On Dec. 23, 2023, the federal government released the proposed Criminal Interest Rate Regulations (Regulations) in the Canada Gazette, which have the effect of reducing the criminal interest rate under section 347 of the Criminal Code. The criminal interest rate, which is currently an effective annual rate (EAR) of 60 per cent – or approximately 48 per cent on an annual percentage rate (APR) basis – is set to be reduced to 35 per cent APR. Although these changes are not yet in force, this significant development should prompt lenders across Canada to re-evaluate their existing loan portfolios and lending policies.

The proposed Regulations come with significant exemptions for certain types of commercial loans and pawn loans. Payday loans are subject to separate prohibitions. The proposed Regulations, along with the Budget Implementation Act, 2023, No. 1 (BIA), present the most significant overhaul to the criminal interest rate regime in Canada since 1980. The objective of the proposed Regulations is to protect vulnerable borrowers that are often extended very high interest rate loans, such as low-income Canadians, newcomers to Canada, and people with limited credit history, while also exempting loans that do not constitute predatory lending practices.

Key facts

- The lowering of the criminal interest rate to 35 per cent APR is set out in the BIA, which has already passed, but is not yet in force.

- The criminal interest rate applies to nearly all credit agreements and arrangements in Canada, although commercial loans, payday loans and pawn loans are subject to additional considerations or different prohibitions.

- The proposed Regulations set out details that add to the changes set out in the BIA and set out some exceptions from the application of the criminal interest rate. Since the Regulations are in draft form, the proposed Regulations are subject to change and the government is in the midst of a stakeholder consultation on the proposed Regulations.

- The changes in the BIA and the proposed Regulations are a significant change to Canadian lending law and the government has indicated that it intends to lower the criminal rate further in the future.

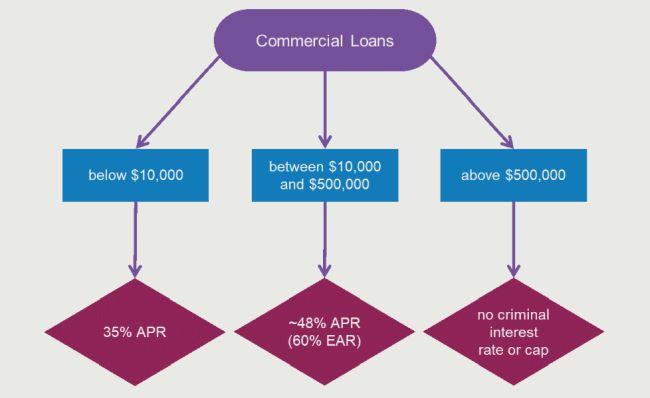

Commercial loans

Commercial loans are business loans to borrowers that are corporations – not individuals – and as such do not trap individual Canadians in a cycle of debt. While there is currently no information about when the proposed Regulations will come into force, it is important for our clients and those in the lending space to start thinking about the effects that the proposed Regulations and their exemptions have on commercial loans. The proposed Regulations will exempt commercial loans from the reduced criminal interest rate. The exemptions are:

- Commercial loans valued from $10,000 to $500,000 will be exempt from the reduced criminal interest rate of 35 per cent. As such, there are no changes to loans of this amount – the criminal interest rate for these loans will remain at approximately 48 per cent APR. This exemption allows businesses to attract capital investment for risky endeavors while offering high rates of return, allowing them to hedge risk and grow their businesses.

- Commercial loans valued over $500,000 will no longer be subject to any criminal interest rate, to benefit venture capital financing, private equity, and automotive floor financing, among other types of sophisticated financing.

These exemptions prevent a potential cooling effect that the proposed Regulations could otherwise have on commercial loans. The federal government acknowledges that most commercial lending does not require a strong degree of regulatory oversight, as the parties involved in these types of transactions are sophisticated.

The intended target of the proposed Regulations are commercial loans valued below $10,000. These loans will be subject to the new 35 per cent APR criminal interest rate in order to deter lenders from circumventing the criminal interest rate by giving consumer loans instead of commercial loans. This is especially important to note as currently institutional lenders set their maximum internal interest rate limits such that they do not come close to the approximately 48 per cent APR criminal rate to allow for a buffer between their maximum rate and the criminal rate. However, when the proposed Regulations come into force, these existing buffers may no longer be sufficient.

Lenders engaged with commercial loans should consider whether to amend any of their internal lending policies to take this change into account. While lenders will not need to lower the interest rates on loans of greater than $500,000, they will need to adjust their documentation and policies to reflect the fact that there will no longer be an interest rate cap on commercial loans of this amount at all.

Pawn loans

The proposed Regulations will also exempt certain pawn loans that are not viewed as predatory. Most pawn loans are not viewed as predatory because they are non-recourse collateralized loans of small dollar value where collateral is retained by the lender if the debt is not repaid, and do not affect a borrower's credit score. Pawn loans of less than $1,000 will be exempted so long as the APR does not exceed the existing criminal interest rate of approximately 48 per cent APR. However, the proposed Regulations will implement the new reduced criminal interest rate of 35 per cent for pawn loans of $1,000 and greater to disincentivize people from obtaining pawn licenses to offer high-value pawn loans.

Payday loans

The proposed Regulations also seek to limit the cost of borrowing on payday loans, which are defined in section 347.1(1) of the Criminal Code as "an advancement of money in exchange for a post-dated cheque, a pre-authorized debit or a future payment of a similar nature." Payday loans must also be for less than $1,500 and for a period of 62 days or less. Lenders will be subject to a limit of $14 per $100 borrowed in all provinces that currently have a payday loan regime. Provinces that have higher limits will need to reduce the cost of borrowing in order to comply with the Criminal Code. The proposed Regulations will also exclude dishonoured cheque fees of $20 or less from the $14 rate limit and will set a one-time dishonoured cheque fee cap at $20. Provinces that allow fees higher than $20 will need to lower their fee to comply with the Criminal Code.

Next steps

The proposed Regulations are currently the subject of a government consultation, and they may be amended to reflect feedback received in the consultation. Those wishing to participate in the consultation are strongly encouraged to use the online commenting feature that is available on the Canada Gazette website. The proposed Regulations will come into force three months after the final proposed Regulations are published in the Canada Gazette, Part II and will coincide with the coming into force of the amendments to the Criminal Code set out in the BIA. The amendments to the Criminal Code will come into force on a day to be fixed by order of the Governor in Council.

The government recently completed a complementary consultation about further lowering the criminal interest rate, increasing access to low-cost, small-value credit in Canada, and additional revisions to the payday lending exemption.

Currently, we have no indication about when these changes will come into force. Until that time, lenders should be thinking about the ways their documentation and policies may need to be adjusted.

Read the original article on GowlingWLG.com

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.