Longer wait times to obtain regulatory approval to close transactions—often exceeding 90 days. More mitigation agreements. A less friendly Declarations process.

On July 31, the Committee on Foreign Investment in the United States (CFIUS or the Committee) released its annual report providing statistics for calendar year 2022. With this latest report we now have two years' worth of CFIUS statistics for the Biden administration, and the numbers are not good for dealmakers.

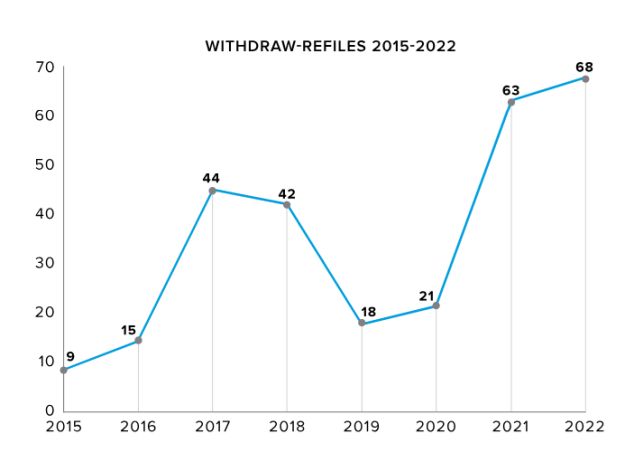

In 2022, CFIUS set a new record for the highest number of withdraw–refiles in a single year, indicating that CFIUS continues to struggle getting its work done within its 90-day statutory deadline. The Committee also set a record for the highest number of mitigation agreements in a single year. Finally, the Committee set a record for the highest number of Notices requested for transactions that were originally filed as Declarations, making the new Declarations process less efficient.

CFIUS set these records even though Chinese companies are filing fewer transactions with the Committee, which means the Committee is spending more time and resources picking apart transactions from countries regarded as neutral, or even as partners and allies.

Overall, the annual report for 2022 shows that the CFIUS process is becoming more difficult to negotiate in a timely and predictable manner and, in some cases, transactions can get bogged down in the CFIUS quagmire for several months.

A complete list of key takeaways from the annual report for 2022 is provided below.

1. TRANSACTION PARTIES ARE SUBMITTING FEWER TRANSACTIONS TO THE COMMITTEE FOR REVIEW.

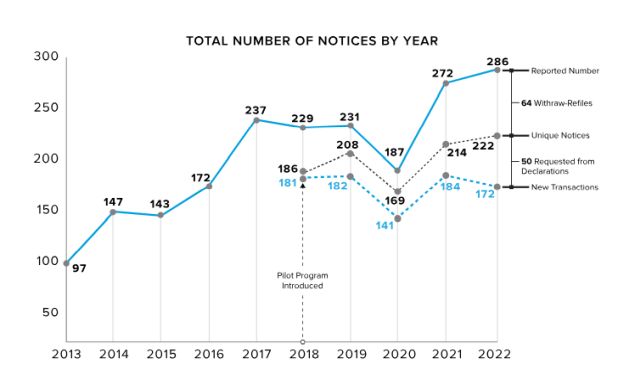

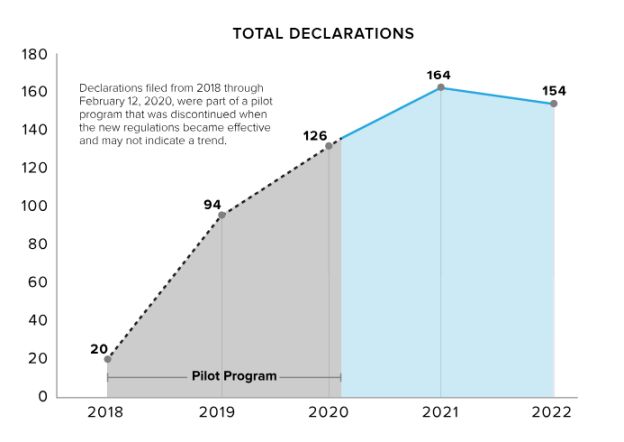

The annual report for calendar year 2022 notes that CFIUS handled 286 Notices and 154 Declarations, for a total of 440 transactions. As in years past, the number of Notices is artificially inflated. But this year, a deeper analysis shows a new concerning trend.

