase in high-yield activity, as well as a larger volume of public equity offerings in the traditional hydrocarbon market in the second half of 2023.

Non-energy participation in the U.S. capital markets has been choppy for some time, with stock prices hit hard by interest rate increases and post-pandemic instability, but investors appear to have noticed that oil & gas companies have been enjoying strong profitability for the past two years. That is, in part, aligned with a growing understanding that energy transition will not mean the end of traditional oil & gas, but rather a move to a much more diverse range of new and existing energy sources.

We expect this increased activity in oil & gas capital markets to continue for the next 18 months or more, assuming no significant recession. Oil & gas has long been viewed as a reasonable inflation hedge and there appears to be an IPO window opening up going into the new year. While recent large consolidations raise questions about the depth of investor appetite for public energy companies, we do see the markets warming for follow-on investments, as well as targeted IPOs, and expect the next 12 months to be considerably more active than the last three years.

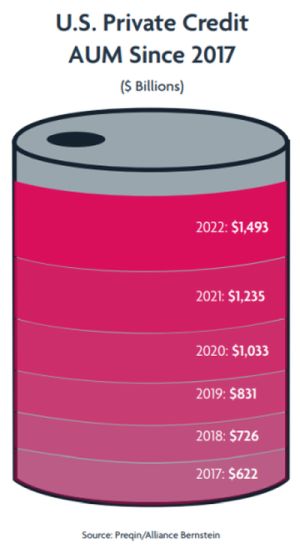

Private Credit

For mid-market oil & gas companies in particular, the past year has been challenging on the fundraising side, as it has proved difficult to access capital from both traditional bank lenders and the capital markets.

Coupled with a heightened focus on ESG concerns, we have seen more major banks and large financial institutions pledge to stop supporting upstream oil & gas projects, and in certain cases, actively pull back from lending to hydrocarbon-focused companies, even seeking to exit their existing credit facilities.

Given this backdrop, private credit funds have been quick to step in and fill the void, seizing an opportunity to build market share. Credit funds are traditionally industry agnostic in nature, but the oil & gas space has proved different given the specialized knowledge required to value the underlying assets. That perhaps led to some initial reticence from funds embracing oil & gas lending, but as the private credit industry matures, we see more and more examples of funds replacing banks as lenders.

The attractiveness of private credit to oil & gas borrowers has grown, with much of the surge on the demand side driven by the flexibility in structuring that can be offered through bilateral lending arrangements. Upstream oil & gas companies have been using their proved, developed and producing reserves and related cash flows as collateral for asset-backed financings, for instance, which has proved an easier and more efficient structure to execute and is just one example of the creativity possible outside of traditional bank syndicates.

To view the full article, click here.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.