HIGHLIGHTS

The measures announced tonight by the Minister of Finance, the Economy and Investment in the budget speech for 2013 include:

|

Progressive reduction of top 35% income tax rate to 32% (reducing to 29% and 25%) on income up to €60,000 |

Extension from 7 to 12 years of opt-out period from 12% final tax on transfers of immovable property |

Removal of duty on inheritance and donation of property from parents to children |

|

Possibility of alternative property valuations for tax purposes in respect of immovable property transfers |

Introduction of possibility of tax neutral mergers and divisions subject to prior Revenue approval |

Enhancement of benefits for certain industrial, cultural, film making and other services activities |

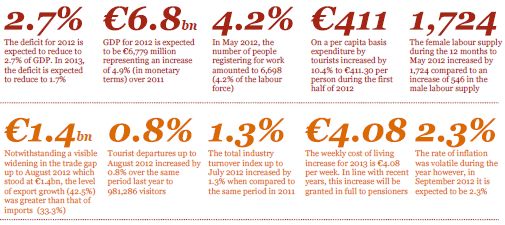

THE ECONOMY 2012

Property related measures

Income tax and stamp duty

The period for opting out of the 12% final withholding tax capital gains regime on transfers of immovable property situated in Malta will be extended from 7 to 12 years.

People taking a bank loan to finance the purchase of their residential home may provide a valuation of the property by the bank's architect and such valuation would represent the market value for tax purposes. In other cases where the value of the immovable property exceeds €250,000, buyer and seller may opt for the property to be valued by the Government's architect (valuation valid for a 6 month period) before concluding the contract of sale, with such value representing the market value for stamp duty purposes.

A donation or transmission causa mortis of immovable property from parents to their children should no longer be subject to duty. Ten year holding period that applied to a transferee post-inheritance will no longer apply when the transferee is a person with special needs.

Stamp duty rate of 3.5% will now apply on the first €150,000 (instead of the first €116,468.67) of the value of the property when a person purchases immovable property as his sole ordinary residence.

Incentives for the restoration and development of property

A 25% refund (30% for property situated in Valletta) of the restoration expenditure on residential property up to a maximum of €5,000 will be granted on property classified as grade 1 and 2 and situated in an Urban Conservation Area ("UCA").

Property transferred by Government to NGOs will also benefit from a 25% refund of the restoration expenditure incurred, up to a maximum of €2,500, when the property is classified as grade 1 or grade 2 and situated in a UCA.

Persons purchasing property outside a UCA for restoration and development purposes, satisfying the conditions prescribed by MEPA, will benefit from a reduced stamp duty rate of 2%. Such persons will also be granted an income tax credit of 20% of the restoration and development expenditure, up to a maximum of €200,000.

Reduction of income tax rate for individuals

For Maltese resident individuals, the maximum income tax rate for chargeable income not exceeding €60,000 will be reduced gradually from 35% to 25%. The maximum income tax rate for chargeable income up to €60,000 shall be reduced by 3% for basis year 2013 (from 35% to 32%), by an additional 3% for basis year 2014 (from 32% to 29%) and by an additional 4% for basis year 2015 (from 29% to 25%).

The new tax bands will be as per the table.

Children's allowance

The minimum children's allowance will increase from €350 to €450 per annum for each child. The rate of children's allowance will also be increased for those families dependant on the minimum wage in order to ensure that such families are granted the highest rate of children's allowance (€1,155.90 per annum for each child).

Social security

Parents born between 1 January 1952 and 31 December 1961 and who have stopped working in order to take care of their children will be credited with the equivalent of one year's social security contributions for every child or the equivalent of two year's social security contributions for every child suffering from a disability, provided that such parent resumes gainful occupation. This mechanism already applied to persons born as from 1 January 1962.

The annual sum of €300 allotted to every individual aged 80 and over, living on their own or with family members, will be extended to those aged 78 and over and eventually to those aged 75 and over.

A retirement pension is reduced by the amount of a service pension. This reduction does not take into account the first €1,006 of a service pension and this amount is being increased to €1,206.

Income tax and pension incentives for persons with a disability

Income tax deduction for fees paid in respect of residency services in respite homes or centres or for community support services. This deduction will be capped at €2,500 and will be available to parents or relatives paying such fees.