According to the annual report, 64 Notices filed in 2022 were not Notices for new transactions but were rather Notices for old transactions that were originally filed in either 2021 or 2022 and then refiled in 2022 to give CFIUS more time to complete its work.1 Moreover, the annual report notes that CFIUS requested Notices for 50 transactions that were originally filed as Declarations.2 That means that transaction parties decided to submit Notices for approximately 172 new transactions in 2022 (286 − 114 = 172). The reported number is 286 only because CFIUS forced transaction parties to refile a bunch of Notices or file Notices at the end of the Declarations process, which artificially drives up the number of Notices.

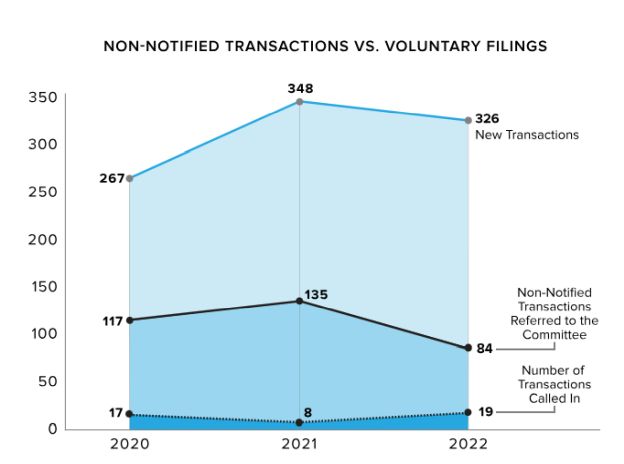

With that background in mind, the annual report for 2022 shows that CFIUS handled approximately 172 Notices and 154 Declarations for new transactions, for a total of approximately 326 filings. Analyzing the annual report for 2021 in the same manner, it appears that in 2021 CFIUS handled approximately 184 Notices and 164 Declarations for new transactions, for a total of approximately 348 transactions.

Thus, the annual report for 2022 shows that the number of new transactions submitted to the Committee for review actually went down from 2021 to 2022, but the Committee spent more time on each transaction by requesting withdraw–refiles or demanding Notices at the end of the Declarations period.

2. CFIUS IS TAKING MORE TRANSACTIONS TO INVESTIGATION.

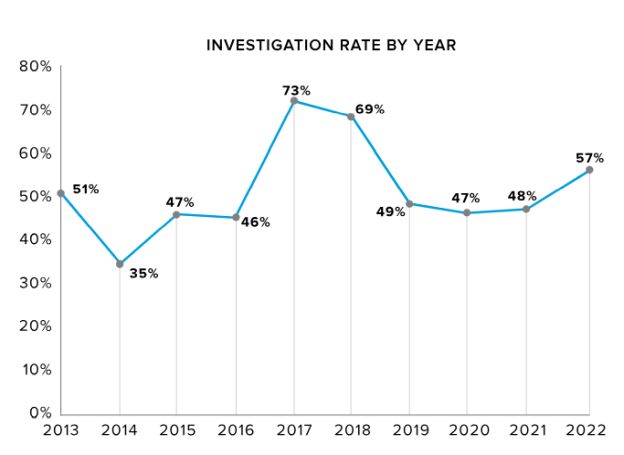

CFIUS reviews are divided into two periods. The first 45-day period is called the review period. The second 45-day period is called the investigation period. Under CFIUS's regulations, the Committee can complete its work and clear a transaction at the end of the review period. Often, transaction parties want to know the odds that the Committee will clear their transaction in review or take the case to investigation. If the case goes to investigation, it will take at least 90 days to get regulatory approval to close the transaction.

