Deal analysis and key highlights of the Maples Group's unique 'One Group' solution for US CLO managers seeking a temporary alternative issuer jurisdiction to launch EU risk retention compliant deals

THE MAPLES (ONE) GROUP APPROACH

- In close collaboration with our Jersey legal and fiduciary colleagues, the Maples Group Cayman Islands based CLO team, together with our Delaware fiduciary and Irish listing teams, helped to create a unique 'One Group' full-service solution for US CLO managers seeking a temporary alternative issuer jurisdiction to launch EU risk retention compliant CLOs.

- Our unique handling maintained existing relationships, knowledge sharing and seamless deal execution with enhanced time-zone coverage.

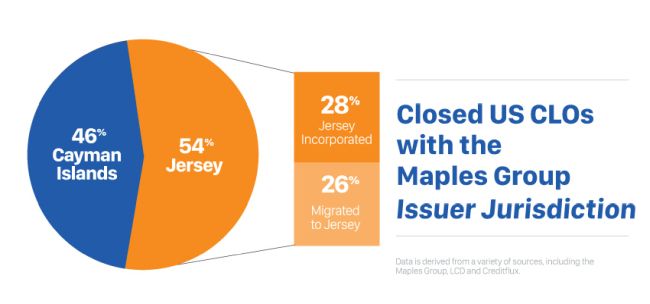

- The Maples Group is proud to have been recognised as the market leading offshore CLO issuer firm through its engagement on over 140 US CLOs that priced in the period March 22 to March 23, representing over 50 managers. Our substantial (and leading) market share gives us unparalleled visibility over trends and developments.

- The Maples Group's active and constructive engagement with the Jersey Financial Services Commission has helped to strengthen the jurisdiction's offering for securities issuances and ensure it is responsive to market requirements and is a sophisticated choice outside of the Cayman Islands.

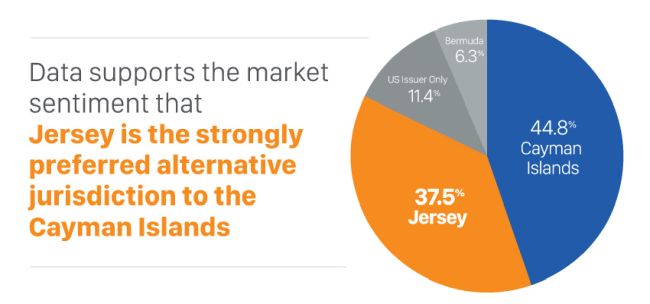

- Jersey is the strongly preferred alternative to the Cayman Islands while we remain on the EU AML list.

- For the Maples Group, issuer jurisdictional split has tended to fluctuate around the 50:50 mark during the review period.

- The Maples Group has not been instructed to use any alternative jurisdiction to the Cayman Islands other than Jersey.

INDICATIONS OF CORRELATION BETWEEN WAREHOUSE DURATION AND EU RR / NON-EU RR COMPLIANT CLOS

- Due to historic use of Cayman Islands SPVs in US CLOs, the need for Jersey SPVs in the majority of cases arises since the SPV is treated as a 'SPPE' for EU Securitisation Regulation purposes, indicating the deal is structured as EU RR compliant.

- Jurisdiction correlation therefore gives a hint as to the impacts of marketing in EU

EU AML DE-LISTING TIMELINE

- At the last plenary session in February 2023, FATF noted the Cayman Islands had made continuous progress towards completing the final recommended action regarding investigations and prosecutions of money laundering cases.

- To the extent further significant progress is made by the June 2023 plenary, we remain hopeful that FATF will remove the Cayman Islands from its "Monitoring List", or 'grey' list.

- In turn, the Cayman Islands is then expected to be removed from the EU AML List in due course, when next updated.

CAYMAN ISLANDS MINISTER OF FINANCIAL SERVICES AND COMMERCE STATEMENT

In a statement issued to James Reeve, Partner, in connection with the Maples Group's successful navigation of the Cayman Islands EU AML listing for regular clients of the Cayman Islands, Hon. André Ebanks, Minister of Financial Services and Commerce, commented about the jurisdiction as follows:

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.