INTRODUCTION

The SEC's Division of Enforcement's 2022 results reflect pledges from Chair Gary Gensler and Director of Enforcement Gurbir Grewal to aggressively enforce the securities laws. Beyond the growing number of filed enforcement actions, the Division of Enforcement (the "Division") has increasingly relied on higher penalty amounts, case-specific undertakings, and executive compensation clawbacks under Section 304 of the Sarbanes-Oxley Act ("SOX 304") in settled actions. The Division has also shown an increased willingness to litigate, taking 15 cases to trial, more than any year in the past decade, and winning summary judgment on liability in another nine cases.1 Given the SEC's ambitious rulemaking agenda, the multi-year duration of Division investigations, and continued public commentary from Gensler and Grewal, we anticipate the level of enforcement activity will only increase in 2023 and beyond.

SUMMARY OF FY 2022 ENFORCEMENT ACTIVITY

After the past two years saw a relative decline in SEC enforcement activity, fiscal year 2022 marked a return to a level of enforcement activity closer to pre-pandemic levels.2

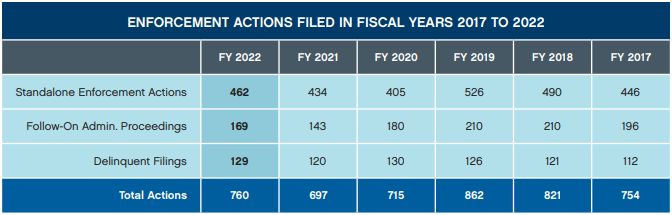

In November 2022, the SEC announced that it filed 760 total enforcement actions in fiscal year 2022 (ending September 30, 2022), which represented a 9% increase over fiscal year 2021. These included 462 stand-alone enforcement actions, a 6.5% increase over fiscal year 2021.3

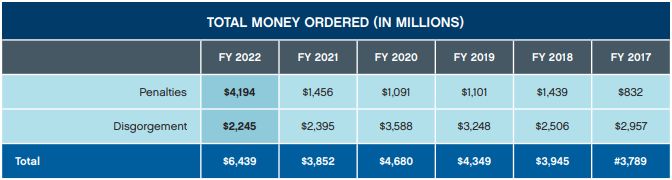

While the number of enforcement actions remains below recent levels, the SEC obtained a record $6.4 billion in civil penalties, disgorgement, and prejudgment interest during this fiscal year, including a record $4.2 billion in civil penalties.4 This total nearly doubles fiscal year 2021's total relief obtained.5 In addition, the SEC returned $937 million to affected investors, compared to $521 million in fiscal year 2021.6

For companies facing Division scrutiny, this data provides a few key points. Penalty amounts have risen substantially since Jay Clayton's tenure as Chair. Companies evaluating the risk of Division scrutiny or in discussions with the Division should not view penalty amounts in actions settled even two or three years ago as indicative of a settlement structure the SEC will accept today. Companies should also expect the Division to demand all forms of relief available under the facts and circumstances, including actions against individuals for aiding and abetting or causing corporate violations, officer-and-director and penny stock bars, suspension or debarment against accountants and attorneys engaged in misconduct, and SOX 304 reimbursement from CEOs and CFOs. Companies should also note that Division demands for greater relief in settlement are backed up by the Division's increased willingness to litigate enforcement actions under Gensler and Grewal.

Click here to continue reading . . .

Footnotes

1. "SEC Announces Enforcement Results for FY22" (Nov. 15, 2022).

2. "Addendum To Division Of Enforcement Press Release Fiscal Year 2022" (Nov. 15, 2022).

3. "SEC Announces Enforcement Results for FY22" (Nov. 15, 2022).

4. Id.

5. Approximately $1.1 billion of the SEC's penalties came from the September 27 books and records settlements with 15 broker-dealers and an affiliated investment adviser arising from the firms' widespread failures to retain off-channel communications within their businesses. See "SEC Charges 16 Wall Street Firms with Widespread Recordkeeping Failures," (Sept. 27, 2022). Even if these penalties are removed from the calculation, the SEC in 2022 still doubled the amount of penalties imposed in fiscal year 2021.

6. Id.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.