In 2022, the investigation rate was 57%, meaning that for every Notice filed with the Committee, there was a greater-than-50% chance that the Committee would not clear the transaction during the review period and would take the case to investigation, using the entire 90-day statutory period (if not longer) to review the transaction.

Historically, most CFIUS transactions are cleared in the review period. Over the last 10 years, CFIUS's investigation rate—the percentage of cases that go to the investigation period—has generally been less than 50%. In 2017 and 2018, there was a huge spike in the investigation rate. Beginning in the second half of 2018, the U.S. Department of the Treasury, the chair of the Committee, made a concerted effort to reduce the investigation rate (which was around the same time that Congress passed a new statute extending the review period for 15 more days, which also certainly helped drive down the investigation rate). In 2019 and 2020, the investigation rate dropped to 49% and 47%, respectively. In 2021, the first year of the Biden administration, the investigation rate remained at a stable 48%, suggesting that the spike in 2017 and 2018 was an aberration and that the investigation rate had returned to its historical rate of less than 50%. Last year, the investigation rate crept back up to 57%, lower than the 2017-2018 spike but higher than the historical average.

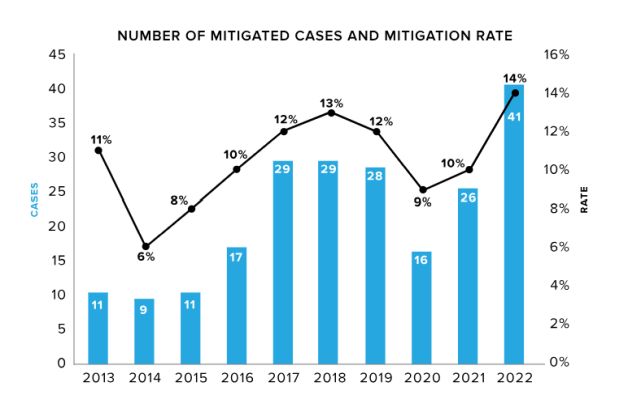

3. CFIUS SET A NEW RECORD FOR THE HIGHEST NUMBER OF CASES MITIGATED IN A SINGLE YEAR.

Last year, CFIUS concluded action after adopting mitigation agreements with respect to 41 Notices—the highest number of mitigation agreements in a single year in the history of CFIUS.

We believe that the mitigation numbers are high, at least in part, because the Committee is mitigating national security risks that are more speculative in nature. This is particularly true for transactions where a foreign investor makes a minority controlling investment3 in a target U.S. business. If the transaction before the Committee does not give rise to a national security risk, and the Committee provides the parties with a safe harbor letter, the Committee knows that it will not be able to review the transaction again, even if the foreign investor acquires a larger stake in the target U.S. business at a later date. If the Committee believes that a future investment might create a risk to U.S. national security, it appears that the Committee is getting more comfortable requiring mitigation, even if the present transaction presents no risk, and even if there is no evidence that a future transaction is likely.

Future annual reports will be improved if they include a breakdown of the number of mitigation agreements signed by each CFIUS member agency.4 That would give Congress and the public a better understanding of which CFIUS member agencies are demanding mitigation agreements, and Congress can exercise more oversight over those agencies to ensure that mitigation agreements are supported by credible evidence and narrowly tailored.

