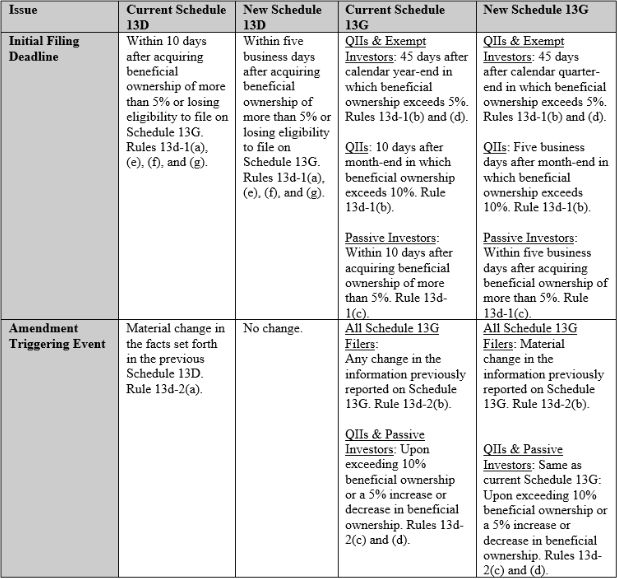

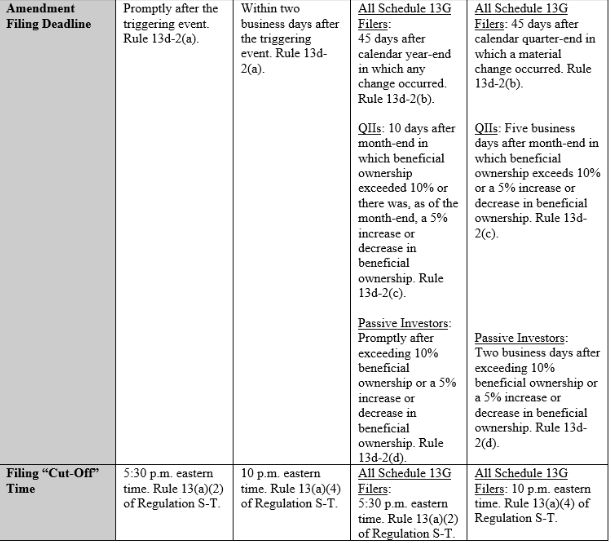

Schedule 13D is required for persons who acquire more than 5% beneficial ownership of a class of equity securities registered under Section 12 of the Exchange Act and who have the purpose or effect of changing or influencing the control of the issuer. Schedule 13G is a short-form alternative to Schedule 13D for certain categories of filers who have a passive or limited investment intent. These categories include Qualified Institutional Investors (QIIs), Exempt Investors, and Passive Investors, which are defined in more detail in the rules. The table below from the adopting release summarizes the changes with respect to Schedule 13D and 13G filings:

The SEC extended existing guidance regarding security-based swaps and beneficial ownership of the underlying reference securities to other cash-settled derivative securities. The adopting release states that, if the instrument confers voting or investment power over the reference securities or the right to acquire such power, or if the instrument is acquired with the purpose or effect of divesting or preventing the vesting of beneficial ownership as part of a scheme to evade reporting requirements, the holder may be deemed a beneficial owner of the underlying reference securities. In addition, the amendments clarify that cash-settled derivative securities, including total return swaps, are required to be disclosed in Item 6 of Schedule 13D.

Further, the SEC reiterated its view that that Sections 13(d)(3) and 13(g)(3) of the Exchange Act do not require an express agreement for persons to be a "group" for purposes of Sections 13(d) and 13(g) and that, depending on the particular facts and circumstances, two or more persons taking concerted actions for the purpose of acquiring, holding or disposing of securities of an issuer may be sufficient to constitute the formation of a group. Rules 13d-5(b)(1)(iii) and (b)(2)(ii) were also amended to impute acquisitions by group members to the group at any time after the group has been formed (excluding intragroup transfers of securities).

Finally, the amendments require the use of a structured data format, specifically XML, for Schedule 13D and 13G filings to improve the accessibility, usability, and comparability of the information reported by filers and to facilitate the analysis and dissemination of the data by the SEC, investors, and other market participants.

The amendments will be effective 90 days after the date of publication in the Federal Register. The compliance date for the structured data requirement is December 18, 2024, with a voluntary compliance period starting on December 18, 2023. The compliance date for the revised Schedule 13G filing deadlines is September 30, 2024.

To view Foley Hoag's IPO, Then What? Blog please click here

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.