Background

Our survey analyzed the terms of 171 venture financings closed in the fourth quarter of 2023 by companies headquartered in Silicon Valley.

Summary

Fourth-quarter Bay Area venture capital financings remained largely flat from the preceding four quarters (average of 174). Q4 was also notably consistent with the prior quarter, aside from select data points.

The Fenwick Venture Capital Barometer", measuring the average percentage share price change between rounds, has remained consistent since Q4 2022 (87% in Q4 2023).

Key Findings

Series B Financings Lead Growth, Other Series Largely Flat

Series B financings (55 in total) comprised 32% of all Q4 financings, up from 25% in Q3. Series A financings (80 in total) comprised 47% of all Q4 financings, falling slightly from 53% in Q3. Later stage financings (36 in total) comprised 21% of all Q4 financings, which is largely flat from 22% in Q3.

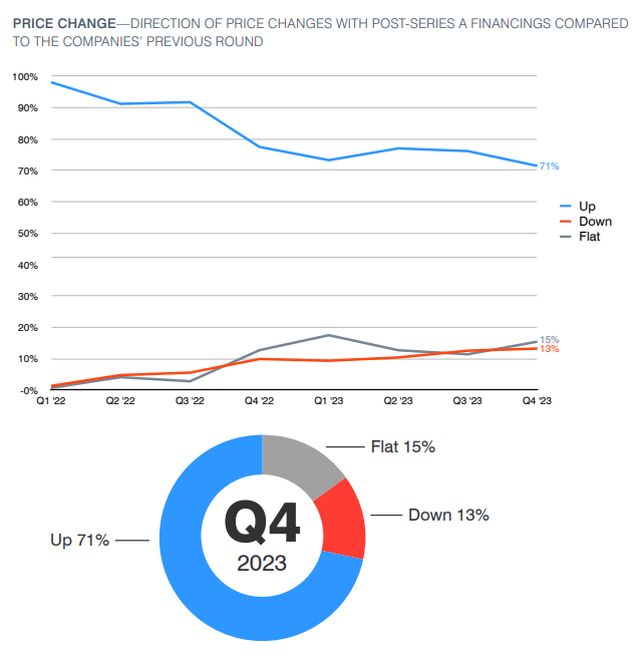

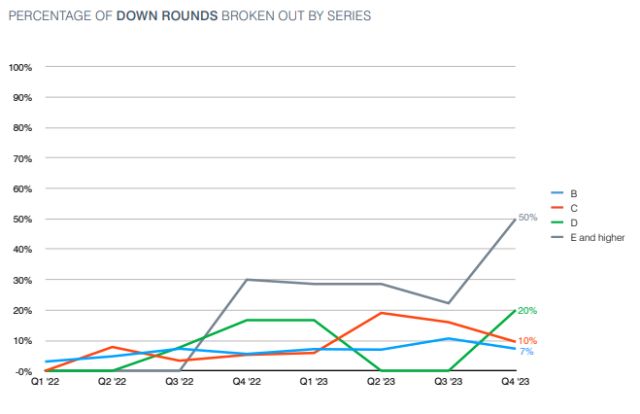

Down Rounds Grow Slightly

The percentage of down rounds grew slightly, continuing its upward trend from 1% of all financings in Q1 2022 to 13% in Q4 2023. This is the highest percentage of down-round financings since Q1 2020, when they jumped to 14% around the onset of the COVID-19 pandemic. Series E+ financings continue to be the most heavily impacted. Life science companies represented the greatest percentage of down rounds in Q4, at 26%.

Median Price Change Flat

Overall, median price change remained unchanged at 44% in Q4 compared to Q3. Software and internet / digital media companies continue to outperform other companies in median price change.

Pay-to-Play Provisions Flat

The share of financings that included pay-to-play provisions providing for conversion of nonparticipating investors' preferred stock into common stock or shadow preferred stock was 4% in Q4, which is consistent with the average level in the preceding four quarters.

Fundraising Environment Remains Difficult

Overall, financing terms continue to be investor favorable, and the fundraising environment remains challenging, as evidenced by an elevated level in corporate restructurings (6% of all financings in Q4), the slight increase in down rounds and other key markers.

Fenwick Data on Valuations

Price Change

To view the full article, click here.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.