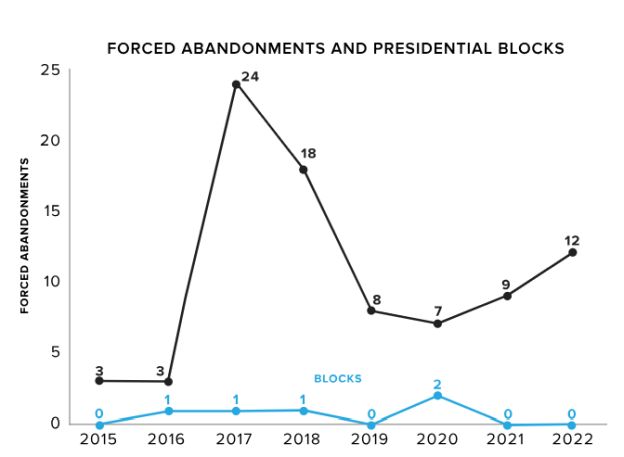

4. THE NUMBER OF FORCED ABANDONMENTS IS UP.

As most CFIUS watchers are aware, CFIUS rarely sends a transaction to the President of the United States with a recommendation to block. In most cases, when CFIUS tells the transaction parties that it cannot identify any mitigation measures that will resolve its national security concerns and that it intends to send the transaction to the President, the transaction parties almost always walk away from the deal rather than incur the reputational damage of having a transaction publicly blocked by the President of the United States. Thus, by simply threatening to send a transaction to the President, CFIUS can effectively block a transaction, which we refer to as a "forced abandonment."

CFIUS only recently started publishing statistics identifying the precise number of forced abandonments—i.e., transactions where the transaction parties walked away from a deal after the Committee threatened to refer the transaction to the President. Over the years, the number of forced abandonments has been relatively low. Other than a spike in 2017 and 2018, forced abandonments have averaged less than 10 per year. In 2022, that number increased to 12.

5. CFIUS SET A NEW RECORD FOR THE HIGHEST NUMBER OF WITHDRAW–REFILES IN A SINGLE YEAR.

In 2022, CFIUS forced the parties to withdraw and refile their transactions 68 times.

The massive increase in withdraw–refiles over the last two years indicates that the Committee is having serious problems completing its work within the 90-day statutory deadline. Transaction parties that voluntarily choose to go through the CFIUS process need to be aware that there is an increased probability that it will take longer than 90 days to obtain regulatory approval for a transaction.

6. TRANSACTION PARTIES FILED FEWER DECLARATIONS.

The total number of Declarations filed in 2022 was 154, which was 10 fewer than the previous year.

Given that we only have two years of comparable data, it is hard to know whether the decline in Declarations from 2021 to 2022 is a trend. But the statistics provide some evidence that transaction parties and their CFIUS counsel may be choosing to forgo the Declarations process because, as discussed below, they are less confident that their Declarations will get cleared.

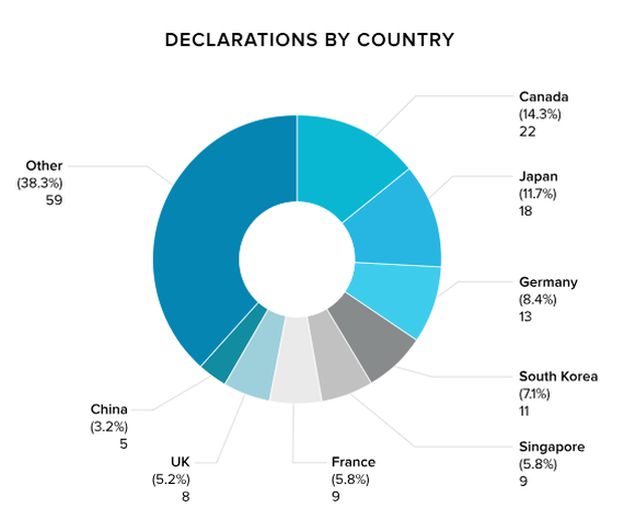

7. MOST DECLARATIONS WERE SUBMITTED BY PARTNERS AND ALLIES.

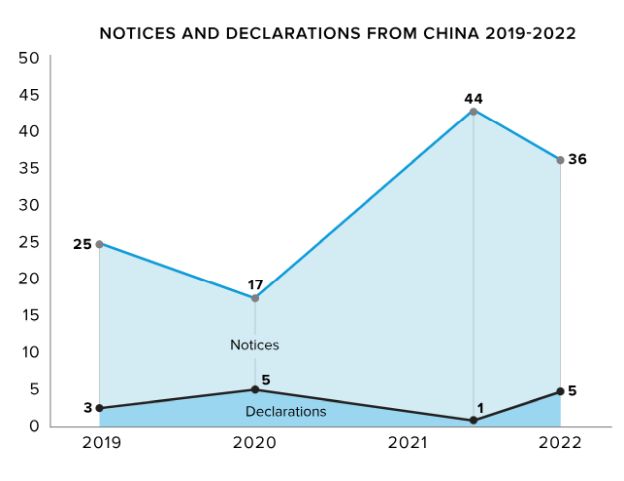

The countries that submitted the most Declarations in 2022 were, unsurprisingly, Canada, Japan, Germany, South Korea, Singapore, France, and the United Kingdom. Chinese companies submitted only five Declarations.

