Survey respondents are also optimistic about AI's potential to improve the sector, and they expect investment in datacenters to increase as AI's adoption curve continues to rise.

The mood was notably optimistic at our annual Real Estate and Capital Markets (RECM) conference this year, which brought nearly 400 commercial real estate (CRE) investors and experts together to talk about the future of the sector. That optimism is reflected in attendees' responses to our 2024 Outlook for Commercial Real Estate Survey.

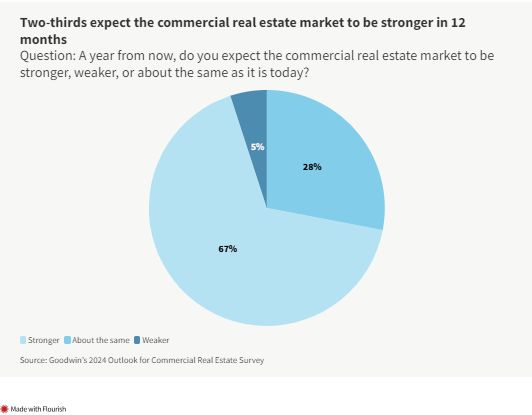

Most notably, almost 70% of respondents expect the CRE market to be stronger 12 months ahead. Other highlights include:

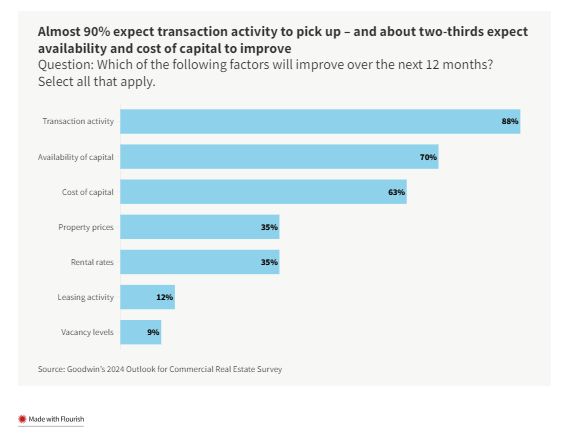

- Almost 90% of respondents expect transaction activity to increase, bolstered by improvements in availability and cost of capital.

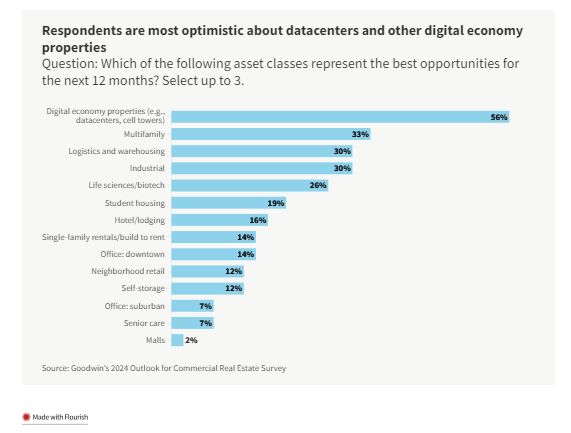

- 56% see digital economy properties, including datacenters, as the best asset class for investment opportunities.

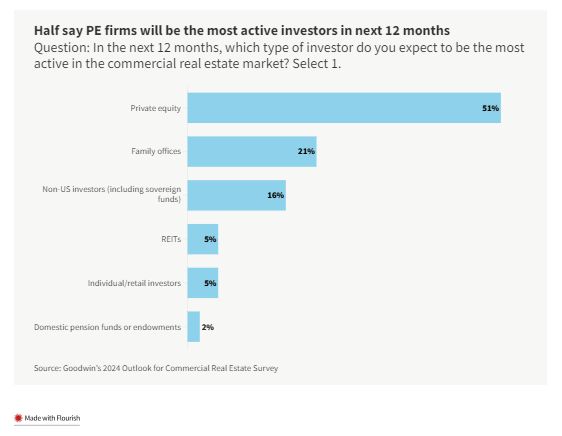

- Half expect private equity firms to be the most active investors in the sector.

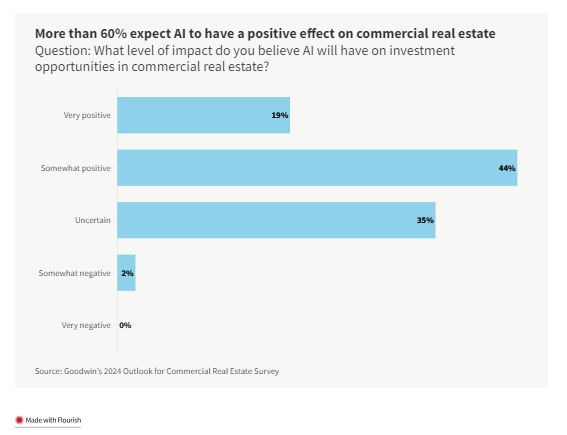

- Two-thirds expect AI to have a positive effect on CRE.

See the following charts for more details from the survey. Visit our RECM 2024 page to for more insights from the event, including full-length speaker and panel videos.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.