Non-contributory pensions for disabled persons to be extended to cover other forms of disabilities.

Extension of current pension benefits granted to disabled persons who got married after the 6th of January 2007 to cover disabled persons who got married before such date.

Domestic Mergers and Group Restructuring

The introduction of a possibility for a tax exemption on domestic mergers and divisions subject to a number of conditions, where such conditions would be aimed to ensure that the merger/ division is undertaken for genuine economic reasons.

VAT

The exemption from VAT on diesel purchased by fishermen for fishing purposes will be extended to 2013.

Excise duty

Excise duty on fuel is being increased by €0.02 per litre.

Excise duty on cement is being increased by €5 on every tonne.

Excise duty on cigarettes and tobacco products is being increased by 6% and 8% respectively.

Motor vehicles registration tax

Registration tax on Euro V cars will decrease by a maximum of 30% whereas that for Euro IV cars will increase by an average of 10%. Registration tax on commercial vehicles of type N1 will decrease by 12.5%.

Registration tax on motorbikes with an engine of up to 250cc will be removed and for motorbikes with an engine larger than 250cc, registration tax will decrease by 25%. Minimum car registration tax for cars imported from outside the EU which are more than 5 years old and have carbon dioxide emissions of 130g/km will be decreased to €1,000.

Registration tax on classic, vintage and veteran cars older than 50 years will be removed.

Other incentives related to environment friendly vehicles.

Removal of the road license payable on classic, veteran and vintage cars to be replaced by an administrative fee of €8. Government will grant a sum of €500 on the acquisition of N1 cars or commercial vehicles and on the scrapping of an old vehicle of the same type subject to the satisfaction of certain conditions.

New schemes are being introduced to encourage conversion of vehicle engines to operation using autogas.

Voluntary Organisations and people involved in voluntary work

Voluntary organisations which conform with the provisions of the Voluntary Organisations Act or related legislation will be exempted from income tax.

Introduction of a stipend for youths up to the age of 25 or persons who up to 3 years after graduating from a Maltese tertiary education institution dedicate one year for voluntary work outside Malta.

Youths who carry out voluntary work in or outside Malta will be credited with social security contributions for a maximum period of 5 years after resuming gainful occupation for a period of more than 5 years.

Energy

A public call for a further 40,000 square metres of roofs to be covered with photovoltaic panels.

For photovoltaic panels which will not benefit from other type of financial assistance on capital, a number of special feed-in tariffs are being introduced.

Extension of the 40% refund scheme for a maximum of €400 on the cost of solar water heaters.

Extension of the 15.25% refund scheme for a maximum of €1,000 on the installation of double glazing windows and other means of insulation and energy efficiency.

The benefit on gas which is given to vulnerable families is being increased from €30 to €40.

Water conservation

An initiative already introduced in Gozo is being extended to Malta, whereby every household will be entitled to a device to be attached to the water taps in order to preserve water consumption.

Residents living in an urban area can benefit either from an aid in order to fix their wells or for a plumbing system for second hand water. Accepted applicants will be entitled to a 50% refund of their expenses capped to €1,000.

High Energy User Scheme

The High Energy User Scheme, originally intended for factories that consume more than 2GwH of energy each year, will be extended to include certain businesses and hotels in Gozo.

Digital Gaming Hub

A new physical and strategic hub to provide facilities enhancing the development of digital games.

Micro invest Scheme

Extending for a further 2 years for eligible businesses in Malta and Gozo the benefit of a 40% and 60% tax credit respectively on investment.

Films in Malta

The Government will increase the rebate on expenditure in the production of films from 20% to 23% (25% if featuring Malta). This incentive comes in the form of a cash grant given to eligible productions on qualifying expenditure incurred in Malta.

B.START scheme

B.START scheme will be introduced whereby businesses will be encouraged to invest in the capital of new companies. They will benefit from a maximum tax credit of €30,000 (as approved by Malta Enterprise).

Financial Services

The importance and growth of the financial services industry has been emphasised and the Minster noted that a considerable number of recommendations discussed with the industry will be implemented.

Hotel Accommodation

Malta Enterprise's Incentive Guidelines will be revised to allow certain licensed hotels to benefit from investment aid in the form of a tax credit at a rate of 15% of capital expenditure.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.