AN INTRODUCTION TO GIFT

The Global Incentives for Trading (GIFT) Programme is a scheme set up to encourage companies to use Malaysia as an international trading base for specified types of commodities to be conducted in, from or through Labuan.

Malaysia, and by extension Labuan IBFC, is strategically located in the heart of Asia Pacific and is populated with a diverse, talented and multilingual workforce. It is a cost efficient destination from which global commodity producers and traders can base their regional operations and service clients internationally.

Why participate in GIFT?

- Malaysia's strategic position makes it an ideal base to expand into Asia Pacific.

- Access to a wide pool of multilingual skilled professionals and technical workforce.

- Access to world-class banking and financial services.

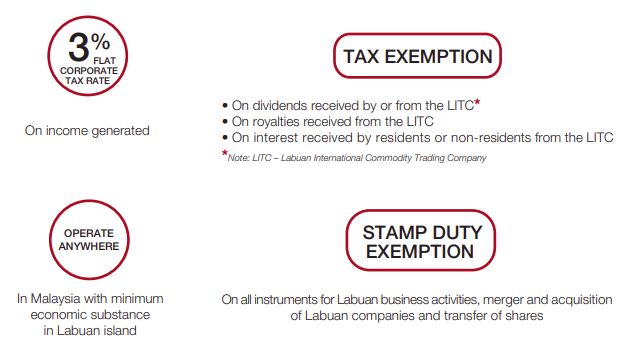

HIGHLIGHTS OF THE GIFT PROGRAMME

HOW CAN I PARTICIPATE IN GIFT?

The GIFT programme is available to commodities trading companies that satisfy certain incorporation requirements and commit to setting up their operations in Malaysia via the establishment of a Labuan International Commodity Trading Company (LITC).

A LITC is a dedicated type of Labuan Company that is registered with the Labuan Financial Services Authority (Labuan FSA), the regulator of Labuan International Business and Financial Centre (Labuan IBFC).

Only LITCs are accorded privileges under GIFT.

Uniquely, although set up as a Labuan company, LITCs are allowed to operate anywhere in Malaysia with minimum economic substance in Labuan island, and as such, are not limited to operating out of Labuan.

The LITCs are allowed to undertake the trading of physical products and related derivatives of the following qualify commodities:

- petroleum & petroleum-related products including LNG

- minerals

- agriculture products

- refined raw materials

- chemicals

- base minerals, including coal

QUALIFYING CRITERIA

Entities looking to establish a LITC in order to enjoy benefits from the GIFT programme are required to meet the following criteria:

- minimum turnover of USD50 million annually.

- local business spending* of at least MYR3 million annually

- employ a minimum of three professional traders. These traders will be residents of Malaysia, with their personal income tax assessed under the Malaysian Income Tax Act 1967.

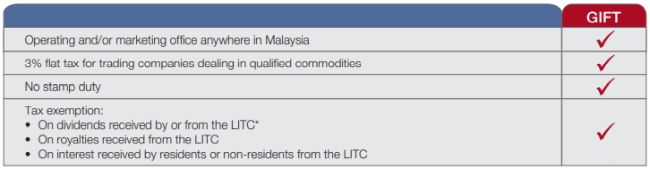

GIFT AT A GLANCE

OTHER KEY CONSIDERATIONS

Access to Credit

It is worth noting that as an international business and financial centre, Labuan IBFC is home to a thriving banking industry, comprising more than 60 global banks. These banks are readily available to provide competitive financing packages.

Risk Mitigation

As a comprehensive business and financial centre, Labuan IBFC offers traders an extensive range of insurance and risk management solutions. Labuan IBFC is one of the fastest growing risk centres in Asia with a wide range of risk mitigating structures, including captives and protected cell companies.

World-Class Storage Facilities

As part of GIFT, traders will have access to world-class storage facilities such as Tanjung Pengerang in Johor. This deep water port (up to 26 meters) offers large super tankers easy access to the storage facilities while being close to international shipping routes and Singapore's international petroleum hub.

Lower Operation Cost

The cost of operations in Malaysia is substantially lower than in other commodities trading hubs across the world, such as London and Geneva. Neighbouring Singapore is the only other commodities trading hub in Asia Pacific, but the cost of doing business as well as living on the island city-state has become less competitive over the years.

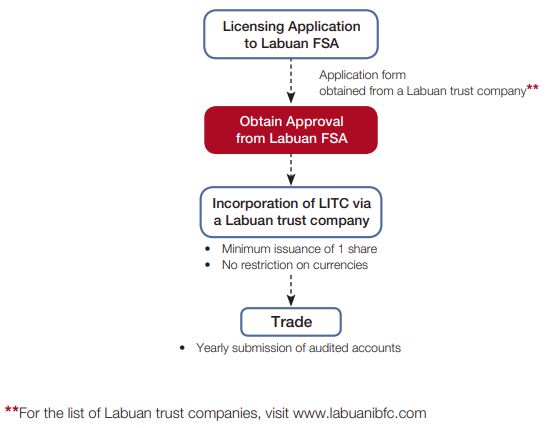

PROCESS FLOW OF SETTING UP A LITC

Note

The LITC is required to submit the following to Labuan FSA:

- The completed Annual Update Submission Form by 15 January of each year

- A copy of its audited financial statements within six months after the close of each financial year

The LITC is expected to comply with all requirements of the Labuan Companies Act, Labuan Financial Services and Securities Act 2010 and the relevant laws, wherever applicable.

FEES PAYABLE

The following are the fees payable to Labuan FSA: (Note: The amounts quoted below excludes the cost of engaging a Labuan trust company, which will essentially act as a company secretary to the LITC)

| Client Charter and Processing Fee | |

|---|---|

|

a) Normal application (21 working days) |

USD 350 |

| Incorporation of LITC | |

|

Registration fee for Labuan companies with paid-up capital: |

|

|

i. Less than MYR50,000 |

USD300 |

|

ii. MYR50,000 but less than MYR1 million |

USD600 |

|

iii. Exceed MYR1 million |

USD1,500 |

|

b) Registration fee for foreign Labuan company |

USD2,000 |

| Annual Fees | |

|

a) Licence fee (to be paid upon licence approval) |

USD13,000 |

|

b) LITC |

|

|

i. Labuan companies |

USD800 |

|

ii. Foreign Labuan company |

USD1,500 |

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.