In December 2022, the Securities and Exchange Commission (SEC) adopted amendments to Exchange Act Rule 10b5-1, the rule that provides an affirmative defense to claims of insider trading for persons acquiring or disposing of company stock pursuant to an appropriately adopted trading plan. The amendments impose significant new restrictions on the adoption and use of Rule 10b5-1 trading plans. In addition, the new rules include several new disclosure and reporting requirements that seek to address SEC concerns regarding insider trading.

Below we provide an overview of Rule 10b5-1 and the recent amendments and identify practical considerations for issuers and company insiders.

Background

The SEC adopted Rule 10b5-1 in 2000 to define when a purchase or sale constitutes trading "on the basis of" material non-public information (MNPI) in insider trading cases brought under Section 10(b) and Rule 10b-5 of the Exchange Act.1 Rule 10b5-1 broadly provides that a person trades "on the basis of" MNPI when the person "was aware of" MNPI at the time of the trade.2 However, the rule also provides an affirmative defense to insider trading where a trade is made pursuant to a written contract, instruction or plan (hereinafter plan) to purchase or sell the securities that was entered into when the trader was not aware of MNPI.3 The plan must either (i) specify the price, amount and date of the trade, (ii) include a written formula or algorithm for determining the price, amount and date of the trade, or (iii) not allow the adopter of the plan to exercise any subsequent influence over how, when or whether a trade occurs.4

In recent years, the SEC has voiced increasing alarm that insiders may be abusing Rule 10b5-1 plans based on concerns by the SEC about, among other things, the lack of requirements for a "cooling off" period after adoption, insiders' ability to establish multiple plans, and the fact that plans can be canceled at any time, including when an insider is in possession of MNPI. In June 2021, SEC Chairman Gary Gensler reported that he had asked the SEC staff to review the rule and consider potential reforms,5 and in December 2021, the SEC initially proposed rule amendments "intended to reduce . . . potentially abusive practices associated with Rule 10b5-1(c)(1) trading arrangements."6

Nearly one year after proposing the initial amendments, the final rule was adopted by the SEC in a surprising unanimous 5-0 vote. In the adopting release, the SEC described the amendments as "designed to address concerns about abuse of the rule to trade securities opportunistically on the basis of material nonpublic information in ways that harm investors and undermine the integrity of the securities markets."7 During an open meeting at which the final rule was adopted, the SEC chair and all four other commissioners commented on the importance of taking action to curb potential abuses of Rule 10b5-1.

Amendments to Rule 10b5-1

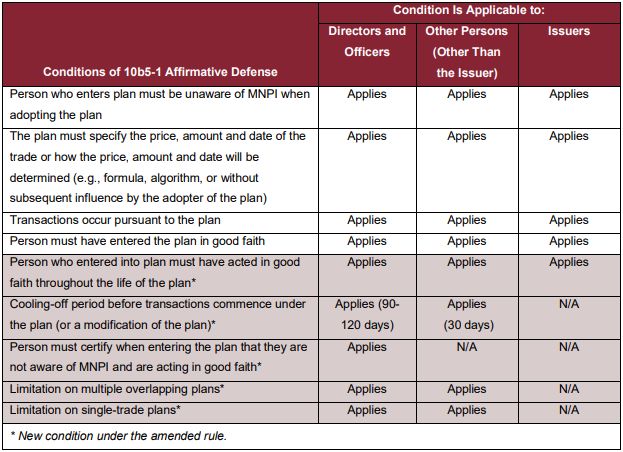

The amendments impose new requirements for insiders to avail themselves of the affirmative defense to insider trading provided by Rule 10b5-1(c). The requirements of Rule 10b5-1(c), as amended, are summarized in the table below, followed by discussion of the amended provisions (which are highlighted in the table).

Cooling-Off Periods for Insiders. Rule 10b5-1 plans put in place by directors and "officers" (as defined in Rule 16a-1(f)) of an issuer must include a cooling-off period for both plan adoptions and modifications. The cooling-off period applicable to directors and officers prevents trades from occurring under a plan until the later of:

(i) 90 days following plan adoption or modification or

(ii) two business days following the disclosure in Forms 10-K or

10-Q of the issuer's financial results for the fiscal quarter

in which the plan was adopted or modified,

but in no case is the cooling-off period required to exceed 120 days following plan adoption or modification.

In the adopting release, the SEC expressed the view that because earnings results often are announced prior to the periodic report filing, the cooling-off period outlined in (ii) above is expected to prevent officers and directors from profiting on MNPI contained in a periodic report but not reflected in an earlier-released current report or press release.8 The amended rule, therefore, does not include an exception or shorter cooling-off period in instances where a company discloses its quarterly financial results before filing the corresponding Form 10-Q or 10-K.

Click here to continue reading . . .

Footnotes

1. Selective Disclosure and Insider Trading, 17 C.F.R. Parts 240, 243 and 249 (Aug. 15, 2000), https://www.sec.gov/rules/final/33-7881.htm.

2. 17 C.F.R. § 240.10b5-1(b) (2000).

3. Id. at (c).

4. Id.

5. Chairman Gary Gensler, U.S. Sec. Exch. Comm'n, Prepared Remarks: CFO Network Summit (June 7, 2021), https://www.sec.gov/news/speech/gensler-cfo-network-2021-06-07.

6. Rule 10b5-1 and Insider Trading, Release No. 33-11013 (Dec. 15, 2021), www.sec.gov/rules/proposed/2022/33-11013.pdf.

7. Insider Trading Arrangements and Related Disclosures, Release No. 33-11138 (Dec. 14, 2022), https://www.sec.gov/rules/final/2022/33-11138.pdf [hereinafter Adopting Release].

8. Id. at 142 n. 419.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.