In the current geopolitical climate, it is a little surprising that Chinese entities attempted as many as 5 Declarations. It's possible that, for these transactions, the Chinese investors did not believe CFIUS had jurisdiction over their transaction and filed a Declaration out of an abundance of caution so that CFIUS could review the jurisdictional issue.

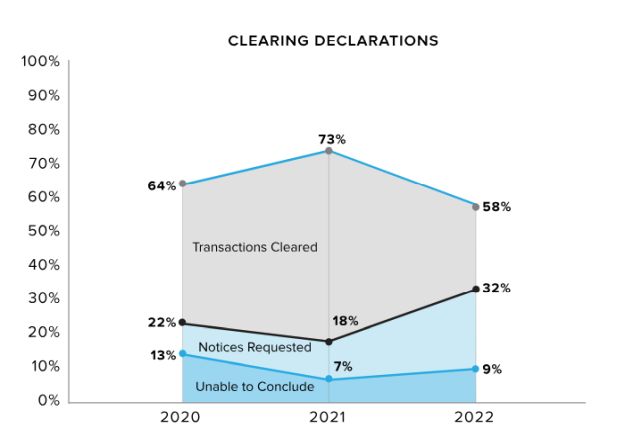

8. EVEN THOUGH MOST DECLARATIONS WERE SUBMITTED BY PARTNERS AND ALLIES, CFIUS'S CLEARANCE RATE DROPPED RATHER DRAMATICALLY.

At the end of the Declarations process, the Committee has three primary options: (1) clear the transaction; (2) request a Notice; or (3) refuse to complete action, which means that the Committee does nothing—it does not clear the transaction, but it also does not request a Notice.

In 2020—the first year that CFIUS's new regulations for Declarations were effective—the Committee cleared 81 out of 126 Declarations, which is a clearance rate of 64%. The next year, 2021, the Committee cleared 120 out of 164 Declarations, which is a clearance rate of 73%. This year, CFIUS cleared only 90 out of 154 Declarations, and its clearance rate dropped to 58%.

The drop in clearance rate is a surprise. If anything, given that China transactions were so low, the clearance rate should have increased. The fact that it did not means that the Committee refused to clear dozens of Declarations filed by partners and allies. If this trend continues, it is likely that transaction parties will file even fewer Declarations in the future.

9. ONLY A SMALL PERCENTAGE OF TRANSACTIONS REVIEWED BY THE COMMITTEE COME FROM THE NON-NOTIFIED TEAM.

In 2022, the non-notified team identified only 84 transactions that were put forward to the Committee for consideration, which is a drop from the previous two years. Of the 84 transactions put forward to the Committee, 11 resulted in filings in 2022. In addition, 8 non-notified transactions identified in prior calendar years resulted in a 2022 request for filing.

The total number of filings in 2022 that resulted from the non-notified process was only 19, which is a relatively small percentage of the transactions reviewed by the Committee. If CFIUS reviewed approximately 326 new transactions (172 Notices and 154 Declarations) in 2022, then only approximately 6% came from the non-notified process. That percentage may actually be a bit higher, given that the report notes that some transaction parties contacted by the non-notified team voluntarily submitted filings and did not wait for the Committee to request one. But the statistics show that the overwhelming number of transactions reviewed by the Committee are voluntarily filed by the parties using the regular CFIUS process, and that only a handful of transactions filed each year come from the non-notified team.

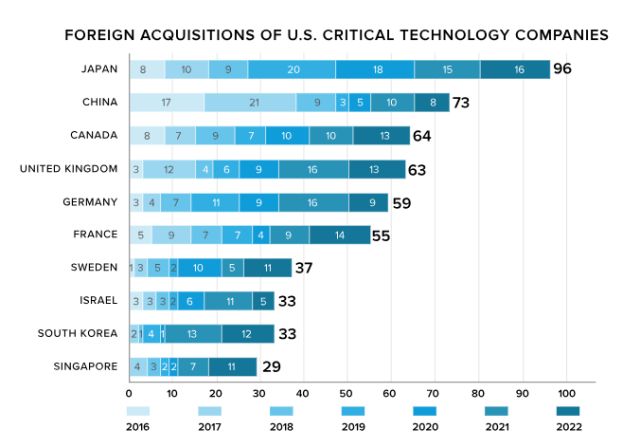

10. MOST FOREIGN INVESTMENTS IN U.S. CRITICAL TECHNOLOGY COMPANIES ARE MADE BY PARTNERS AND ALLIES.

In 2022, the main countries of origin for critical technology transactions were Japan, France, Canada, the United Kingdom, South Korea, and Sweden.

Although the annual report claims that China was involved in 8 transactions involving U.S. critical technology companies, there is reason to believe that number is inflated. The report states that the numbers in the chart do not represent "distinct transactions," which means that if the same case were withdrawn and refiled multiple times, each refile would be counted in the chart. If we had to guess, we would say that China invested in fewer than 8 U.S. critical technology companies in 2022, but those transactions had to go through multiple withdraw–refiles, which increased the number to 8.

11. CHINA TRANSACTIONS ARE GOING DOWN.

The annual report for 2022 shows that the total number of China transactions has gone down from last year, from 45 to 41.

That being said, 41 transactions seems high. The annual report does not break down these statistics, but it is reasonable to assume that a vast majority of the 19 or so transactions that were filed in 2022 at the request of the non-notified team involved China. It also seems reasonable to assume that the China transactions often involved (multiple) withdraw–refiles, which artificially inflates the number. Although the report is not clear on exactly how many times new transactions were filed by Chinese investors in 2022, it is fair to assume the number was low—probably much lower than 41.

12. TRANSACTION PARTIES MUST THINK CAREFULLY BEFORE SUBMITTING A VOLUNTARY CFIUS FILING.

For dealmakers, the main takeaways from the 2022 annual report are clear. If a CFIUS filing is mandatory, dealmakers need to be prepared for the CFIUS process to take longer than 90 days, even if the transaction does not involve Chinese parties. Moreover, dealmakers should be prepared for CFIUS to require mitigation in circumstances where the need for mitigation does not appear obvious.

On the other hand, if a CFIUS filing is not mandatory the transaction parties should carefully evaluate whether it is better to finalize the transaction and take the risk that CFIUS's non-notified team will subsequently identify the transaction and request a filing, or whether it is better to voluntarily disclose the transaction before closing and risk that CFIUS will delay the transaction unnecessarily or demand mitigation measures that may appear to be unreasonable to the parties.

Footnotes

1. The annual report for 2021 notes that 11 transactions were withdrawn and refiled in 2022. The annual report for 2022 notes that 53 transactions filed in 2022 were withdrawn and refiled in 2022. That means a total of 64 transactions that were filed as Notices in 2022 were not original filings giving CFIUS notice of new transactions but were rather old transactions that CFIUS needed more time to review.

2. Although the annual report does not clarify, we think it is reasonable to assume that most—if not all—of the 50 Notices requested by CFIUS at the end of the Declarations process were filed in 2022.

3. We use the term "minority controlling investment" to refer to a transaction where a foreign investor makes a minority investment in a target U.S. business, but because of CFIUS's very low standard for control, the minority investment gives the foreign investor "control" over the target U.S. business.

4. The Department of the Treasury is a signatory to every mitigation agreement, but that is primarily for housekeeping measures to ensure that the chair of the Committee is properly informed of the Committee's activities. Simply because Treasury has signed a mitigation agreement does not necessarily mean that Treasury favored mitigation.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.